The KSE-100 index of Pakistan Stock Market marked a positive turn in Thursday’s trading session, concluding at 64,617.57 with a notable increase of 697.72 points or 1.09%. Investor optimism was fuelled by expectations of a favorable outcome from the meeting with the International Monetary Fund (IMF) for the second loan tranche of $700 million. The index lost (-250.73) points in the previous session.

T-Bills Auction Signals: A critical indicator of market expectations, the T-Bills auction held the previous day revealed an overwhelming participation, showcasing the market’s bet on an imminent interest rate cut. Investors aggressively sought higher yields, with a total participation reaching around Rs2.75 trillion, signalling confidence in the potential for a rate drop in the coming months.

KSE100

The Benchmark KSE100 Index closed the session Green with index posting an intraday high of 781.13 (1.22%) points and an intraday low of -4.90 (-0.01%) points. PKR stays strong against the mighty US DOLLAR.

The VOLUME and VALUE TRADED (000’s) stood at 365,090,974 and Rs.11,548,187.89 respectively. Index closed at 64,617.57 pts adding 697.72 (1.09%) points to the index.

Sectors contributing positively to KSE100 index included Oil and Gas Exploration sector, Commercial Banks sector and Power Generation and Distribution sector .

Companies contributing positively to the index included MAR, PPL, OGDC.

The volume leaders included KEL(+7.16%), WTL(-0.68%), BOP(-1.02%). The scrips traded 481.20 million, 33.38 million and 28.42 million shares respectively.

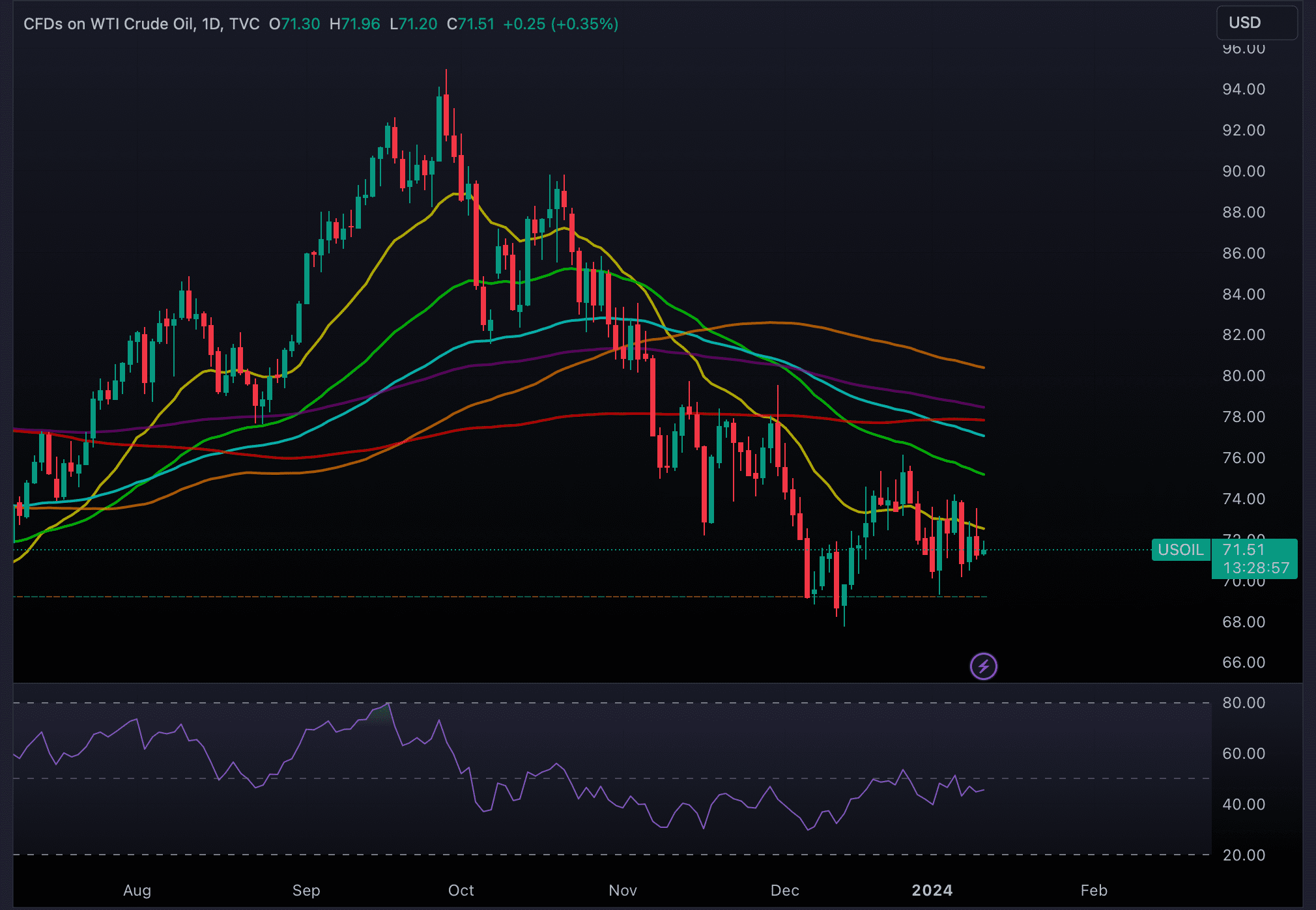

OIL (XTIUSD)

Oil is trading below EMA21 on a daily time frame and is trading on a strong support.

CFDs on Brent Crude oil posted an intraday high of $77.46 and intraday low of $76.74. Oil is currently trading at $76.98 (1:29pm Thursday, 11 January 2024 (GMT+5) Time in Pakistan).

CFDs on WTI Crude Oil posted an intraday high of $71.96 and intraday low of $71.20. Oil is currently trading at $71.51 (1:29pm Thursday, 11 January 2024 (GMT+5) Time in Pakistan).