In the ever-evolving world of finance, staying informed about economic indicators is crucial for making informed decisions. BE IN THE KNOW! Recently, the United States Bureau of Labor Statistics (BLS) released Consumer Price Index (CPI) data for December, providing insights into inflation trends and their potential impact on various sectors.

- US Inflation Surpasses Forecasts: The initial report highlights that US inflation for the year to December exceeded forecasts, reaching 3.4%. This figure was higher than the expected 3.2%, dimming market expectations of an imminent interest rate cut, contrary to previous speculations of a rate reduction as early as March.

- Gold Prices React to CPI Data: CPI data on gold prices. The annual headline inflation of 3.4% surpassed expectations of 3.2%. Despite a nominal effect on expectations for Fed rate cuts in March, the appeal for gold slightly faded as investors’ confidence waned due to the higher inflation data. The post-CPI scenario reflects a nuanced perspective on the likelihood of early rate cuts.

- Inflation Climbs to 3.4% in December: CPI underscores the persistence of inflationary pressures, with a rise from 3.1% to 3.4% in December. Although the rate still exceeds the Federal Reserve’s target of 2%, there’s a sense of relief as inflation has moderated, moving closer to the desired goal. The article also discusses the impact on consumer sentiment and the broader economic implications.

CONCLUSION

Moving beyond statistical figures, the concluding article offers insights into the viewpoint of consumers. Despite a decline in inflation from its peak in 2022, individuals still confront elevated prices compared to pre-pandemic levels. Notably, certain categories like food at home and energy prices have witnessed more significant decelerations, offering a degree of relief. However, staple items such as white bread, ground beef, and milk persistently reflect heightened costs, underscoring the ongoing challenges faced by consumers.

Summing Up: In summary, the recent inflation data portrays a nuanced outlook of the economic terrain. Despite a moderation in the inflation rate, it remains above the Federal Reserve’s target. The market’s reaction, evident in gold prices and expectations for potential interest rate cuts, underscores the intricate equilibrium between economic expansion and inflationary pressures. Navigating these intricacies necessitates staying well-informed and critically analyzing diverse perspectives to make sound decisions in the ever-evolving financial landscape.

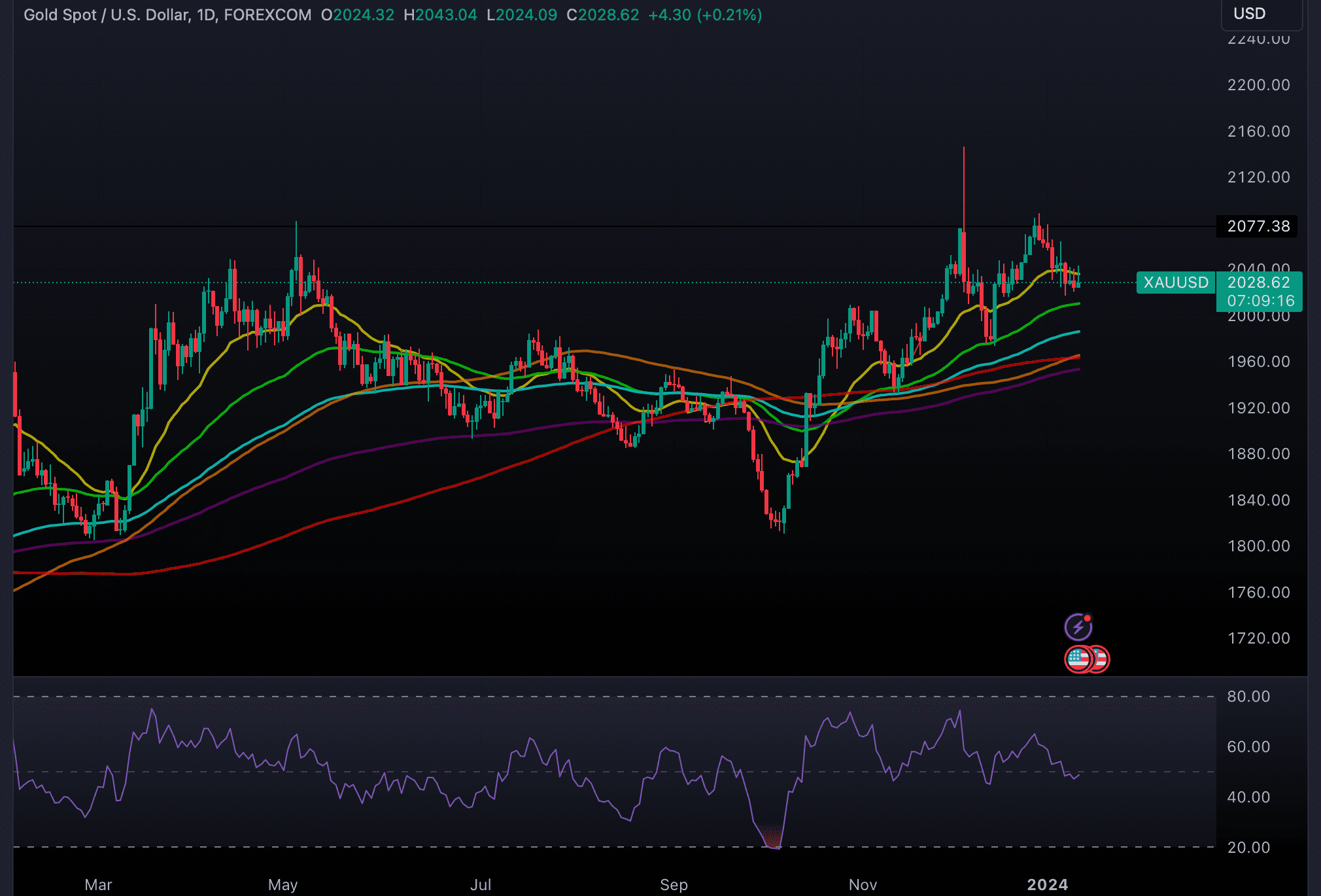

TECHNICAL ANALYSIS: GOLD FACES RESISTANCE AT $2,030

Following the release of a notable inflation report, gold prices are exhibiting volatile fluctuations around the $2,030 mark. The precious metal, observed on a daily timeframe, is encountering challenges in sustaining a recovery beyond the 20-day Exponential Moving Average (EMA) positioned at $2,037. The 14-period Relative Strength Index (RSI) hovers around 50.00, signaling a neutral stance among investors as they anticipate a potential catalyst to guide future market movements. The current technical indicators suggest a cautious market awaiting a clear direction before committing to further actions.

XAUUSD exhibited an intraday high of $2043.04 and a low of $2024.09. As of 7:57 pm on Thursday, 11th January 2024 (GMT+5), gold is currently trading at $2028.62 in Pakistan.

US DOLLAR (DXY)

The US Dollar (USD) has withstood ongoing pressure, particularly during this week, as market speculation intensified about its potential decline below the crucial 102 level in the US Dollar Index (DXY). Traders had positioned bets in favor of accelerated disinflation, creating an environment where the Greenback was expected to weaken. The latest inflation data aligns with the stance of the US Federal Reserve, affirming their warnings and prudent decision to maintain current interest rates, opting to await additional data before considering any rate cuts.

For technical analysis, the first crucial level on the upside is 103.00, aligning closely with the trend line from October 3 to December 8. A breach and close above this level could signal further strength, bringing the 200-day Simple Moving Average (SMA) at 103.43 into play. The subsequent hurdle lies at 103.78 (55-day SMA) before approaching the 104.00 level.

Conversely, a rejection at the descending trendline may bolster Greenback bears, leading to a potential downturn. The critical support level here is 101.74, a floor that held firm in mid-December before breaking down in recent weeks. Should the US Dollar Index (DXY) breach this level, the next significant test would likely occur around the low near 100.80. Traders are advised to closely monitor these key levels to gauge the potential trajectory of the US Dollar in response to the inflation dynamics at play.

US Dollar Index (DXY) exhibited an intraday high of $102.744 and a low of $102.158. As of 8:01 pm on Thursday, 11th January 2024 (GMT+5), DXY is currently trading at $102.581 in Pakistan.

In addition to inflation concerns, traders closely monitored the Jobless Claims numbers. Despite the almost stagnant disinflation, the labor market exhibited resilience, maintaining a tight status. Contrary to expectations of a surge in Initial Jobless Claims, the figures remained unchanged. This juxtaposition between inflation and labor market indicators adds complexity to the economic landscape, requiring careful observation for further insights into the trajectory of the US Dollar.

PAKISTAN CONSUMER PRICE INDEX (YOY)

In Pakistan, the assessment of inflationary or deflationary tendencies involves the periodic summation of prices for a representative basket of goods and services, presented as the Consumer Price Index (CPI). The Pakistan Bureau of Statistics compiles and releases CPI data on a monthly basis. The Year-over-Year (YoY) reading compares the prices of goods in the reference month to the same month a year earlier. The CPI serves as a crucial indicator for measuring inflation and shifts in purchasing trends within the Pakistani economy. Generally, a high YoY reading is viewed as favorable for the Pakistani Rupee (PKR), while a low reading is perceived as less optimistic.

WHY IMPORTANT FOR TRADERS?

- closely monitor inflation, as it plays a significant role in shaping monetary policy. Traders pay attention to CPI releases as they offer insights into potential shifts in interest rates. Central banks may adjust interest rates in response to inflationary pressures to maintain economic stability.

- Currency Strength or Weakness: Inflation can impact the strength or weakness of a country’s currency. Traders in the forex market analyze CPI data to assess the economic health of a nation. Higher inflation may lead to expectations of higher interest rates, attracting foreign capital and strengthening the currency.

- Asset Allocation and Investment Strategies: Inflation affects the real return on investments. Traders and investors adjust their asset allocation and investment strategies based on inflation expectations. For example, during periods of high inflation, they may favor assets like commodities or real estate that traditionally act as hedges against inflation.

- Equity Market Performance: Inflation can influence corporate profits and, consequently, stock prices. Traders in the equity markets consider CPI data to gauge the potential impact on companies’ costs and revenues. Industries with pricing power may fare better during inflationary periods.

- Fixed-Income Securities: Inflation erodes the purchasing power of fixed-income securities. Bond traders closely watch CPI figures to assess the real return on bonds. Rising inflation may lead to higher interest rates, resulting in lower bond prices.

- Consumer Spending and Retail Stocks: Consumer spending is a critical driver of economic activity. Traders in retail stocks and consumer-focused sectors pay attention to CPI data to anticipate changes in consumer purchasing power. High inflation may affect consumer spending patterns and impact the performance of retail stocks.

In conclusion, traders can learn a great deal about inflationary pressures from the Consumer Price Index, which is a crucial economic indicator that affects a number of financial market factors like interest rates, currency values, asset allocation, and investment strategies.