In defiance of an unexpected surge in U.S. crude stockpiles, oil prices climbed up on Thursday, buoyed by escalating concerns over the Middle East conflict and fresh attacks on shipping in the Red Sea.

CFDs on Brent Crude oil posted an intraday high of $77.46 and intraday low of $76.74. Oil is currently trading at $76.98 (1:29pm Thursday, 11 January 2024 (GMT+5) Time in Pakistan).

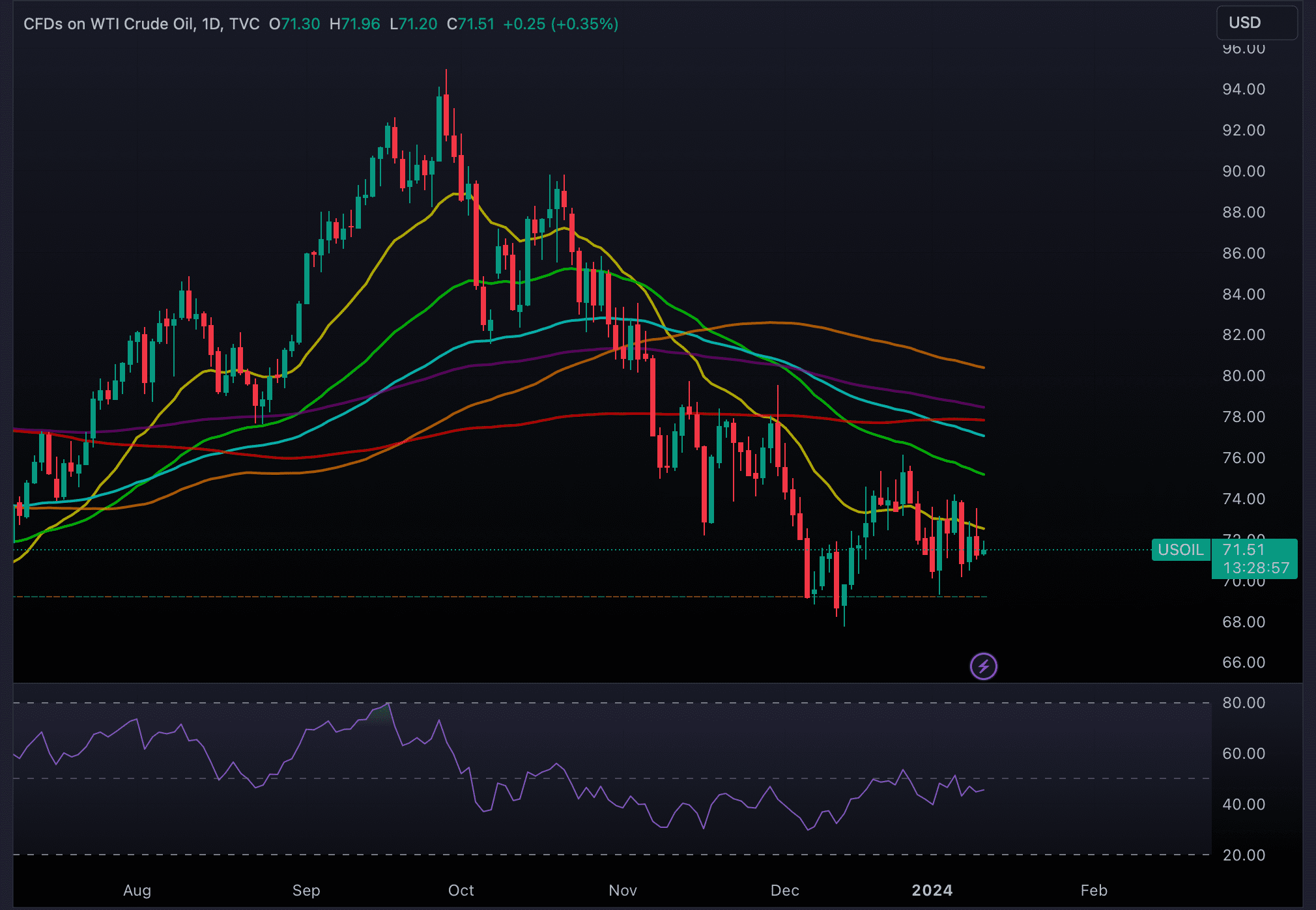

CFDs on WTI Crude Oil posted an intraday high of $71.96 and intraday low of $71.20. Oil is currently trading at $71.51 (1:29pm Thursday, 11 January 2024 (GMT+5) Time in Pakistan).

The previous day witnessed a dip in the benchmarks following an unforeseen spike in U.S. crude stockpiles, fueling apprehensions about demand in the largest oil market, as reported by Reuters.

SHARARA OIL FIELD OPERATIONS

The Sharara oil field has been forced to close by demonstrators calling for social and economic development in the southwest Libyan region of Fezzan. The protest movement aims to make the government aware of the difficulties the local populace faces.

Libya is experiencing a daily loss of over $20 million in revenue due to the protest, leading to an inability to produce approximately 300,000 barrels of oil per day.

Initiated by marginalized Berber tribes grappling with poverty and neglect, the protest erupted on January 1, 2024, prompting the National Oil Company (NOC) to close the site a week later. Ongoing talks between NOC and protest leaders aim to address the grievances raised by the local population.

RED SEA

However, market uncertainties resurfaced as Yemen-based Houthis executed their most significant attack on commercial shipping lanes in the Red Sea. Concurrently, intensified Israeli strikes in southern and central Gaza heightened tensions on Wednesday.

In response to the escalating situation, both the U.S. and Britain hinted at further measures if the attacks persisted. The UN Security Council passed a resolution, urging an immediate cessation of the strikes.

“This week, oil prices appear to be grappling with indecision as market participants try to process a combination of factors,” noted Yeap Jun Rong, a market strategist at IG, citing Middle East geopolitical tensions, conflicting U.S. inventory reports, and sluggish global growth.

Rong added, “The latest EIA data acted as a dampener to the higher-than-expected drawdown in US crude inventories reflected in the API data yesterday, leading to a partial unwinding of earlier gains.”

According to the Energy Information Administration (EIA), U.S. crude inventories rose by 1.3 million barrels in the week ending January 5, reaching 432.4 million barrels—contrary to analyst predictions of a 700,000-barrel draw.

US INFLATION DATA

Attention now shifts to U.S. inflation data, expected to influence perceptions of when the Federal Reserve might consider interest rate cuts.

“Concerns about crude oil demand arose due to an unexpected rise in U.S. crude inventories. However, revised expectations for a rate cut should provide support to oil prices, given the economy is slowing down less than the Fed forecast,” explained Leon Li, an analyst at CMC Markets.

Li further expressed that oil prices might find support above $70 until additional data indicates increased downward pressure on the economy.

Looking ahead, China’s customs administration is set to release December trade data on Friday, offering a comprehensive overview of overall demand from the world’s largest oil buyer throughout the year.