Petroleum Development Levy (PDL) is a government-imposed financial mechanism used in some countries to support and regulate the petroleum industry. Serving multitude of purposes, primarily generating revenue for the government and funding various development projects in the petroleum sector.

Let’s dive down the idea using an example to see how it functions:

EXAMPLE

Hypothetically imagine “DesiLand,” a nation with a developing petroleum sector. The Petroleum Development Levy is implemented by the DesiLand government in order to finance significant projects and encourage the growth of the industry.

WHAT IS PETROLEUM LEVY?

Levy Introduction: The Petroleum Development Levy, effectively a tax on each barrel of crude oil extracted by domestic petroleum companies is introduced by the DesiLand government. Assume that a levy of RS10,000 per barrel is imposed.

Income Generation: Companies that extract crude oil now has to pay RS10,000 to government for each barrel of crude oil. The money collected is now put into the designated fund.

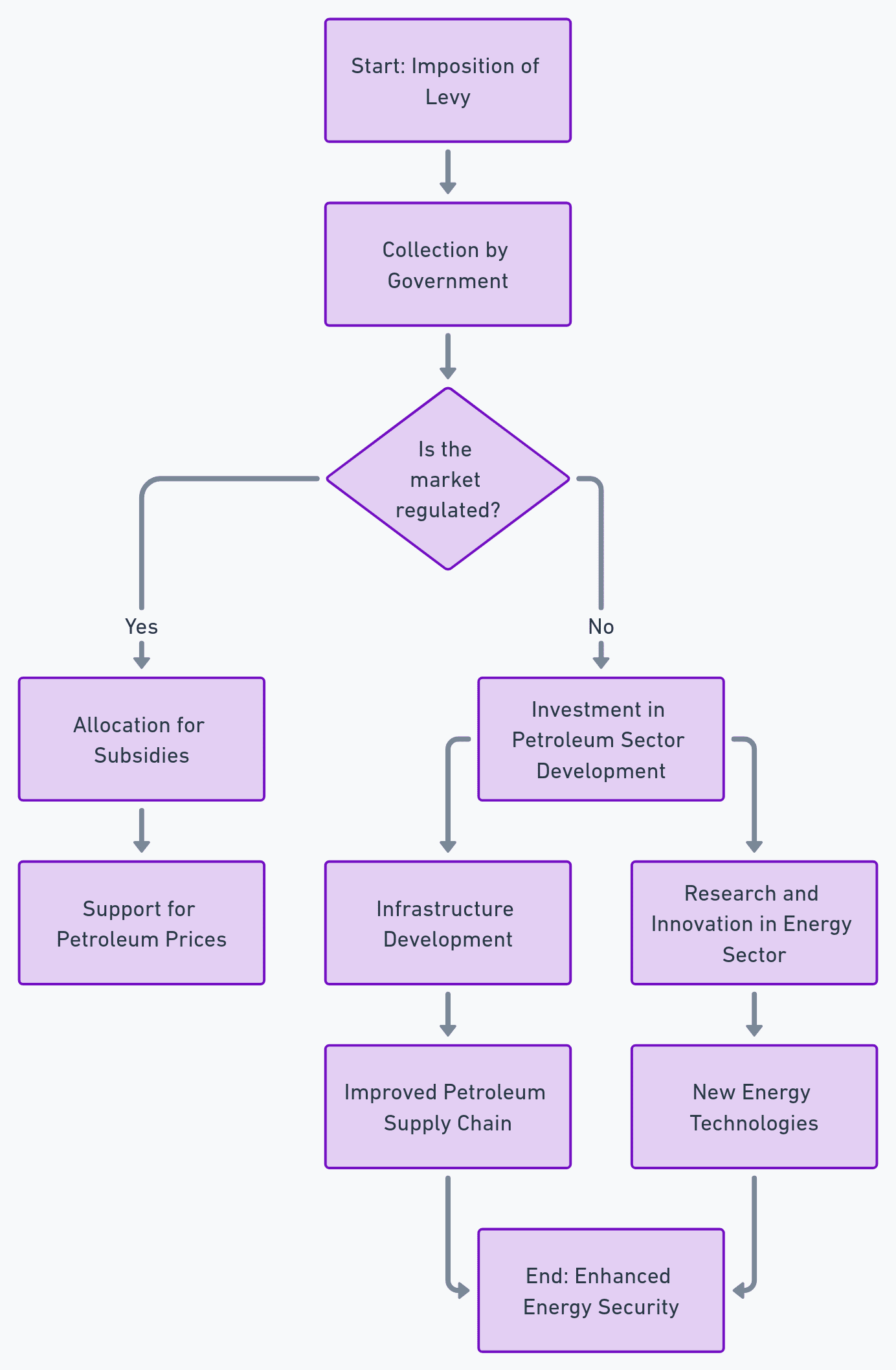

Use: The funds raised by the Petroleum Development Levy are applied to various projects, such as:

- Supporting petroleum related research.

- Building infrastructure

- Supporting education

- In general supporting anything that serves the nation.

INCREASING THE LEVY

The government would generate more revenue. Furthermore, it might make producing petroleum more expensive for the industry, which would eventually result in higher prices for fuel for the end consumers.

DECREASING THE LEVY

In addition to lowering production costs for petroleum companies, lowering the Petroleum Development Levy may attract more investors to the petroleum sector. For consumers, this might mean cheaper fuel prices.

Reducing the levy could, however, could lead to less funding for initiatives related to industry development and the environment.

SUMMARY

Governments must carefully manage the levy to strike a balance between industry development and consumer affordability, as adjustments may have both positive and negative economic effects.

BENEFITS OF INCREASING

The government’s income from the oil industry is greatly increased by raising the petroleum levy.

The necessary infrastructure and public services, such as healthcare, education, and transportation, are funded in part by this additional revenue.

Higher levies also fund environmental projects that support restoration and protection efforts.

The levy’s increased funding also makes improvements to public transport, highways, and bridges possible, improving public safety and mobility in general.

Additionally, a portion of these monies can be set aside to promote training and education.

NEGATIVE IMPACTS OF INCREASING

An increase in the petroleum levy may have unfavourable consequences, such as higher fuel prices that are passed on to customers and affect household budgets and the cost of living.

The increase in fuel prices is one factor contributing to the general inflation that lowers people’s purchasing power and raises the cost of daily goods.

Furthermore, industries and small enterprises that depend on fuel could experience higher operating costs, which could result in fewer job opportunities and put a financial strain on the general public.

BENEFITS OF DECREASING

One of the many benefits of lowering the petroleum levy is that it lowers fuel prices, which help consumers by saving money and making travel more affordable.

This increases consumer disposable income, encourages spending, the creation of jobs, and overall economic growth, all of which further stimulate economic activity.

Reduced operating costs benefit energy and transportation-dependent industries as well. This could lead to more competitive prices for goods and services, which would ultimately benefit consumers.

DISADVANTAGES OF DECREASING

Reducing the petroleum levy has some very bad effects. Reduced levies directly lead to lower government revenue, which in turn limits funding for social programmes, infrastructure improvements, and essential services, potentially lowering the standard of public services.

Moreover, a lower tax may result in less money going towards environmental projects, which would raise questions about harmful environmental effects if petroleum operations continue to be funded with less money going towards mitigation.

HYPOTHETICALLY

The introduction of petroleum levies, which are meant to generate revenue and promote industry growth, may theoretically be vulnerable to unfair practices.

Funds may be diverted from their intended purposes by corruption and embezzlement, undermining accountability and transparency.

Governments may manipulate politics by changing tax rates to achieve political advantage, undermining fair competition.

Reducing the levy might have a detrimental effect on ecological protection by reducing environmental oversight.

Reductions that are too drastic could result in underinvestment in vital infrastructure, which would impede economic growth.

Unequal revenue distribution has the potential to exacerbate economic inequality and spark social unrest.

From levy manipulation, monopolies and market manipulation may emerge, affecting consumer prices and competition.

The public may be burdened if the levy is used as a secret tax without adequate disclosure. It is possible for fund management and allocation to lack accountability. putting short-term profits first by lowering the tax

Reducing the levy in order to prioritise short-term gains could jeopardise sustainability over the long run. Governments must maintain openness, justice, and accountability in order to prevent these problems. Civil society, auditors, and regulatory agencies must also ensure the public good and the sustainability of the industry. Moreover, financial literacy of this kind must be ensured so the public can respond to foul plays.