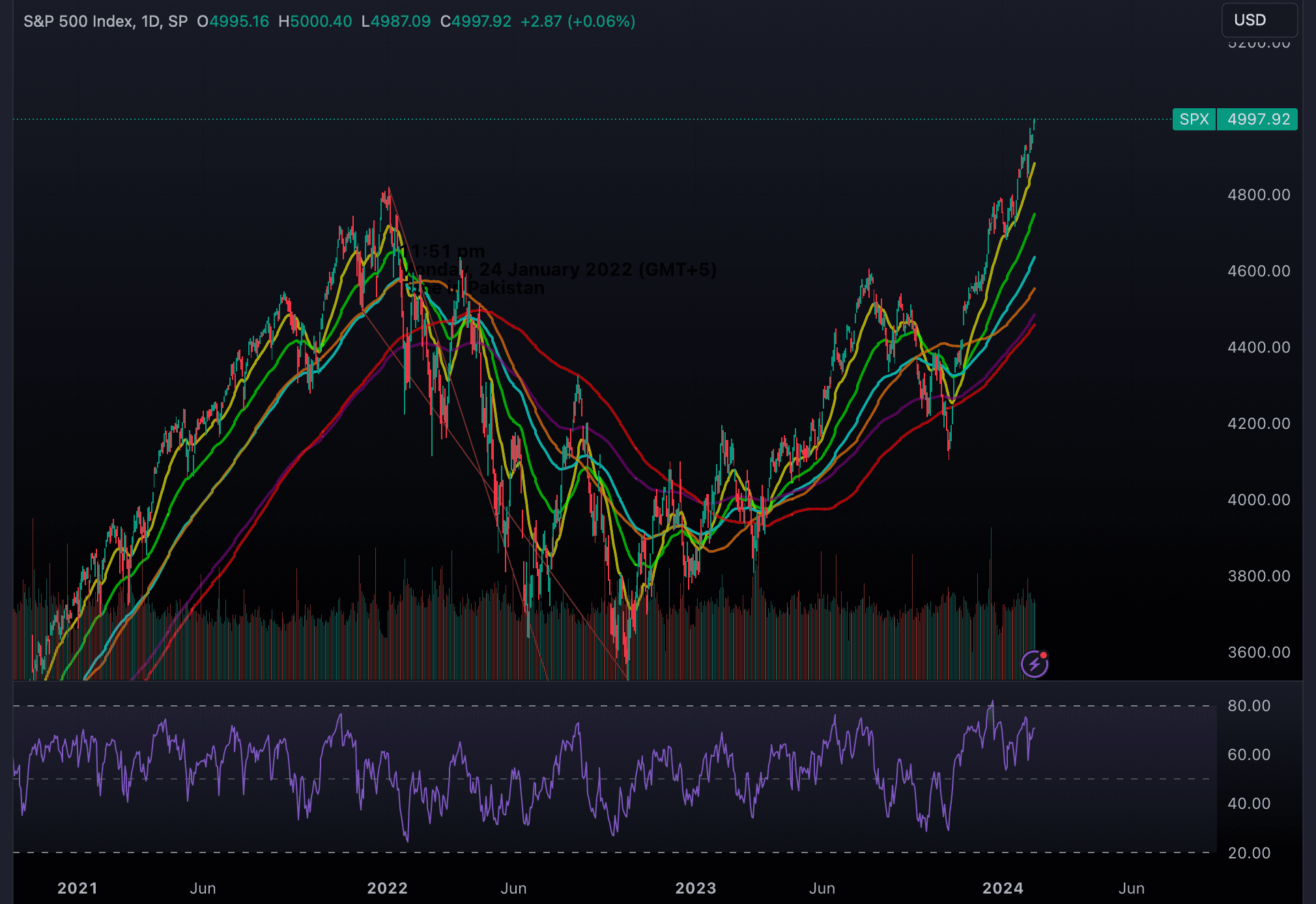

On Friday, U.S. stock index futures experienced a modest uptick, following a day of record-breaking achievements where the S&P 500 surpassed the 5,000 mark for the first time. This surge comes as investors eagerly await inflation data, hoping for insights into the Federal Reserve’s timing for its first interest-rate cut.

RECORD HIGHS AND EARNINGS OPTIMISM

The S&P 500 and Dow Jones Industrial Average both reached all-time highs on Thursday, with the tech-heavy Nasdaq closing within 2% of its peak. This rally was fueled by strong earnings reports, particularly from companies positioned to benefit from the burgeoning artificial intelligence sector.

INFLATION DATA IN FOCUS

Attention is now turning to the U.S. Bureau of Labor Statistics’ revised inflation figures for 2023, set to be released at 8:30 a.m. These figures are crucial as they incorporate new seasonal adjustment factors, aiming to offer a more accurate representation of price movements throughout the year.

This data, especially with January’s inflation figures on the horizon, is eagerly anticipated for its potential impact on the Federal Reserve’s rate cut decisions.

MARKET REACTIONS AND FEDERAL RESERVE’S STANCE

Despite the optimism, the market remains cautious, recalling last year’s seasonal adjustment pattern that favored higher inflation in the second half.

This nervousness is compounded by recent economic data and Federal Reserve policymakers’ hawkish remarks, which have led traders to adjust their expectations for a rate cut timeline.

PRE-MARKET MOVEMENTS

As of early trading, Dow e-minis saw a slight increase of 0.02%, while S&P 500 e-minis were up by 0.11%, and Nasdaq 100 e-minis rose by 0.29%.

These movements indicate a market poised for its fifth consecutive week of gains, buoyed by strong earnings reports despite concerns over interest-rate paths and regional banks’ exposure to commercial real estate.

EARNINGS SEASON HIGHLIGHTS

With over half of the S&P 500 companies having reported fourth-quarter earnings, more than 80% have surpassed profit expectations, significantly higher than the typical quarter’s 67% beat rate.

However, not all news was positive, with PepsiCo’s revenue falling short of estimates due to price hikes affecting demand, and Pinterest’s premarket drop reflecting challenges in the digital advertising space. Conversely, Cloudflare’s optimistic revenue and profit forecast propelled its shares upwards, showcasing the diverse outcomes of this earnings season.

CONCLUSION

As U.S. stock futures edge higher, the market’s focus on upcoming inflation data and its implications for Federal Reserve policy decisions underscore the ongoing interplay between economic indicators and market sentiment.

With investor eyes set on inflation trends and central bank strategies, the financial landscape remains dynamic, reflecting the complex factors influencing the direction of U.S. stocks.