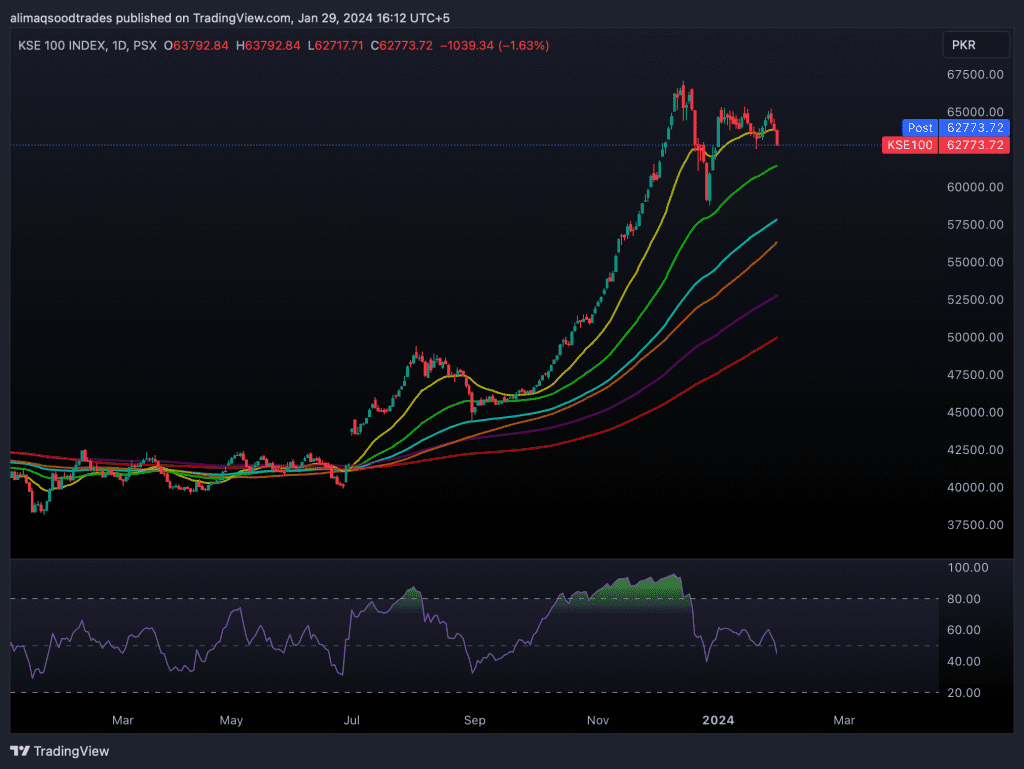

The Pakistan Stock Market’s (PSX) KSE100 index starts off the week on a negative note with high pressure selling continued on Monday. The selling was further fuelled by the recent drone attack on US troops. The index lost (484.94) points in the previous session.

Similarly, the energy and commodity markets responded to the drone attack. The global oil market has kicked off the week with a significant uptick in prices, driven by supply disruptions resulting from a drone attack on U.S. forces stationed in Jordan. Similarly, Gold Price Rises Amidst Geopolitical Tensions: What’s Driving the Precious Metal’s Value?

As previously mentioned, KSE-100 index also faced resistance in a technical perspective. Moreover, the elections uncertainty and Monetary Policy Committee (MPC) meeting of the State Bank of Pakistan (SBP) today has also kept investors on the back-foot.

KSE100

The Benchmark KSE100 Index closed the session Red with index posting an intraday high of -20.22 (-0.03%) points and an intraday low of -1,095.35 (-1.72%) points.

Companies contributing negatively to the KSE100 index included EFERT(-96.79) points, PPL(-94.37) points, MARI(-91.53) points. The volume leaders included KEL(-5.86%), PIAA(-3.52%), WTL(-3.31%). The scrips traded 49.60 million, 22.94 million and 21.47 million shares respectively.

There was widespread selling in the KSE100 index-heavy sectors, such as chemical, commercial banks, power generation, refineries, oil and gas exploration companies, and cement.

As uncertainty surrounded the resolution of the energy sector’s circular debt issue, index-heavy OGDC and PPL saw negative trading activity in today’s trading session.

MARKET FRONT

BRENT CRUDE SURGES TO $84.04 PER BARREL

CFDs on Brent Crude oil posted an intraday high of $84.04 and intraday low of $83.00. Oil is currently trading at $83.18 (12:40pm Monday, 29 January 2024 (GMT+5) Time in Pakistan).

WTI CRUDE RISES TO $79.25 PER BARREL

CFDs on WTI Crude Oil posted an intraday high of $79.25 and intraday low of $78.08. Oil is currently trading at $78.29 (12:40pm Monday, 29 January 2024 (GMT+5) Time in Pakistan).

The domestic gold market in Pakistan starts the week with an upward trend. After witnessing four consecutive weeks of decline, the price of 24-karat gold has surged by a notable Rs1,500 per tola, reaching a price of Rs215,400.

The Pakistani rupee (PKR) witnessed a marginal depreciation of 4.76 paisa against the US dollar. The currency settled at PKR 279.64 per USD.