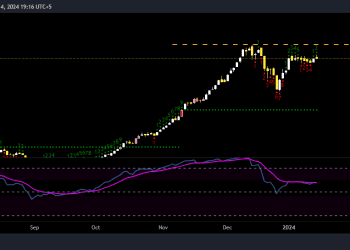

The Pakistan Stock Exchange (PSX) witnessed a remarkable surge in today’s session, with its benchmark index surpassing its previous all-time high and setting a new peak.

The KSE-100 index closed at 67,756.04, marking an impressive increase of 869.77 points or 1.3%. Throughout the trading day, the index remained in positive territory, hitting an intraday high of 67,873.22 (+986.95) and a low of 66,985.02 (98.75) points. The total volume of the KSE-100 index reached 140.991 million shares.

This extensive bullish rally, which initiated last year following the country’s avoidance of default with IMF assistance, continues to gather momentum. Factors such as the favorable outcome of general elections, anticipation of interest rate cuts, and fresh inflows from the IMF are further bolstering market gains. Moreover, the government’s recent efforts to restructure and privatize Pakistan International Airlines Corp (PIAA) have garnered significant attention from market participants.

Of the 100 index companies, 68 closed up, 23 closed down, 4 remained unchanged, while 5 remained untraded. The KSE-100 index received support primarily from sectors including Cement, Fertilizer, Oil & Gas Exploration Companies, Inv. Banks / Inv. Cos. / Securities Cos., and Engineering.

KSE-100 INDEX SUPPORTED BY KEY SECTORS

In today’s trading session, the KSE-100 index exhibited robust performance, propelled by several key sectors while led by prominent companies.

Sectoral Support:

- Cement: Cement sector contributed significantly with 289.5 points.

- Fertilizer: Fertilizer sector added 255.75 points to the index.

- Oil & Gas Exploration Companies: This sector contributed 131.11 points.

- Inv. Banks / Inv. Cos. / Securities Cos.: This segment supported the index with 63.6 points.

- Engineering: Engineering sector contributed 39.04 points to the index.

Sectoral Pressure:

- On the contrary, certain sectors exerted downward pressure on the index:

- Synthetic & Rayon: This sector detracted 13.43 points.

- Textile Composite: Textile Composite sector reduced the index by 1.62 points.

- Power Generation & Distribution: This segment lowered the index by 1.57 points.

- Miscellaneous: Contributed to a decrease of 1.06 points.

- Vanaspati & Allied Industries: This sector pulled down the index by 0.25 points.

Top Gainers and Losers:

- Leading the index upwards were companies such as ENGRO, EFERT, LUCK, PPL, and OGDC, collectively adding significant points.

- Conversely, companies like MEBL, IBFL, MCB, HUBC, and SCBPL weighed down the index.

Broader Market Performance:

- The All-Share index concluded at 44,591.51, marking a notable gain of 288.65 points.

- Total market volume surged to 361.823 million shares compared to the previous session.

- Traded value recorded at Rs11.90 billion, reflecting a significant increase.

- There were 163,089 trades reported in 339 companies, with a majority closing up.

Top Ten by Volume:

- PIAA: With a substantial volume of 38,235,500 shares.

- FLYNG: Followed by FLYNG with 21,459,500 shares.

- WTL: Recorded a volume of 20,977,567 shares.

- POWER: With a trading volume of 16,977,500 shares.

- CNERGY: Contributed with a volume of 12,701,738 shares.

- FCCL: Followed with a volume of 12,462,408 shares.

- NBP: Traded at a volume of 11,232,436 shares.

- KEL: With a trading volume of 11,020,691 shares.

- PTC: Recorded a volume of 10,602,024 shares.

- DFML: Completed the top ten list with a volume of 10,394,564 shares.

Conversely, sectors such as Synthetic & Rayon, Textile Composite, Power Generation & Distribution, Miscellaneous, and Vanaspati & Allied Industries exerted downward pressure on the index.

Leading contributors to the index’s gains were companies like ENGRO, EFERT, LUCK, PPL, and OGDC, while companies such as MEBL, IBFL, MCB, HUBC, and SCBPL dragged the index lower.

In the broader market, the All-Share index closed at 44,591.51, recording a net gain of 288.65 points. Total market volume surged to 361.823 million shares compared to 239.650 from the previous session, with traded value reaching Rs11.90 billion, indicating an increase of Rs2.95bn. A total of 163,089 trades were reported in 339 companies, with 207 closing up, 108 closing down, and 24 remaining unchanged.

It’s noteworthy that the KSE-100 has gained 26,303 points or 63.45% during the fiscal year, while the ongoing calendar year has witnessed a cumulative increase of 5,305 points, equivalent to 8.49%.

MARKET NOISE

In Wednesday’s interbank session, the Pakistani rupee (PKR) experienced a depreciation of 8.08 paisa against the US dollar, settling at PKR 277.92 per USD.

Gold prices, denoted by XAU/USD, experienced a pullback after reaching a fresh record high earlier in the week, primarily influenced by stronger US macroeconomic data.

Intermarket Securities released a report today projecting that the scrip of Meezan Bank Limited (PSX: MEBL) is expected to reach Rs240 per share by the end of December 2024.

The Securities & Exchange Commission of Pakistan (SECP) has granted conditional permission to the Pakistan General Insurance Co. Ltd. (PSX: PKGI) to commence its operations.

Pakistan Refinery Limited (PSX: PRL) has announced its intention to adopt the amended provisions and incentives outlined in the newly introduced Brownfield Refining Policy 2024.

The Central Directorate of National Savings (CDNS) has announced a significant increase in the rates of return for its National Savings Certificates, effective from March 19th, 2024.