After experiencing two consecutive declines, the Pakistan Stock Exchange (PSX) breathed a sigh of relief as the benchmark KSE-100 index concluded Tuesday’s trading session at 66,886.26, marking an increase of 89.94 points or 0.13%. A day earlier!

During the trading session, the index exhibited a range of 385.91 points, reaching an intraday high of 66,959.55 (+163.22) and a low of 66,573.63 (-222.69) points. The total volume of the KSE-100 index stood at 94.865 million shares.

| Statistic | Value |

|---|---|

| Closing Price | 66,886.26 (+89.94 / 0.13%) |

| As of | Apr 2, 2024 2:15 PM |

| High | 66,959.54 |

| Low | 66,573.63 |

| Volume | 94,865,141 |

| 1-Year Change | 67.68% |

| YTD Change | 3.44% |

| Previous Close | 66,796.32 |

| Day Range | 66,573.63 — 66,959.54 |

| 52-Week Range | 39,482.17 — 67,307.63 |

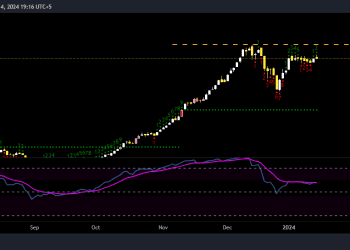

It is noteworthy that the PSX’s main gauge soared by 4,554 points or 7.3% in the first quarter of 2024, registering its fourth consecutive quarterly gain. In USD terms, the 100 index witnessed a substantial gain of 8.8%.

The persistent upward trajectory, which commenced last year following Pakistan’s successful negotiations with the International Monetary Fund (IMF) to avoid default, received additional impetus from the favorable outcome of general elections, expectations of interest rate cuts, and fresh inflows from the IMF. Moreover, government initiatives aimed at restructuring and privatizing Pakistan International Airlines Corp (PIAA) contributed to this positive sentiment.

In today’s session, the ratio of advancers to decliners remained evenly distributed, with 41 companies closing higher and 48 closing lower. Six stocks remained unchanged, while five remained untraded.

INDEX SUPPORT AND DRAG

The KSE-100 index found support from Commercial Banks, Inv. Banks / Inv. Cos. / Securities Cos., Technology & Communication, Miscellaneous, and Automobile Parts & Accessories sectors. Conversely, the index faced pressure from Oil & Gas Exploration Companies, Power Generation & Distribution, Tobacco, Oil & Gas Marketing Companies, and Chemical sectors.

Contributing positively to the index were companies like DAWH, SYS, FFC, MCB, and BAFL, while companies such as HUBC, PPL, EFERT, PAKT, and MARI exerted downward pressure.

The KSE-100 index witnessed a mixed performance, supported by various sectors while facing downward pressure from others. Here’s a breakdown of the support and drag:

Supportive Sectors:

- Commercial Banks: Contributed 103.12 points

- Investment Banks / Investment Companies / Securities Companies: Added 79.46 points

- Technology & Communication: Supported with 47.78 points

- Miscellaneous: Added 26.61 points

- Automobile Parts & Accessories: Contributed 15.3 points

Sectoral Declines:

- Oil & Gas Exploration Companies: Dragged down the index by 49.97 points

- Power Generation & Distribution: Pulled down by 31.34 points

- Tobacco: Contributed negative 18.75 points

- Oil & Gas Marketing Companies: Dropped by 16.94 points

- Chemical: Decreased by 16.17 points

Company Contributions:

Adding Points:

- DAWH: Contributed 80.51 points

- SYS: Added 59.03 points

- FFC: Contributed 25.73 points

- MCB: Added 23.78 points

- BAFL: Contributed 21.45 points

Dragging Down:

- HUBC: Pulled the index lower by 28.8 points

- PPL: Dragged down by 22.48 points

- EFERT: Contributed negative 21.34 points

- PAKT: Decreased by 18.75 points

- MARI: Pulled down by 18.31 points

In the broader market, the All-Share index closed at 44,302.86, witnessing a net loss of 66.89 points. Total market volume stood at 239.650 million shares, with a traded value of Rs8.94 billion, reflecting an increase of Rs0.61 billion compared to the previous session.

With 123,259 trades reported in 336 companies, 157 stocks closed higher, 150 closed lower, and 29 remained unchanged.

Top Ten by Volume:

- WTL: 32,343,929

- PTC: 27,131,713

- PAKRI: 13,127,500

- TELE: 9,534,499

- FLYNG: 7,382,500

- PIAA: 6,596,000

- TOMCL: 6,531,000

- NBP: 6,022,036

- CNERGY: 5,996,107

- BOP: 5,487,193

It’s worth noting that during the fiscal year, the KSE-100 index has surged by 25,434 points or 61.36%, while the ongoing calendar year has witnessed a cumulative increase of 4,435 points, equivalent to 7.1%.

MARKET NOISE

The Pakistani rupee (PKR) demonstrated strength against the US dollar in Tuesday’s interbank session, appreciating by 10.12 paisa.

Gold prices (XAU/USD) continued to attract buyers for the sixth consecutive day on Tuesday, remaining within striking distance of the all-time peak in the $2,265-$2,266 range reached the previous day.

EFU Life Assurance Limited (PSX: EFUL) has successfully concluded the acquisition of 100% of the shares in EFU Health Insurance Limited, according to the company’s filing on the Pakistan Stock Exchange (PSX) today.

The country’s total textile export witnessed a notable increase of 3.17% Year-on-Year (YoY), reaching $1.3 billion compared to $1.26 billion in March of the previous year.

The government, in collaboration with PIA Holding Company Limited (PIA Holdco), has initiated the process of privatizing Pakistan International Corporation Limited (PIACL) and has invited Expressions of Interest (EOI) from potential investors.

Pakistan’s trade deficit witnessed a significant reduction, contracting by 24.94% to $17.03 billion during the July-March period (9MFY24) compared to the same period last year.