US MARKETS EXPERIENCE VOLATILITY FOLLOWING FED ANNOUNCEMENT

Wednesday proved to be a turbulent day for US markets, marked by a mixed close after a rollercoaster of trading activity. Stocks initially remained stable in the morning before surging following Federal Reserve Chair Jerome Powell’s indication during a press conference that the possibility of further rate hikes in the current cycle was unlikely.

However, this initial rally was short-lived as the S&P 500 and Nasdaq reversed course later in the day, ending lower by the closing bell.

The Dow managed to end the day on a positive note, gaining 87 points or 0.2%. In contrast, both the S&P 500 and the Nasdaq experienced declines.

Despite Powell’s comments and the brief surge, Wall Street failed to break April’s losing streak. All three major indexes concluded the month with losses, a notable shift following five consecutive months of gains. Particularly, the Dow recorded its worst month since September 2022.

Earnings reports also influenced market sentiment, with chip stocks notably affected. Shares of Advanced Micro Devices (AMD) tumbled by 9% following a lackluster earnings report, while Super Micro Computer saw a 14% decline in its share price. Nvidia also experienced a dip of about 4%.

As the trading day concluded, it’s worth noting that slight fluctuations in levels might still occur. The day’s volatility underscores the ongoing uncertainty and market sensitivity to factors such as Federal Reserve announcements and corporate earnings reports. Investors continue to navigate these challenges, adjusting their strategies in response to changing market dynamics.

HERE’S WHAT A 4% UNEMPLOYMENT RATE WOULD MEAN TO THE FED

With the US unemployment rate remaining below 4% for over two years, economists have observed a remarkable streak unparalleled in decades. Despite expectations of a rise above 4% due to efforts to slow the economy and control inflation through rate hikes, the jobless rate has defied projections.

However, Federal Reserve Chair Jerome Powell suggested that it might only be a matter of time before this streak ends. Yet, he emphasized that a return to a sub-4% unemployment rate would not significantly alter the Fed’s stance.

At 3.8% in the latest jobs report, any substantial increase in the unemployment rate would need to occur to capture the central bankers’ attention and potentially prompt considerations for earlier rate cuts. Powell noted that a mere uptick of a couple of tenths of a percentage point in the unemployment rate would not necessarily warrant such actions from the Fed.

In essence, while a shift in the unemployment rate may be inevitable, it would require a notable deterioration in the labor market to prompt significant changes in the Federal Reserve’s monetary policy approach.

SAVERS BENEFIT AS FEDERAL RESERVE HOLDS INTEREST RATES STEADY

For individuals grappling with high-interest debt, the Federal Reserve’s decision to once again abstain from cutting interest rates at its Wednesday meeting may bring disappointment. However, for those with savings, this stance represents a silver lining, as the Fed’s cautious approach has continued to bolster their financial security.

In the face of inflationary pressures, the Fed remains steadfast in its commitment to monitor data closely before considering any rate adjustments. This prudence has translated into continued opportunities for savers to maximize their returns by seeking out federally insured accounts offering the highest rates.

According to data from Lending Tree’s DepositAccounts.com, savers reaped significant rewards in 2023, with interest income totaling $315.4 billion—a fourfold increase from the previous year’s $78.7 billion. This surge in earnings can be attributed to the Fed’s proactive rate-hike campaign initiated in 2022, enabling savers to earn yields that outpace inflation on various US domestic deposits, including bank and credit union savings accounts, certificates of deposit, and money market accounts.

Moreover, Treasury bills have emerged as a compelling investment option, offering competitive yields comparable to those provided by banks while maintaining low risk. This alignment of favorable interest rates across different financial instruments further empowers savers to fortify their financial positions amidst economic uncertainty.

In essence, while the Fed’s decision may not alleviate the burden of high-interest debt, it underscores the resilience of savers who have diligently navigated the shifting financial landscape. As they continue to leverage federally insured accounts and explore low-risk investment opportunities, savers are poised to thrive in an environment characterized by inflationary pressures and evolving market dynamics.

FED CHAIR POWELL EMPHASIZES INDEPENDENCE FROM POLITICAL INFLUENCE IN ELECTION YEAR

Federal Reserve Chair Jerome Powell reaffirmed the central bank’s commitment to independence from political considerations, emphasizing that upcoming elections do not sway its policymaking decisions.

In response to queries regarding the potential impact of the 2024 presidential election on interest rate decisions, Powell underscored the Fed’s long-standing tradition of prioritizing economic factors over political considerations. He highlighted his tenure spanning nearly 12 years and challenged observers to scrutinize transcripts for any mention of impending elections, asserting that such discussions are not part of the Fed’s mandate.

Powell cautioned against intertwining politics with economic policymaking, noting that doing so could compromise the accuracy of the Fed’s economic assessments. He reiterated the Fed’s steadfast dedication to making decisions solely based on what is deemed best for the economy, devoid of external political pressures.

“We’re always going to do what we think the right thing for the economy is,” Powell emphasized, emphasizing that the Fed remains steadfast in its commitment to economic stability and growth.

In conclusion, Powell reiterated the Fed’s unwavering stance against political influence, emphasizing that considerations beyond economic factors are not part of the central bank’s decision-making framework. As the Fed navigates complex economic landscapes, its commitment to independence remains a cornerstone of its operations.

POWELL DISPELS STAGFLATION CONCERNS AS MARKETS RALLY ON RATE HIKE OUTLOOK

Federal Reserve Chair Jerome Powell dismissed concerns about stagflation, emphasizing that current economic conditions do not align with the troublesome combination of high inflation and slow growth.

Addressing fears sparked by the latest gross domestic product report, Powell contrasted the current situation with historical episodes of stagflation, such as those experienced during the 1970s oil crisis. He highlighted the severity of past stagflation, characterized by double-digit unemployment, high single-digit inflation, and sluggish economic growth, which stands in stark contrast to the present scenario.

Powell pointed out that while inflation has accelerated, economic growth remains “pretty solid.” He reassured that the Fed’s preferred inflation gauge remains below 3%, mitigating concerns about runaway price increases.

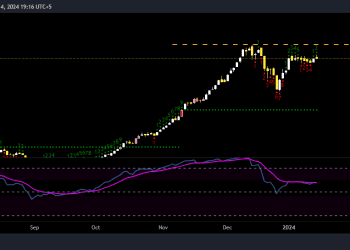

Market sentiment was buoyed by Powell’s remarks during a press conference, where he indicated that further interest rate hikes were unlikely in the current cycle. This dovish outlook prompted a surge in US markets, with the Dow gaining nearly 500 points, the S&P 500 rising by 1%, and the Nasdaq climbing 1.5%.

In summary, Powell’s dismissal of stagflation concerns and his indication of a restrained approach to interest rate policy contributed to a positive market response, underscoring investors’ confidence in the Fed’s management of economic challenges.

POWELL SIGNALS UNLIKELIHOOD OF RATE HIKE DESPITE INFLATION CONCERNS; TREASURY YIELDS DROP

Ahead of the Federal Reserve’s May meeting, discussions among officials have surfaced regarding the potential necessity of further interest rate hikes to combat inflation. However, Federal Reserve Chair Jerome Powell indicated on Wednesday that it is improbable for the next policy rate move to be a hike.

While Powell did not offer assurance of a rate cut this year, investors, anticipating such a move, have adjusted their expectations to a later timeline. Powell reiterated the Fed’s commitment to data-dependent policy decisions, emphasizing that adjustments will be contingent on how the economy evolves.

Despite previous projections by Fed officials for three rate hikes this year, Powell refrained from committing to a specific path. When questioned about the feasibility of these projections given the number of upcoming meetings, Powell emphasized a focus on evolving economic conditions rather than adhering to predetermined timelines. He noted that confidence in inflation returning to the Fed’s 2% target remains uncertain, indicating that rate cuts will only be considered when such confidence is attained.

However, Powell acknowledged a decrease in his own confidence regarding inflation dynamics compared to previous meetings, highlighting the complexity of the current economic landscape.

In response to the Fed’s decision to maintain interest rates, yields on US Treasuries experienced a notable decline. The Fed’s statement, which outlined a significant slowdown in the pace of allowing its holdings to mature without reinvestment, contributed to this decline, with yields on the 10-year Treasury note reaching fresh lows for the day.

In the stock market, US equities saw mixed movement following the announcement, with the Dow rising by 0.4%, the S&P 500 dipping by 0.1%, and the Nasdaq remaining relatively flat. This divergence reflects ongoing market uncertainty amid evolving monetary policy dynamics and inflationary pressures.

WALL STREET REACTS AS FED MAINTAINS INTEREST RATES, ADJUSTS BALANCE SHEET RUNOFF PACE

Following the Federal Reserve’s decision to keep interest rates steady at a 23-year high, Wall Street analysts offered diverse perspectives on the implications of the central bank’s actions:

Whitney Watson, co-chief investment officer at Goldman Sachs Asset Management, noted that while the downtrend in inflation may have been delayed, the decision to taper quantitative tightening reflects a nod to liquidity concerns in the financial system.

Seema Shah, chief global strategist at Principal Asset Management, highlighted the Fed’s acknowledgment of a lack of further progress, suggesting that imminent rate cuts are unlikely without convincing evidence of inflation stabilization.

Stephen Rich, chief executive at Mutual of America Capital Management, expressed concern over the impact of delayed rate cuts on lower- and middle-income consumers, citing continued pressure on discretionary budgets due to elevated costs for daily goods and services.

Rajeev Sharma, managing director of fixed income at Key Wealth, interpreted the Fed’s announcement as dovish, noting a market reaction that saw yields fall to session lows. He emphasized the significance of the Fed’s plan to slow the runoff of its balance sheet, resulting in less Treasury paper entering the market over the coming months.

In a separate announcement, the Federal Reserve revealed plans to ease its grip on the economy by reducing the pace of its balance sheet runoff, starting in June. The central bank will allow up to $25 billion in Treasuries from its portfolio to mature each month without replacement, down from the current $60 billion.

Overall, the Fed’s decision to maintain interest rates at their current levels for the sixth consecutive meeting underscores ongoing concerns about inflationary pressures and the need for sustained economic stability before considering adjustments to borrowing costs.

FEDERAL RESERVE’S RATE STANCE CASTS SHADOW OVER SPRING HOMEBUYING SEASON

The Federal Reserve’s decision to maintain interest rates at multi-decade highs has thrown a curveball into the spring homebuying season, disrupting expectations for rate cuts that would have helped lower mortgage rates.

Initially, rate cuts appeared imminent as inflation approached the Fed’s 2% target month after month. However, recent inflationary pressures have complicated this trajectory, leaving central bankers with limited options beyond maintaining current interest rates or potentially raising them further.

The impact of these decisions is evident in the housing market, where the spring homebuying season has hit a snag. Higher rates have constrained inventory, with some homeowners reluctant to sell due to the allure of low monthly mortgage payments secured during the pandemic, particularly in expensive markets where mortgage costs are more sensitive to rate fluctuations.

Federal Reserve officials have expressed varying viewpoints on potential rate moves:

- Federal Reserve Governor Michelle Bowman, a hawkish voice, signaled openness to a rate hike if progress on inflation stalls or reverses.

- Minneapolis Fed President Neel Kashkari suggested the possibility of no rate cuts this year, although he acknowledged that rate hikes are not off the table.

- New York Fed President John Williams emphasized that rate hikes are not part of his baseline outlook, citing the current trajectory’s alignment with the Fed’s goals. However, he did not rule out future rate increases under certain circumstances.

- Boston Fed President Susan Collins highlighted uncertainties related to timing and the need for patience, suggesting that the recent robust job report may temper expectations for rate cuts this year.

Despite officials generally expecting rate cuts at some point in 2024, there is a lack of consensus on the timing and magnitude of such cuts. This uncertainty adds further complexity to an already challenging economic landscape, potentially impacting homebuying trends and consumer sentiment in the coming months.

JAMIE DIMON EXPRESSES CONCERNS OVER GOVERNMENT DYSFUNCTION, FED’S POLICY IMPACT

Jamie Dimon, CEO of JPMorgan Chase, voiced frustration over the state of affairs in the US government, emphasizing the need for effective and competent governance. Speaking at an event hosted by the New York Jobs CEO Council, Dimon expressed dismay at the administrative state’s current shortcomings.

Dimon refrained from assigning blame to any specific political party but highlighted the lack of transparency and accountability in government agencies. He criticized the Federal Reserve, among others, for not adequately communicating how they utilize allocated funds, despite the Fed’s unique financing structure.

In addition to his concerns about government inefficiency, Dimon also expressed worries about the Federal Reserve’s ability to achieve a soft landing for the economy. He cautioned that persistent inflation may hinder the Fed’s efforts to balance inflation control without increasing unemployment levels.

Meanwhile, on Wall Street, there is growing speculation about the possibility of a rate hike by the Federal Reserve, instead of the anticipated rate cuts. Stubborn inflation levels and disappointing economic data have led investors to reconsider their expectations, with recent inflation reports triggering market volatility and reducing the likelihood of imminent rate cuts.

The increasing uncertainty surrounding rate cuts reflects the challenges in navigating inflation’s trajectory back to the Fed’s target of 2%. Concerns about stagflation, coupled with the Fed’s commitment to price stability amid a robust job market, have led analysts to adjust their forecasts, anticipating potential delays in rate cuts until later in the year.

As the Fed monitors inflation trends, investors eagerly await the release of April labor market data, which will provide insights into wage gains, unemployment rates, and overall economic conditions. Amidst evolving economic indicators, market participants remain vigilant for any shifts in the Fed’s policy stance and their potential implications for the broader economy.

input from CNN Business