On Wednesday, the price of oil declined globally as a result of unanticipated increases in consumer prices in the United States and growing worries about oversupply.

After falling over (-3.50%) in the previous session, oil prices continue to decline in the international market.

CFDs on Brent Crude oil posted an intraday high of $73.38 and intraday low of $72.33. Oil is currently trading at $72.42 (1:50pm Wednesday, 13 December 2023 (GMT+5) Time in Pakistan).

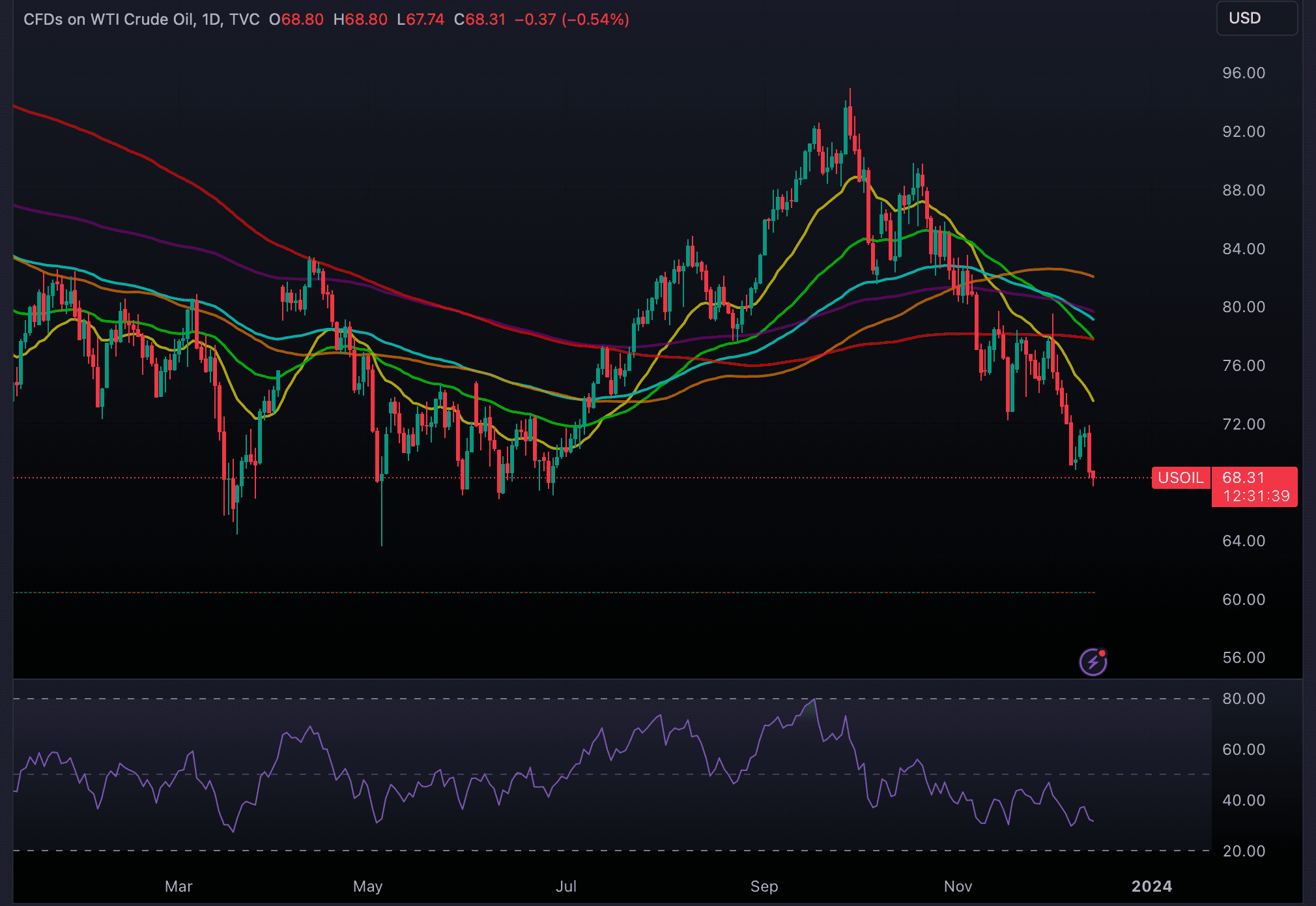

CFDs on WTI Crude Oil posted an intraday high of $68.80 and intraday low of $67.74. Oil is currently trading at $67.79 (1:50pm Wednesday, 13 December 2023 (GMT+5) Time in Pakistan).

THE ECONOMIC DATA

Remarkably, after a substantial decline of roughly 3.5% in the previous session, both benchmarks hit their lowest points in six months.

The month of November 2023 saw a 3.1% year-over-year increase in the U.S. consumer price index (CPI), marginally above analyst projections. The U.S. CPI grew sequentially by 0.1% month over month after declining by 0% the month before.

An extended period of higher interest rates could hinder economic growth and lead to a softer outlook for oil demand, according to analysts like Again Capital LLC partner John Kilduff.

INTERNATIONAL OIL PRICES TAKING A SLOW UPWARD TURN – PARTICIPANTS SKEPTICAL

OPEC AND IEA

Both organisations are expected to update their forecasts this week, given the unfavourable current outlook for the oil market. The organisations earlier predicted the oil demand to slow down in 2024.

ANALYSTS

When asked about the current state of affairs, Kpler analyst Matt Smith said, “Negative sentiment towards the oil complex is still overpowering at the moment.”

Concerns about weak demand and scepticism about the effectiveness of the OPEC+ deal to curtail supply continue to influence crude oil prices. In the first quarter, OPEC+ had previously agreed to limit supply by 2.2 million barrels per day.

Market right now eyes the Federal Reserve’s meeting results on Wednesday, when it is widely expected that the central bank will maintain interest rates.

U.S. Energy Information Administration (EIA) lowered its price prediction for Brent crude by $10 per barrel in 2024.

EIA still believes that supply reductions brought about by the OPEC+ agreement will help drive up prices in the first half of 2024.

CRUDE

Brent to average at $83 is an expected outlook for oil in 2024. In 2023 and 2024, respectively, the EIA projects that the United States will produce 12.93 million and 13.11 million barrels of crude oil per day. This happens just in time for Wednesday’s official government stockpile data release. The week ending December 8 saw a 2.3 million barrel decline in U.S. crude stockpiles.

Worries about potential Middle East supply disruptions have arisen as Yemen’s Houthis claimed to have attacked a Norwegian commercial tanker in retaliation for Israel’s actions in Gaza.