This thorough analysis of Pakistan’s market data and economic indicators offers a detailed look at the country’s financial and economic situation as of March 2024, with comparisons to earlier times. Currency exchange rates, stock market performance, gold prices, interest rates, and important economic indicators are just a few of the topics covered in the report.

CURRENCY AND EXCHANGE RATES

- The PKR InterBank rate slightly improved from 279.0366 to 278.7428 against the dollar.

- Open Market Rates for USD decreased marginally from 281.70 to 281.25.

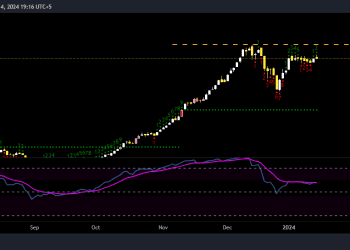

STOCK MARKET

- The KSE100 Index experienced a downturn, moving from 65,793.76 to 64,816.47.

- Average Daily Volume traded also decreased from 425,011,077 to 339,569,296.

GOLD PRICES

- Gold prices in Karachi for 10 grams slightly decreased from Rs. 195,988 to Rs. 195,945.

- Internationally, gold price per ounce decreased from $2,178.78 to $2,156.18.

INTEREST RATES

- The KIBOR 6M rate decreased slightly from 21.36 to 21.31.

- T-Bill Auction Cutoff Yields and PIB Auction Cutoff Yields showed slight adjustments across different maturities, with a notable decrease in the 10Y PIB Auction Cutoff Yield from 14.5000 to 14.3500.

FOREX RESERVES

- SBP FX Reserves saw a slight increase from $7,895.7 million to $7,912.9 million.

- Total FX Reserves also increased from $13,020.0 million to $13,151.3 million.

ECONOMIC INDICATORS

- The Consumer Price Index (CPI) showed a very slight month-over-month increase from 259.92 to 260.01, while the year-over-year change decreased significantly from 28.34% to 23.06%.

- Exports decreased from $2,792.00 million in January to $2,583.00 million in February, while imports also decreased from $4,771.00 million to $4,326.00 million, leading to a smaller trade deficit of -$1,743.00 million in February compared to -$1,979.00 million in January.

- Home Remittances saw a decrease from $2,397.91 million in January to $2,249.77 million in February.

- The Annual Inflation Rate for the fiscal year ending in June 2023 stood at 29.18%, a significant increase from the previous year’s 12.15%.

These metrics offer a complex picture of Pakistan’s economic outlook, displaying both stability and difficulties in various domains, particularly with regard to controlling trade balances, investment flows, and inflation.