Tuesday’s trading session ended with the benchmark KSE-100 of the Pakistan Stock Market (PSX) index at 79,552.88, up 728.55 points, or 0.92%.

From PKR 278.34 in the previous session to PKR 278.38 at the close, the PKR experienced a minor decrease versus the US dollar.

With an impact on both individuals and businesses, the introduction of the FY25 budget bill has sparked intense debate and discontent throughout Pakistan.

Twenty-four-karat gold was still priced at Rs. 214,500 a tola on Tuesday. Ten grams of 24 carat gold and ten grams of 22 carat gold likewise experienced no changes in price, remaining constant at Rs. 207,047 and Rs. 189,793, respectively.

PSX NOTICES: PAKISTAN PETROLEUM LIMITED ANNOUNCES SIGNIFICANT GAS DISCOVERY IN LATIF BLOCK

GAS DISCOVERY FROM TOR-1 EXPLORATORY WELL

Pakistan Petroleum Limited (PSX: PPL) has announced a significant gas discovery from the Tor-1 exploratory well in the Latif Block, located in Khairpur District, Sindh Province. The company’s filing on PSX revealed that the well is operated by United Energy Pakistan Beta (UEP Beta) with a 33.40% working interest, alongside Joint Venture partners PPL and Prime Pakistan Limited, each holding a 33.30% working interest.

DRILLING DETAILS AND TEST RESULTS

The Tor-1 well was spud-in on May 5, 2024, and successfully reached the target depth of 3,438 meters (Measured Depth). Based on wireline logs interpretation and the Modular Formation Dynamic Tester (MDT), the Intra-C Sand of the Lower Goru Formation was tested. The well flowed at a rate of 11.27 Million Standard Cubic Feet per Day (MMSCFD) of gas, with a Well Head Flowing Pressure (WHFP) of 1,424 Pounds per Square Inch (PSI) at a 40/64″ choke.

IMPACT ON INDIGENOUS HYDROCARBON SUPPLY

This discovery is expected to significantly enhance the indigenous hydrocarbon supply, adding more hydrocarbon reserves and helping to mitigate the country’s gas demand. The increased supply from the Tor-1 well will contribute to the energy security and economic stability of Pakistan.

PSX NOTICES: VIS CREDIT RATING COMPANY UPGRADES THE ORGANIC MEAT COMPANY LIMITED RATINGS

UPGRADED ENTITY RATINGS TO ‘A/A-1’

The VIS Credit Rating Company (VIS) has upgraded the entity ratings of The Organic Meat Company Limited (TOMCL) to ‘A/A-1’ from ‘A-/A-2’, according to the company’s filing on PSX today. This upgrade signifies a strong improvement in TOMCL’s credit quality and financial stability.

STRONG CREDIT QUALITY AND TIMELY PAYMENT CERTAINTY

The long-term rating of ‘A’ reflects good credit quality with adequate protection factors, while the short-term rating of ‘A-1’ indicates a high certainty of timely payment, excellent liquidity factors, and minor risk factors. The rating outlook is ‘Stable’, underscoring the company’s consistent performance and robust financial health.

KEY FACTORS FOR RATING UPGRADE

Several key factors have contributed to the rating upgrade. TOMCL’s strong market position as a major processor and exporter of red meat, along with its largest capacity from slaughtering to packaging, has solidified its presence in 16 export markets. Additionally, TOMCL’s diverse product range, including various forms of processed meat, pet chews, and cooked meat products, showcases its extensive industry reach and adaptability.

The company’s efficient business model minimizes wastage and effectively leverages byproducts, contributing to its overall operational excellence and financial performance.

PSX NOTICES: CITI PHARMA LIMITED ANNOUNCES STRATEGIC PARTNERSHIP WITH MURLI KRISHNA PHARMA PRIVATE LTD

EXCLUSIVE STRATEGIC PARTNERSHIP AGREEMENT

Citi Pharma Limited (PSX: CPHL) has entered into an exclusive strategic partnership agreement with Murli Krishna Pharma Private Ltd, an Indian pharmaceutical company. The development was shared in a notice to the Pakistan Stock Exchange (PSX) on Tuesday. This partnership aims to establish terms and conditions for Murli Krishna Pharma to supply high-quality Active Pharmaceutical Ingredients (APIs) and products exclusively to Citi Pharma Limited in the Pakistan market.

EXCLUSIVITY AND QUALITY COMMITMENT

Under the terms of this agreement, Murli Krishna Pharma Private Ltd agrees not to supply any of the APIs in N-l form (the form they will be supplying to CPHL) to any other company in Pakistan except Citi Pharma. This exclusivity ensures that Citi Pharma Limited will have the sole right to market, distribute, and sell these exclusive products within Pakistan. Murli Krishna Pharma is committed to supplying these products in accordance with the highest quality standards in the pharmaceutical industry, complying with British Pharmacopoeia (BP) or United States Pharmacopeia (USP) standards, or as specified by Citi Pharma’s regulatory team.

FINANCIAL AND OPERATIONAL IMPACT

This agreement is anticipated to generate a turnover increase of Rs2.8 billion for Citi Pharma Limited, with the cost of sales expected to rise by Rs2.38 billion. Despite the increase in operational costs, the company expects minimal impact as it will be leveraging its existing resources. Upon the successful completion of phase one of this agreement (the first two years), Citi Pharma Limited and Murli Krishna Pharma Private Ltd have agreed to discuss and negotiate the expansion of their supply chain to other countries, including but not limited to the USA and the Kingdom of Saudi Arabia.

ABOUT MURLI KRISHNA PHARMA PRIVATE LTD

Murli Krishna Pharma Private Ltd is a 20-year-old Indian organization providing innovative solutions to optimize the delivery of pharmaceutical preparations. The company has established itself as a key player in the pharmaceutical industry, known for its commitment to quality and excellence.

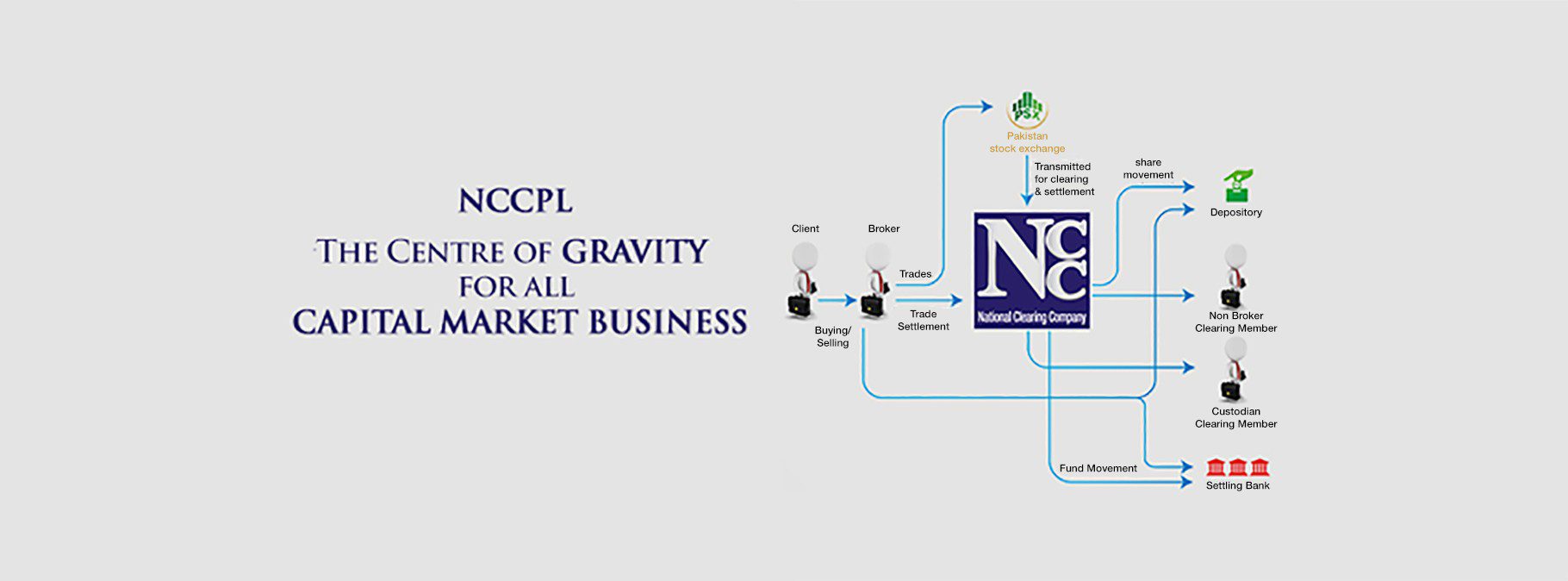

PSX NOTICES: NCCPL EXTENDS KYC REGISTRATION DEADLINE FOR EXISTING CUSTOMERS

NEW DEADLINE SET FOR AUGUST 31, 2024

The National Clearing Company of Pakistan Limited (NCCPL) has announced an extension for the registration of existing customers in the KYC Database, now set for August 31, 2024. This decision comes in light of the significant number of investors who have yet to register under the Know Your Customer (KYC) regime.

INSTRUCTIONS TO ACCOUNT INSTITUTIONS (AIS)

NCCPL has advised all Account Institutions (AIs) to complete the KYC process for their customers by the new deadline. Failure to do so will result in necessary actions being taken under the applicable CKO regulations. NCCPL is also validating customer credentials, with verification results to be shared with the respective AIs for their information and registration in the KYC Information System (KIS).

MULTIPLE OPTIONS FOR CUSTOMER REGISTRATION

NCCPL reiterated that the Central KYC Organization (CKO) has introduced several convenient options for customer registration under the KYC regime. AIs are urged to make diligent efforts to complete the registration process within the prescribed timeline.

PSX NOTICES: PSX ANNOUNCES TRAINING WORKSHOP ON IFRS SUSTAINABILITY DISCLOSURE STANDARDS

COLLABORATIVE INITIATIVE WITH UN SSE

The Pakistan Stock Exchange Limited (PSX) has announced an upcoming training workshop for listed companies on International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards. This workshop is a collaborative initiative between PSX and the UN Sustainable Stock Exchanges (SSE) Initiative.

WORKSHOP OBJECTIVES AND BENEFITS

The workshop aims to help representatives of listed companies understand IFRS Sustainability Disclosure Standards S1 and S2, build capacity to implement these standards, and ensure their consistent global uptake. This training session will equip PSX-listed companies with the knowledge and tools necessary to align with the IFRS Sustainability Standards, thereby integrating these standards into their reporting and operational practices.

PSX NOTICES: CCP APPROVES MERGER IN TV RATINGS AND STREAMING MARKET

MERGER APPROVED FOR MEDIALOGIC PAKISTAN ACQUISITION

The Competition Commission of Pakistan (CCP) has approved a significant merger in the TV ratings and streaming market, involving the acquisition of 100% shareholding of Medialogic Pakistan (Pvt) Ltd according to a Share Purchase Arrangement (SPA).

ABOUT MEDIALOGIC PAKISTAN

Medialogic Pakistan (Pvt) Ltd, established in 2007, is a key provider of media research services to broadcasters and advertisers in Pakistan. The company plays a crucial role in supplying data that forms the basis of media decisions for broadcasters, advertisers, and media agencies across the country.

COMPETITION ASSESSMENT AND MARKET IMPACT

CCP’s Phase I competition assessment identified ‘Media Research’ as the relevant product market. The analysis confirmed that despite Medialogic Pakistan’s considerable market share, market conditions will remain unchanged post-transaction. The transaction allows two Pakistani acquirers to gain a presence in the media research market without leading to market dominance, thus meeting the requirements for authorization under Section 31 of the Competition Act, 2010.

IMPROVED MARKET POSITION

With this merger approval, CCP anticipates that Medialogic Pakistan will be better positioned to measure and analyze consumers’ rapidly changing behaviors across all channels and platforms, thereby enhancing its service offerings.

MERGER REVIEW PROCESS

CCP implements a mandatory Merger Regime, reviewing mergers and acquisitions of shares or assets, including joint ventures under Section 11 of the Act, ensuring alignment with international standards.

BUSINESS NEWS PAKISTAN

CEMENT DESPATCHES INCREASE BY 1.6% IN FY 2023-24

ANNUAL PERFORMANCE OVERVIEW

Total cement despatches in Pakistan saw a modest increase of 1.6%, reaching 45.29 million tons during the fiscal year 2023-24 compared to 44.58 million tons in the previous fiscal year, according to data released by the All Pakistan Cement Manufacturers Association.

DOMESTIC VS. EXPORT DESPATCHES

Domestic despatches experienced a decline, with a 4.58% reduction to 38.18 million tons from 40 million tons last year. In contrast, export despatches saw a significant rise of 55.71%, surging to 7.11 million tons from 4.57 million tons during the previous fiscal year.

PERFORMANCE OF NORTH AND SOUTH BASED MILLS

- North Based Mills:

- Domestic Despatches: 31.55 million tons, down 3.76% from 32.78 million tons in FY 2022-23.

- Exports: Increased by 36.23% to 1.457 million tons from 1.07 million tons.

- Total Despatches: Reduced by 2.49% to 33 million tons from 33.85 million tons last year.

- South Based Mills:

- Domestic Despatches: 6.64 million tons, down 8.30% from 7.24 million tons.

- Exports: Increased by 61.67% to 5.65 million tons from 3.5 million tons.

- Total Despatches: Increased by 14.49% to 12.29 million tons from 10.73 million tons last year.

MONTHLY PERFORMANCE (JUNE 2024)

In June 2024, cement despatches declined by 12.58% to 3.552 million tons compared to 4.06 million tons in June 2023. Local despatches were 3.08 million tons, down 11.69% from 3.49 million tons in June 2023, while exports dropped by 17.95% to 472,865 tons from 576,309 tons.

- North Based Mills (June 2024):

- Domestic Despatches: 2.61 million tons, down 8.45% from 2.86 million tons in June 2023.

- Exports: Increased by 14.19% to 108,861 tons from 95,333 tons.

- Total Despatches: 2.72 million tons, down 7.71% from 2.95 million tons.

- South Based Mills (June 2024):

- Domestic Despatches: 465,578 tons, down 26.34% from 632,093 tons in June 2023.

- Exports: Decreased by 24.32% to 364,004 tons from 480,976 tons.

- Total Despatches: 829,582 tons, down 25.47% from 1.11 million tons.

CALL FOR POLICY INTERVENTION

A spokesperson for the All Pakistan Cement Manufacturers Association highlighted the importance of the domestic market for the cement industry and urged policymakers to address the decline in domestic uptake. The spokesperson emphasized the need to reduce duties and taxes on cement, noting that the government’s recent increase in excise duty from Rs 2,000 per ton to Rs 4,000 per ton in the 2024-25 budget is likely to further dampen demand. They stressed that cement is a basic necessity and urged the government to take measures to reduce construction costs to make it more affordable for the masses.

OVERVIEW OF BROAD MONEY (M2) IN PAKISTAN AS OF JUNE 21, 2024

M2 REACHES RS35.13 TRILLION, SHOWING GROWTH

As of June 21, 2024, Broad Money (M2), the primary measure of money supply in Pakistan, increased by Rs28.22 billion week-on-week (WoW) to reach Rs35.13 trillion, as reported by the State Bank of Pakistan (SBP) in its provisional accounts on Monetary Aggregates.

Annual Comparison Highlights Significant Growth

Comparing to June 2023, M2 has surged by Rs3.61 trillion, from Rs31.52 trillion recorded at the end of the last fiscal year.

Breakdown of M2 Components:

- Currency in Circulation:

- Increased by Rs96.17 billion WoW to Rs9.4 trillion as of June 21, 2024.

- Year-to-date rise of Rs248.07 billion compared to Rs9.15 trillion in June 2024.

- Represents 26.75% of M2, up from 26.5% a week earlier and down from 29.02% in June 2023.

- Total Deposits with Banks:

- Recorded at Rs25.6 trillion.

- Decreased by Rs66.73 billion WoW.

- Increased by Rs3.34 trillion year-to-date (FYTD).

- Excludes inter-bank deposits, government deposits, and foreign constituents.

UNDERSTANDING CURRENCY IN CIRCULATION:

Currency in circulation includes banknotes and coins held by the general public and financial institutions. It serves as a vital component of M2, reflecting the cash flow within the economy.

DEFINITION AND COMPOSITION OF M2:

M2 in Pakistan encompasses:

- Liability Side: Currency in circulation, total deposits of the non-government sector (including residents’ foreign currency deposits), and other deposits with SBP.

- Asset Side: Comprises net domestic assets and net foreign assets of the banking system (SBP and scheduled banks).

In conclusion, M2 provides a comprehensive view of the money supply dynamics in Pakistan, crucial for assessing economic liquidity and financial stability.

GOVERNMENT OF PAKISTAN’S FISCAL BORROWINGS UPDATE

GOVERNMENT DEBT INCREASES TO RS6.68 TRILLION IN FY 2025

During the week ended June 21, 2024, the Government of Pakistan accumulated an additional debt of Rs74.2 billion, pushing its total net borrowing for the ongoing fiscal year 2025 to Rs6.68 trillion, as estimated by the central bank.

CATEGORIES OF GOVERNMENT BORROWINGS

Government borrowings are categorized into:

- Budgetary Support: Rs6.81 trillion

- Commodity Operations: Rs115.79 billion retired

- Others: Rs6.11 billion retired

BREAKDOWN OF WEEKLY BORROWINGS:

- Budgetary Support: Rs72.89 billion

- Commodity Operations: Rs1.6 billion

- Others (Retirement): Rs292.51 million

SOURCES OF FINANCING

The primary sources of financing for budgetary support are the State Bank of Pakistan (SBP) and Scheduled Banks. This fiscal year, the breakdown of net transactions includes:

- From SBP: Government paid off Rs678.86 billion

- Federal Government: Rs296.53 billion

- Provincial Government: Rs349.95 billion

- AJK Government: Rs30.42 billion

- GB Government: Rs1.96 billion

- From Scheduled Banks: Lent out Rs7.49 trillion

- Federal Government: Borrowed Rs7.75 trillion

- Provincial Government: Retired Rs261.27 billion

OIL MARKETING COMPANIES (OMCS) SALES UPDATE FOR FY 2023-24

OVERALL SALES DECLINE BY 8% YEAR-ON-YEAR

In fiscal year 2023-24, the sales of oil marketing companies (OMCs) in Pakistan saw a significant decline of 8% year-on-year (YoY), totaling 15.28 million Metric Tons (MTs) compared to 16.61 million MTs in the previous fiscal year. This marks the lowest yearly sales volume since at least FY 2006, highlighting challenges within the sector.

MONTHLY PERFORMANCE HIGHLIGHTS

- June 2024: Oil sales increased by 7.6% YoY to 1.45 million MTs from 1.34 million MTs in June 2023, according to data from the Oil Companies Advisory Council (OCAC).

- Month-on-Month: A 4.1% increase was observed compared to May 2024, where sales stood at 1.39 million MTs.

PRODUCT-WISE SALES BREAKDOWN

- Motor Spirit (MS): Sales declined by 3.8% YoY to 7.14 million MTs in FY 2023-24. In June 2024, sales increased by 9% YoY to 0.7 million MTs.

- High-Speed Diesel (HSD): Sales decreased by 1.7% YoY to 6.26 million MTs for the fiscal year. June 2024 saw a 4.6% YoY increase to 0.57 million MTs.

- Furnace Oil (FO): Experienced the most significant decline, plummeting by 49.2% YoY to 1.04 million MTs in FY 2023-24. In June 2024, sales rose by 6.2% YoY to 0.11 million MTs.

KEY INSIGHTS AND ANALYSIS

The decline in OMCs’ sales reflects broader economic conditions impacting fuel consumption patterns in Pakistan. Despite monthly fluctuations, the sector faces challenges in maintaining previous sales levels, particularly in furnace oil due to shifting energy dynamics and regulatory changes.