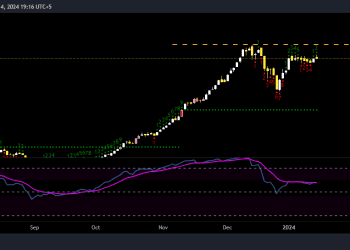

The Pakistani rupee (PKR) weakened by 4.62 paisa or 0.02% against the US dollar during Tuesday’s interbank session, closing at PKR 278.67 per USD, compared to the previous close of PKR 278.62.

The currency recorded an intraday high (bid) of PKR 278.70 and a low (ask) of PKR 278.65.

Open Market Rates

In the open market, the US dollar was quoted at PKR 278.50 for buying and PKR 280 for selling by exchange companies.

Performance Against Other Currencies

The rupee also experienced depreciation against several major currencies:

- Euro: Down 2.44 rupees (0.85%), closing at PKR 290.30 compared to PKR 287.86.

- British Pound: Fell by 2.73 rupees (0.79%), ending at PKR 349.81 from PKR 347.08.

- Swiss Franc: Declined 1.19 rupees (0.39%), settling at PKR 308.12.

- Japanese Yen: Weakened 0.22 paisa (0.12%), closing at PKR 1.7690 from PKR 1.7668.

- Chinese Yuan: Decreased by 1.80 paisa (0.05%), ending at PKR 38.03 compared to PKR 38.01.

- Saudi Riyal: Dropped by 3.20 paisa (0.04%), closing at PKR 74.23.

- UAE Dirham: Slipped by 1.25 paisa (0.02%), settling at PKR 75.87.

Year-to-Date Performance

- Fiscal Year: The rupee has depreciated by 32.61 paisa (0.12%) against the US dollar.

- Calendar Year: A decline of 11.73 paisa (0.04%) has been observed so far in 2025.

Money Market Update

In the money market, the benchmark 6-month Karachi Interbank Bid and Offer Rates (KIBOR) eased slightly:

- Bid rate: Down 3 basis points (bps) to 11.77%.

- Offer rate: Declined 3 bps to 12.02%.

Conclusion

The PKR’s marginal depreciation highlights the currency’s vulnerability to global market trends and economic uncertainties. Traders remain cautious amid ongoing geopolitical tensions and await upcoming economic data for further cues.