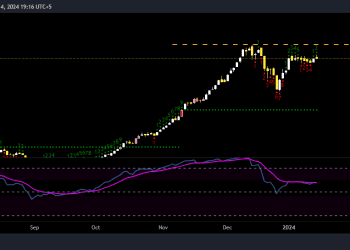

The Pakistan stock market extended its decline on Wednesday, with the benchmark KSE-100 index losing 447.22 points, or 0.6%, to close at 74,219.44. This follows a 1.2% drop on the previous day.

INTRADAY PERFORMANCE

The KSE-100 index traded within a range of 621.59 points, reaching an intraday high of 74,758.11 (+91.45 points) and a low of 74,136.52 (-530.13 points). The total trading volume for the index was 138.9 million shares.

MARKET MOVERS

Sectors Dragging the Index:

- Commercial Banks: -186.71 points

- Oil & Gas Exploration Companies: -102.26 points

- Cement: -39.03 points

- Engineering: -37.3 points

- Textile Composite: -26.05 points

Sectors Supporting the Index:

- Fertilizer: +5.27 points

- Insurance: +4.23 points

- Power Generation & Distribution: +3.83 points

- Leather & Tanneries: +2.89 points

- Automobile Assembler: +2.52 points

KEY COMPANIES

Top Losers:

- HBL: -58.45 points

- OGDC: -57.9 points

- BAFL: -48.79 points

- BAHL: -38.13 points

- PPL: -21.26 points

Top Gainers:

- EFERT: +16.83 points

- FABL: +12.44 points

- TRG: +7.9 points

- FFC: +6.46 points

- HUBC: +5.88 points

BROADER MARKET

The broader market, represented by the All-Share index, closed at 47,962.70, with a net loss of 268.24 points. The total market volume was 348.55 million shares, down from 414.48 million in the previous session, while the traded value was recorded at Rs16.39 billion, showing a decrease of Rs1.93 billion.

A total of 206,428 trades were reported across 441 companies, with 127 closing up, 246 closing down, and 68 remaining unchanged.

TOP TEN BY VOLUME

- KEL: 25,285,416 shares

- AMTEX: 23,587,783 shares

- WTL: 16,062,912 shares

- NBP: 14,253,731 shares

- DFML: 14,210,068 shares

- AIRLINK: 14,198,348 shares

- NETSOL: 13,227,028 shares

- HUMNL: 10,057,058 shares

- TRG: 9,935,728 shares

- FCCL: 8,239,995 shares

MARKET PERFORMANCE

Despite the recent declines, the KSE-100 index has gained 32,767 points, or 79.05%, during the fiscal year. The ongoing calendar year has witnessed a cumulative increase of 11,768 points, equivalent to an 18.84% rise.