Karachi, August 1, 2024 – The benchmark KSE-100 Index closed Thursday’s trading session at 77,740.30 points, marking a decline of 146.68 points or 0.19%. The index exhibited a volatile trading range of 645.10 points, reaching an intraday high of 78,241.02 (+354.04) and a low of 77,595.92 (-291.06) points.

The trading session saw a total volume of 97.02 million shares for the KSE-100 Index. Out of the 100 listed companies, 34 ended the day in positive territory, 57 posted losses, and 9 remained unchanged.

Major Movers of the Day PSX STOCKS

Top Decliners:

The top losers of the session included Pakistan Oilfields Limited (POML), Bank Alfalah Limited (BAFL), Pakistan International Bulk Terminal (PIBTL), YouW Limited (YOUW), and Standard Chartered Bank Pakistan Limited (SCBPL), which saw declines of 3.95%, 3.69%, 3.38%, 3.23%, and 3.07%, respectively.

Top Gainers:

On the flip side, leading the gains were Fauji Fertilizer Company (FFC), Packages Limited (PABC), Bestway Cement Limited (BWCL), Thal Limited (THALL), and Murree Brewery Company Limited (MUREB), with increases of 3.76%, 3.57%, 2.56%, 2.39%, and 2.04%, respectively.

Index Contributors

The companies that exerted the most downward pressure on the index included United Bank Limited (UBL) with a contribution of -98.12 points, Bank Alfalah Limited (BAFL) with -53.47 points, Mari Petroleum Company Limited (MARI) with -27.75 points, Pakistan Petroleum Limited (PPL) with -27.70 points, and Bank Al Habib Limited (BAHL) with -21.67 points.

Conversely, companies that provided positive contributions were Fauji Fertilizer Company (FFC) with 150.40 points, Lucky Cement Limited (LUCK) with 27.10 points, Habib Bank Limited (HBL) with 25.63 points, Meezan Bank Limited (MEBL) with 17.29 points, and Pakistan Oilfields Limited (POL) with 13.61 points.

Sector Performance

The performance of various sectors saw the KSE-100 Index being weighed down predominantly by Commercial Banks (-176.76 points), Oil & Gas Exploration Companies (-57.16 points), Food & Personal Care Products (-26.50 points), Pharmaceuticals (-12.41 points), and Oil & Gas Marketing Companies (-10.76 points). However, Fertilizer (+122.36 points), Automobile Assembler (+13.48 points), Technology & Communication (+11.99 points), Automobile Parts & Accessories (+11.66 points), and Miscellaneous (+8.82 points) sectors provided some support.

Broader Market Overview

In the broader market, the All-Share Index settled at 49,361.74 points, reflecting a net loss of 111.72 points or 0.23%. Market activity saw a total volume of 278.99 million shares, a decrease from the previous session’s 382.60 million shares, while the traded value came in at Rs13.09 billion, down by Rs1.54 billion.

The broader market recorded 166,797 trades across 433 companies, with 172 closing up, 198 closing down, and 63 remaining unchanged.

Top Ten Active Stocks by Volume

• Hascol Petroleum (HASCOL): Price: Rs6.45, Change: +5.22%, Volume: 26.71 million shares

• WorldCall Telecom (WTL): Price: Rs1.25, Change: 0.00%, Volume: 21.82 million shares

• Waves Corporation (WAVESAPP): Price: Rs8.04, Change: -9.15%, Volume: 13.53 million shares

• Fauji Cement Company Limited (FCCL): Price: Rs20.83, Change: +0.29%, Volume: 11.55 million shares

• Tariq Glass Industries Limited (TOMCL): Price: Rs40.67, Change: +3.25%, Volume: 10.50 million shares

• Synthetic Products Enterprises Limited (SPEL): Price: Rs38.19, Change: +6.65%, Volume: 8.91 million shares

• Kohinoor Spinning Mills Limited (KOSM): Price: Rs4.09, Change: +0.25%, Volume: 8.85 million shares

• Air Link Communications (AIRLINK): Price: Rs103.79, Change: +1.60%, Volume: 8.13 million shares

• The Searle Company Limited (SEARL): Price: Rs58.42, Change: +1.00%, Volume: 7.18 million shares

• K-Electric Limited (KEL): Price: Rs4.07, Change: -0.97%, Volume: 6.62 million shares

Annual Performance Overview

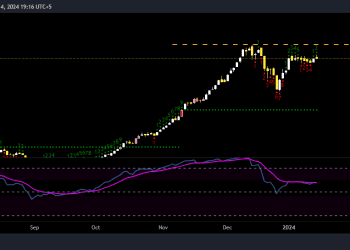

As of the latest session, the KSE-100 Index has lost 705 points or 0.90% during the fiscal year. However, the calendar year has shown a strong performance with an overall increase of 15,289 points, equivalent to a 24.48% gain.

PAKISTAN ECONOMY

PKR Appreciates Against USD, Gold Prices Surge Amid Market Uncertainty

The Pakistani Rupee (PKR) showed resilience during Thursday’s interbank trading session, appreciating by 7.79 paisa against the US Dollar. This slight yet notable gain comes amidst fluctuating market conditions, providing some relief to the local currency which has faced pressure in recent weeks.

The appreciation of the PKR is seen as a positive development for the economy, as it could help mitigate inflationary pressures that have been driven by a weaker rupee in the past. This movement is closely monitored by businesses and consumers alike, as the exchange rate plays a crucial role in the cost of imports, international debt servicing, and overall economic stability.

Gold Prices on the Rise

In parallel with the currency market, the price of gold saw a significant uptick on Thursday. The rate for one tola of 24-karat gold surged by Rs. 1,400, reflecting increased demand for the precious metal as investors seek safe-haven assets amid ongoing economic uncertainties.

Date Published: August 1, 2024