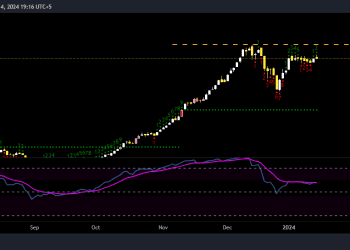

Oil prices staged a notable recovery after a significant slump on Friday, spurred by a series of political and geopolitical events. Brent crude rose to $83.11 per barrel, marking a 0.58% increase on the day, while West Texas Intermediate (WTI) crude climbed to $79.05 per barrel, up by 0.52%. This comes after both benchmarks fell over 3% last week.

The rebound was influenced by a major political development in the United States. President Joe Biden ended his reelection campaign and endorsed Vice President Kamala Harris. Concerns had been growing that Biden might not be able to secure a win against Donald Trump. This political shift had immediate effects on the market, contributing to the easing of the US dollar in Asian trading, which in turn benefited commodities priced in the currency.

Additionally, Canada’s oil production is under threat due to a wave of wildfires across Alberta’s oil patch. The wildfires have put an estimated 348,000 barrels a day of production at risk, according to data from Alberta Wildfire and the Alberta Energy Regulator.

Oil prices have been trending higher this year as OPEC+ continued to limit output, which has led to a drawdown in global stockpiles over the northern hemisphere summer. Geopolitical tensions have also played a significant role in shaping the oil market. The ongoing conflict between Israel and Hamas, along with clashes involving Iran-backed groups such as the Yemen-based Houthis, has raised concerns about regional instability and potential threats to supply.

Recently, Israel conducted airstrikes on targets around the Houthi-controlled Red Sea port of Hodeidah in response to a drone attack on Tel Aviv. The strikes targeted facilities including fuel-storage sites, with Houthi-run media showing footage of flames and smoke from the affected installations.

Market metrics indicate tight near-term conditions. Brent’s prompt spread, which is the difference between its two nearest contracts, showed a backwardation of more than $1 a barrel, indicating a bullish market sentiment. Just two weeks ago, this gap was 76 cents, reflecting the growing concerns over supply constraints and geopolitical risks.

As these developments unfold, the oil market continues to navigate a complex landscape influenced by both political shifts and geopolitical tensions. The recovery in oil prices highlights the market’s sensitivity to such factors and underscores the importance of stability in ensuring consistent supply and pricing.