ADB Supports Pakistan with $500 Million Loan for Climate and Disaster Resilience

The Asian Development Bank (ADB) has approved a significant $500 million policy-based loan for Pakistan, focusing on climate change mitigation and disaster resilience. This financial aid will bolster the nation’s capacity to manage and respond to climate-related challenges, supporting sustainable growth and improved resilience against natural disasters.

Currency and Market Watch: PKR, USD, and Saudi Riyal

The Pakistani Rupee (PKR) experienced a slight depreciation against the US dollar, dropping by 0.02% to close at PKR 277.74 in Tuesday’s interbank trading. Meanwhile, the Saudi Riyal was traded at Rs73.52 for buying and Rs74.17 for selling, as currency market trends continue to respond to shifts in local and international economic dynamics.

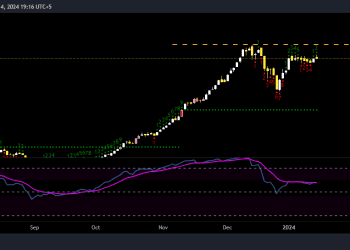

PSX on Record-Breaking Bull Run

Pakistan’s stock market has extended its record-breaking rally, as the KSE-100 index closed its seventh consecutive positive session. Stronger macroeconomic indicators and investor confidence contributed to another 1,000-point surge, highlighting an optimistic outlook amid evolving market conditions.

Corporate Earnings Highlights

- The Organic Meat Company Limited (TOMCL) reported a remarkable 228.6% surge in its first-quarter profit, reaching Rs170.61 million.

- AGP Limited saw a 35% rise in its third-quarter profit, totaling Rs549.75 million.

- Agha Steel reported a significant loss of Rs1.81 billion, driven by a 46% revenue decline, highlighting challenges in the steel industry.

- Saif Power Limited experienced a 25% decrease in quarterly profit, recording Rs535.37 million amid cost pressures.

Commodity Updates: Gold Prices Rise

Gold prices in Pakistan climbed by Rs1,600 per tola, reaching Rs285,000 for 24-karat gold. This increase follows recent trends as precious metal markets react to global economic uncertainties.

Significant Financial Movements and Announcements

- Pakistan Petroleum Limited (PPL) witnessed a 20% drop in first-quarter profits but issued a dividend, surprising investors.

- Unity Foods Limited returned to profitability with Rs51.23 million in earnings, reflecting a favorable shift in the food sector.

- Mari Petroleum released bonus shares after verifying tax payments, boosting shareholder confidence.

Economic Development and Foreign Investment News

Pakistan received $594 million in external financing in September, marking a significant month-over-month increase of 119.5%. Additionally, ZAREA Limited, a major digital commodities marketplace, filed for an IPO on the Pakistan Stock Exchange (PSX), aiming to capitalize on Pakistan’s growing digital economy.

Energy and Infrastructure Updates

Pakistan and Russia have reaffirmed their commitment to strengthen ties across sectors including trade, energy, and agriculture. This collaboration reflects Pakistan’s growing interest in diversifying its international partnerships, especially in areas critical for long-term infrastructure development.

PM Reiterates Commitment to Eradicating Polio

Prime Minister Shehbaz Sharif underscored his administration’s dedication to making Pakistan polio-free, calling for renewed efforts in immunization and public health initiatives to protect the nation’s children from preventable diseases.

Insights on Technology’s Role in Tackling Challenges

Shaza Fatima Khawaja, Pakistan’s Minister of State for IT, highlighted the role of technology in addressing urgent national challenges. With digital infrastructure expansion at the forefront, technology is positioned as a cornerstone for Pakistan’s future economic resilience.