The Benchmark KSE100 Index closed the session Green with index posting an intraday high of 426.68 pts. The Global Crude Oil prices continue the downtrend.

The volumes increased from the previous sessions close. Index closed at 4371.82 pts adding 352.93 points to the index.

The volumes increased from 114.95 million shares in the previous session to 188.45 million shares Today. The volume leaders included TELE(+7.72%), TPLP(+4.29%), TREET(+3.16%). The scrips traded 19.57mn, 15.29mn and 13.73mn shares respectively.

Sectors contributing positively to KSE100 index included Cement sector (75.90pts), Power Generation sector (68.07pts) and Technology sector (55.33pts). Companies contributing positively to the index included HUBC(65.51pts), LUCK(36.06pts), TRG(28.33pts).

CFDs on Brent Crude Oil posted an intraday high of $105.65 and an intraday low of $97.49. Oil is currently trading at $99.70 (4:46 pm Tuesday, 15 March 2022 (GMT+5) Time in Pakistan).

CFDs on WTI Crude Oil posted an intraday high of $102.57 and an intraday low of $93.56. Oil is currently trading at $95.33 (4:46 pm Tuesday, 15 March 2022 (GMT+5) Time in Pakistan).

[highlight color=”yellow”]Market Front:[/highlight] PKR Interbank Closing Rates. PKR closed at 178.98 on Mar, 14, 2022 and closed at 179.22 on Mar, 15, 2022. Change: -0.13%

The government has disbursed a sum of Rs47,587.63 million for various power division schemes under Annual Public Sector Development Programme (PSDP) for Year 2021-22 so far.

Chief of Army Staff General Qamar Javed Bajwa says misinformation and propaganda by inimical forces threatens National cohesion which must be identified and countered collectively through a unified response.

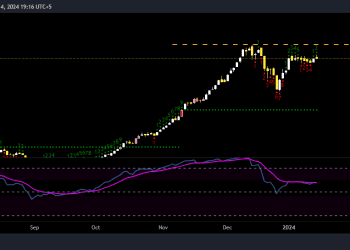

[highlight color=”yellow”]TECHNICALS[/highlight]

Here you can see that the market is again trying to have a go at the resistance. This time the signs are looking positive for a break out situation since this move is supported by volatility increase.

However, we are still below the resistance and need to close above it with volume confirmation and avoid making a local high before the break out, since we will have Hidden bearish divergence on the chart in case of a local high below the resistance, trade safe.