Pakistan Stock Market Index lost over 1100 points in intraday today. Fitch on Tuesday changed Pakistan’s outlook from stable to negative. This led to the second consecutive drop in the week which has just started. Moreover, PKR witnessing major drops against the dollar didn’t help either as it traded over RS 222 against dollar on Tuesday.

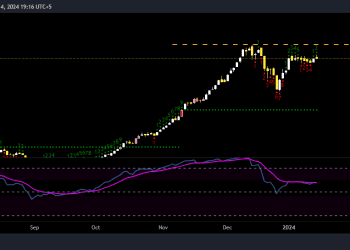

KSE100

The Benchmark KSE100 Index closed the session Red with index posting an intraday high of 184.42 points and an intraday low of 1150.73 points. PKR continues to lose strength against dollar over the political uncertainty, panic buying by the banks, and State Bank on the roll to save reserves. Oil bounced from MA200 support, nearing initial resistance.

The volumes increased from the previous sessions close. Index closed at 40389.07 pts erasing 978.04 points from the index.

The volumes increased from 151.041 million shares in the previous session to 193.40 million shares Today. The volume leaders included KEL(-1.64%), WTL(-8.09%), CNERGY(-3.47%). The scrips traded 19.36mn, 17.63mn and 3.47mn shares respectively.

Sectors contributing negatively to KSE100 index included Commercial Banks sector (261.73pts), Oil and Gas Exploration sector (168.04pts) and Fertilizer sector (157.64pts). Companies contributing negatively to the index included ENGRO(79.69pts), MEBL(66.07pts), POL(58.65pts).

MARKET FRONT

CFDs on Brent Crude oil posted an intraday high of $106.94 and intraday low of $105.21. Oil is currently trading at $105.28 (3:45pm Tuesday, 19 July 2022 (GMT+5) Time in Pakistan).

CFDs on WTI Crude Oil posted an intraday high of $99.94 and intraday low of $98.12. Oil is currently trading at $98.17 (3:45pm Tuesday, 19 July 2022 (GMT+5) Time in Pakistan).

Technically the KSE100 index has a initial support of 40,300 and 39000 subsequently and the initial resistance of 41,300.

Yet another set back for Pakistan’s Capital markets as Ratings agency Fitch has revised Pakistan’s outlook from ‘stable’ to ‘negative’, citing several reasons for the downgrade, including adjustment risks, financing, political risks and declining reserves.