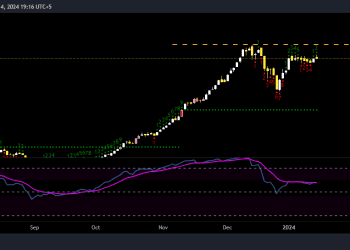

The KSE-100 Index closed above 94,000 points for the first time, marking its 52nd record this year. The index closed at 94,191.89, up by 836.47 points, or 0.90%. Positive throughout the session, the index reached an intraday high of 94,289.97 and a low of 93,672.72, with a total trading volume of 255.61 million shares.

Market Movers

- Top Gainers: TRG (+10.00%), EFUG (+10.00%), ATRL (+7.41%), MEHT (+7.10%), and NRL (+4.50%).

- Top Losers: BNWM (-4.55%), KEL (-3.37%), POML (-2.89%), ABOT (-2.53%), and GLAXO (-2.36%).

Index Contributions

- Positive Contributions: UBL (+121.68 pts), OGDC (+100.22 pts), HBL (+98.99 pts), MCB (+68.62 pts), TRG (+66.27 pts).

- Negative Contributions: SYS (-40.32 pts), FFC (-30.08 pts), ABOT (-17.77 pts), GLAXO (-15.85 pts), SEARL (-15.49 pts).

Sector Performance

- Leading Sectors: Commercial Banks (+404.92 pts), Oil & Gas Exploration (+167.71 pts), Refinery (+61.31 pts), Power Generation (+49.45 pts), and Investment Banking (+46.47 pts).

- Lagging Sectors: Pharmaceuticals (-60.20 pts), Fertilizer (-36.06 pts), Auto Parts & Accessories (-11.40 pts), Tobacco (-6.85 pts), and Paper & Packaging (-5.66 pts).

Broader Market Performance

- All-Share Index: Closed at 60,306.56, up by 497.05 points (0.83%).

- Total Market Volume: Increased to 1,084.34 million shares, with traded value at Rs32.68 billion.

- Trade Summary: 464 companies traded with 260 closing up, 148 down, and 56 unchanged.

Top Ten by Volume

| Symbol | Price | Change (%) | Volume |

|---|---|---|---|

| WTL | 1.38 | +9.52% | 177,393,273 |

| HASCOL | 8.21 | +13.87% | 59,224,094 |

| TBL | 15.81 | +9.26% | 47,940,702 |

| SSGC | 24.78 | +9.89% | 42,748,255 |

| CNERGY | 4.6 | +2.00% | 32,665,062 |

| TPLP | 8.66 | +6.65% | 30,497,881 |

| TREET | 17.66 | +7.62% | 29,734,104 |

| TELE | 7.96 | +3.24% | 29,162,423 |

| PRL | 26.58 | -1.12% | 27,309,247 |

| FFL | 10.55 | +2.93% | 24,679,082 |

Market Gains

In the fiscal year, the KSE-100 has risen by 15,747 points (20.07%), and it has increased by 31,741 points (50.83%) year-to-date. This sustained upward momentum reflects robust investor sentiment and a positive economic outlook for Pakistan.

PAKISTAN MARKETS

On Thursday, the Pakistani Rupee (PKR) strengthened by 10.99 paisa, or 0.04%, closing at PKR 277.74 against the US Dollar in the interbank market. This marks a continuation of the currency’s gradual appreciation trend. The PKR witnessed an intraday high (bid) of 277.80 and a low (ask) of 277.60 against the dollar. In the open market, exchange companies quoted the dollar at 277.02 for buying and 278.80 for selling.