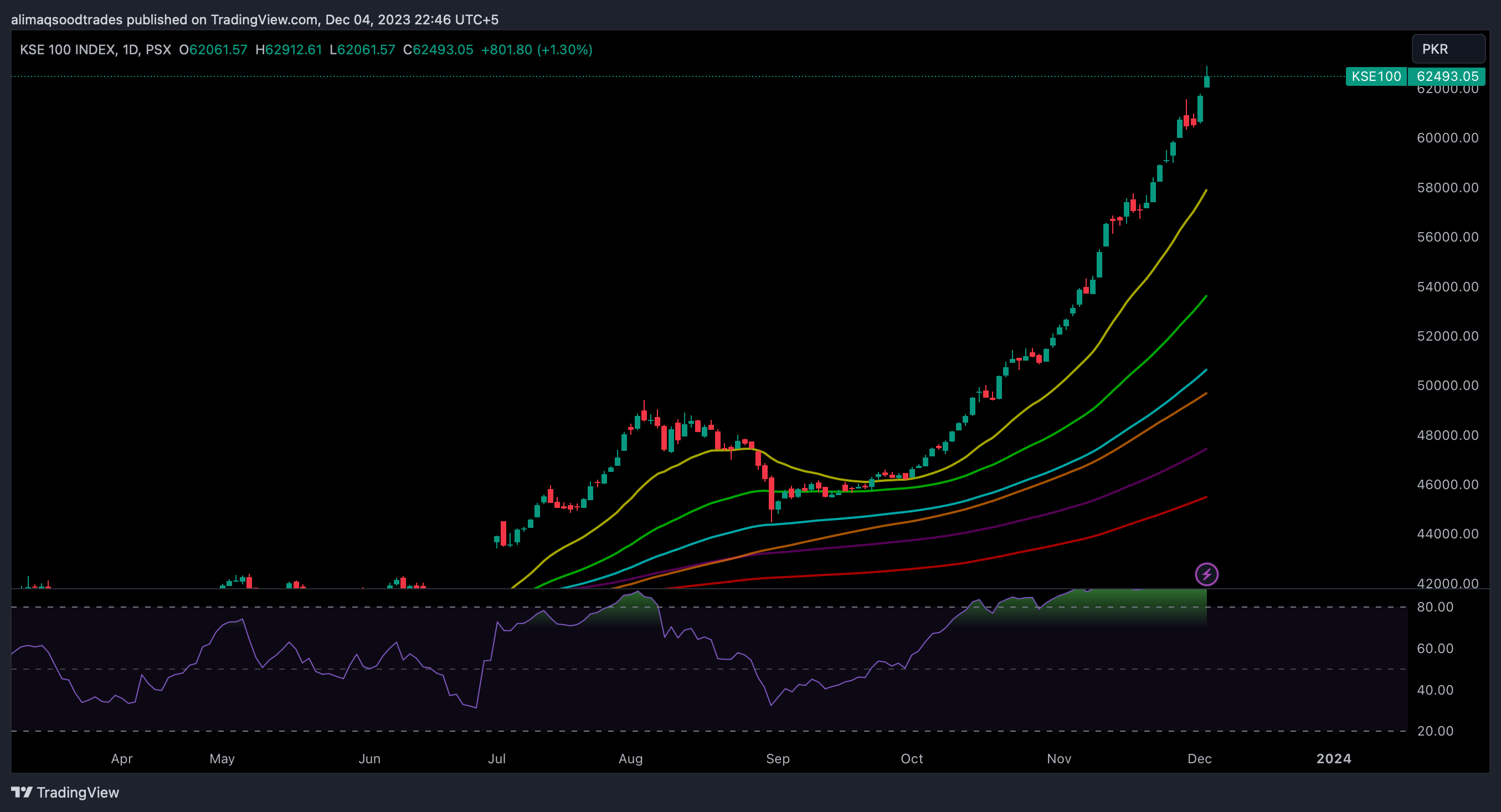

The benchmark KSE-100 Index recorded a remarkable start to the week with strong bullish momentum, ending the trading day at a record-breaking high of 62,493.05.

Investor confidence was further reinforced when the index recorded a significant daily increase of 801.80 points, or 1.3%.

KSE100

The Benchmark KSE100 Index closed the session again with a bullish green candle for the day, week and the month. The index posted an intraday high of 479.68 points and an intraday low of 73.86 points. PKR continues to gain strength against the greenback and oil is still trading below MA200 and EMA21 Oil ended the previous session with a 9-2.70%0 loss for the day.

The volumes decresed from the previous sessions close. Index closed at 61,691.25 pts adding 1159.98 (1.92%) points to the index.

The index was positive all day long, peaking at 62,912.61 (+1,221.36) points and falling to 62,061.57 (+370.31) points at its lowest point. There were 368.996 million shares traded for the KSE-100 Index overall.

Expectations of improved economic conditions continue to fuel investors’ optimism. There are several reasons for this optimism: the currency is relatively stable due to government-backed administrative efforts; inflows from friendly countries and the International Monetary Fund (IMF) are anticipated; and interest rates may drop.

In a recent move, the IMF commended Pakistan’s caretaker federal government for its efforts to uphold economic stability and carry out necessary reforms.

Furthermore, the State Bank of Pakistan (SBP) recently disclosed trade data that shows a $9.38 billion trade deficit, a 33.59% reduction from the same time last year.

With a noteworthy gain of 2,677 points, or 4.53% WoW, the KSE-100 Index recorded its ninth consecutive weekly gain last week. Out of the 100 index companies, 56 closed higher, 21 closed lower, and 23 remained untraded during today’s session.

Important industries that bolstered the KSE-100 Index were automotive assemblers, oil and gas marketing companies, food and personal care products, and fertiliser.

Businesses like PPL, OGDC, MTL, MARI, and HUBC are positively correlated with the index. However, industries like tobacco, textile spinning, automotive parts and accessories, vanaspati & allied industries, and synthetic & rayon had an adverse effect on the index.

An index that was weighed down by top-performing stocks was UBL, LUCK, MLCF, HMB, and MCB.

Overall, the market saw a net gain of 557.30 points as the All-Share index closed at 41,602.68. The traded value of the total market volume, which was 734.295 million shares, was recorded at Rs31.64 billion, which is the ninth-highest traded daily value in PKR terms. This represents an increase over the previous session.

A total of 387 companies reported 310,137 trades during the day’s trading activity; 248 of those companies closed up, 120 closed down, and 19 remained unchanged. WTL was the volume leader, with FCCL, OGDC, PPL, and PRL following closely behind.

The volumes decresed from the previous sessions close. Index closed at 61,691.25 pts adding 1159.98 (1.92%) points to the index.

The volumes decreased from 343.52 million shares in the previous session to 295.89 million shares Today. The volume leaders included MLCF(+7.10%), PAEL(+6.93%), FFBL(+2.33%). The scrips traded 43.07mn, 39.80mn and 25.57mn shares respectively.

MARKET FRONT

CFDs on Brent Crude oil posted an intraday high of $79.68 and intraday low of $77.55. Oil is currently trading at $78.62 (10:32pm Monday, 04 December 2023 (GMT+5) Time in Pakistan).

CFDs on WTI Crude Oil posted an intraday high of $75.00 and intraday low of $72.66. Oil is currently trading at $73.88 (10:32pm Monday, 04 December 2023 (GMT+5) Time in Pakistan).