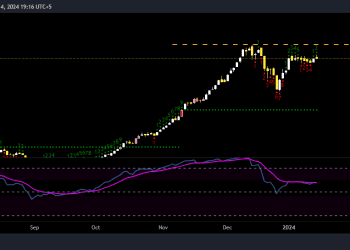

Pakistan stocks rebounded after a significant drop of almost 2% the previous day, with the benchmark KSE-100 Index rising by 447.91 points or 0.57% to close Tuesday’s trading session at 78,987.09. The index showed an intraday high of 79,585.34 (+1,046.16 points) and a low of 78,634.15 (+94.97 points).

MARKET VOLUME AND PERFORMANCE

The total volume of the KSE-100 Index was 137.60 million shares. Out of the 100 index companies, 61 closed up, 34 closed down, and 5 remained unchanged.

TOP GAINERS AND LOSERS

- Top Gainers: LCI (+6.77%), INIL (+4.43%), CEPB (+3.25%), MUREB (+3.18%), and FATIMA (+3.16%).

- Top Losers: FABL (-3.32%), FCEPL (-3.03%), SNGP (-2.99%), ABL (-2.89%), and HGFA (-2.27%).

INDEX-POINT CONTRIBUTIONS

- Companies that boosted the index: HUBC (+88.68 points), OGDC (+43.49 points), MARI (+39.60 points), UBL (+28.36 points), and MTL (+27.95 points).

- Companies that dragged the index down: HBL (-20.80 points), SNGP (-20.05 points), FABL (-19.45 points), ABL (-12.54 points), and BAHL (-11.82 points).

SECTOR-WISE PERFORMANCE

- Supporting Sectors: Oil & Gas Exploration Companies (+111.91 points), Power Generation & Distribution (+89.49 points), Fertilizer (+68.40 points), Automobile Assembler (+40.17 points), and Technology & Communication (+33.34 points).

- Lagging Sectors: Investment Banks/Investment Companies/Securities Companies (-11.45 points), Food & Personal Care Products (-6.88 points), Cable & Electrical Goods (-4.47 points), Insurance (-2.95 points), and Close-End Mutual Funds (-1.26 points).

BROADER MARKET PERFORMANCE

The All-Share Index closed at 50,135.58 with a net gain of 268.24 points or 0.54%. The total market volume was 316.25 million shares, down from 375.60 million in the previous session. The traded value was recorded at Rs17.07 billion, a decrease of Rs2.28 billion. There were 214,597 trades reported across 433 companies, with 225 closing up, 164 closing down, and 44 remaining unchanged.

TOP TEN BY VOLUME

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| PIAHCLA | 15.63 | -8.17% | 22,079,450 |

| PAEL | 26.26 | -1.24% | 19,793,659 |

| WTL | 1.17 | -0.85% | 19,515,808 |

| FFBL | 42.2 | 3.08% | 17,618,054 |

| AIRLINK | 110.91 | 5.69% | 13,683,532 |

| KEL | 4.49 | 1.81% | 13,145,716 |

| SILK | 1.0 | 0.00% | 10,555,515 |

| AVN | 67.78 | 2.37% | 9,616,486 |

| WAVESAPP | 9.1 | -1.09% | 7,046,999 |

| NETSOL | 145.51 | 3.45% | 7,005,455 |

MONTHLY AND YEARLY PERFORMANCE

The KSE-100 has gained 542 points or 0.69% so far this month, while the ongoing calendar year has seen a cumulative increase of 16,536 points, equivalent to 26.48%.

PAKISTANI RUPEE DEPRECIATES AGAINST US DOLLAR

PKR WEAKENS AGAINST USD IN INTERBANK MARKET

The Pakistani rupee (PKR) depreciated by 10.72 paisa against the US dollar in Tuesday’s interbank session, closing at PKR 278.41 per USD compared to the previous session’s PKR 278.3 per USD. The currency experienced an intraday high (bid) of 278.65 and a low (ask) of 278.40.

GOLD PRICES DECLINE IN PAKISTAN AS INTERNATIONAL MARKETS REMAIN STABLE

GOLD PRICE DECREASE IN PAKISTAN

Gold prices in Pakistan fell on Tuesday, with 24-karat gold being sold at Rs250,500 per tola, down Rs500. The Karachi Sarafa Association reported the price of 24-karat gold at Rs214,763 per 10-gram, a decrease of Rs429. Similarly, the price of 22-karat gold dropped to Rs196,866 per 10-gram.

STABILITY IN INTERNATIONAL GOLD MARKETS

On the international front, spot gold held near $2,395 an ounce, showing little change from the previous session. Gold price (XAU/USD) found support near the $2,400 resistance level in Tuesday’s European session. This stability comes as US bond yields decline amid strong speculation that the Federal Reserve will begin lowering its key borrowing rates from September, with 10-year US Treasury yields falling near 4.23%.