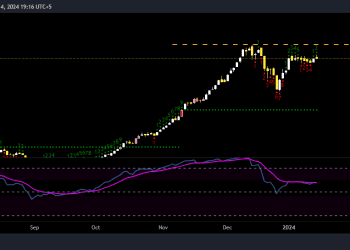

The Karachi Stock Exchange (KSE) 100 Index concluded Friday’s trading session on a positive note, gaining 485.68 points or 0.62%, to close at 78,225.98. The index demonstrated a steady upward trajectory throughout the day, with an intraday high of 78,434.16 (+693.86 points) and a low of 77,926.53 (+186.23 points).

PSX STOCK DAILY ACTIVITY

• Volume: The total trading volume of the KSE-100 Index was robust, with 203.30 million shares exchanged during the session.

• Performance of Index Companies: Out of 100 index-listed companies, 60 closed up, 29 ended down, 10 remained unchanged, and 1 was not traded.

Top Gainers and Losers

• Top Gainers: Leading the gains were CNERGY (+15.94%), NRL (+10.00%), ATRL (+8.88%), NATF (+7.41%), and YOUW (+4.67%).

• Top Losers: The companies that saw declines included PSEL (-4.74%), JVDC (-4.20%), PIOC (-2.76%), DGKC (-1.55%), and KOHC (-1.42%).

Contributions to Index Movement

• Top Contributors: The companies that contributed most significantly to the index’s rise were HUBC (+79.45 points), HBL (+49.03 points), UBL (+47.28 points), OGDC (+41.05 points), and ATRL (+40.82 points).

• Negative Contributors: Conversely, companies that negatively impacted the index were BAHL (-28.81 points), PSEL (-25.99 points), DAWH (-20.37 points), MCB (-19.43 points), and MTL (-18.25 points).

Sector-wise Performance

• Supporting Sectors: The sectors that bolstered the KSE-100 Index included Power Generation & Distribution (+103.40 points), Oil & Gas Exploration Companies (+95.57 points), Refinery (+88.73 points), Commercial Banks (+64.63 points), and Food & Personal Care Products (+61.88 points).

• Declining Sectors: On the downside, Miscellaneous (-30.86 points), Automobile Assembler (-24.15 points), Cement (-20.55 points), Investment Banks / Investment Companies / Securities Companies (-16.56 points), and Property (-7.05 points) exerted downward pressure on the index.

Broader Market Performance

• All-Share Index: The broader market also closed on a positive note, with the All-Share Index rising by 389.54 points or 0.79%, to settle at 49,751.28.

• Market Volume: The total market volume surged to 443.48 million shares, up from 278.99 million in the previous session, with a traded value of Rs20.50 billion, reflecting an increase of Rs7.40 billion.

• Market Breadth: Out of 439 companies traded, 235 closed higher, 142 ended lower, and 62 remained unchanged.

Top Ten by Volume

• CNERGY: 66,993,533 shares, +15.94%, Price: Rs4.0

• TOMCL: 18,623,103 shares, +9.84%, Price: Rs44.67

• PAEL: 17,306,367 shares, +4.40%, Price: Rs26.81

• TPLP: 16,831,144 shares, +8.92%, Price: Rs8.43

• WTL: 16,564,632 shares, +0.80%, Price: Rs1.26

• KOSM: 15,803,148 shares, +7.82%, Price: Rs4.41

• AGHA: 13,283,656 shares, +3.84%, Price: Rs9.19

• MLCF: 12,978,326 shares, -1.26%, Price: Rs34.61

• FCCL: 12,922,634 shares, +0.67%, Price: Rs20.97

• FFBL: 10,971,656 shares, +1.50%, Price: Rs43.39

Yearly Performance

The KSE-100 Index has recorded a loss of 219 points or 0.28% during the current fiscal year. However, the ongoing calendar year has seen the index rise by 15,775 points, reflecting a significant gain of 25.26%.

PAKISTAN ECONOMY

Currency Market Update

The Pakistani rupee (PKR) appreciated by 16.4 paisa against the US dollar in Friday’s interbank session. The currency closed at PKR 278.5 per USD, improving from the previous session’s close of PKR 278.66 per USD. This appreciation comes as a slight but positive move amidst the PKR’s ongoing volatility against the greenback.

Gold Market Update

Gold prices in Pakistan saw a significant surge on Friday. The price of 24 karat gold per tola rose by Rs. 2,400, reflecting heightened demand and fluctuating market conditions. This increase has brought the new rate to Rs. 235,400 per tola, signaling a strong upward trend in the precious metal’s value.

This sharp rise in gold prices is indicative of global market influences and local currency fluctuations, making gold an even more attractive investment option for many amidst economic uncertainties.