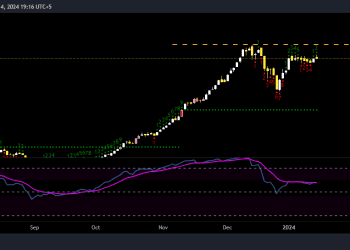

The benchmark KSE-100 index concluded Tuesday’s trading session at 71,359.41, marking a marginal decrease of 74.06 points or 0.1%. The index demonstrated a range-bound movement throughout the day, trading within a span of 508.21 points. It reached an intraday high of 71,846.64 (+413.17) and a low of 71,338.43 (-95.03) points. The total volume of the KSE-100 index stood at 383.445 million shares, reflecting active market participation.

In terms of market breadth, advancers were balanced with decliners, as 46 companies closed up, 51 closed down, and 3 remained unchanged.

The performance of the KSE-100 index was bolstered by sectors such as Cement, Textile Composite, Automobile Assembler, Glass & Ceramics, and Property, contributing positively to the index points. Conversely, sectors including Commercial Banks, Oil & Gas Exploration Companies, Oil & Gas Marketing Companies, Automobile Parts & Accessories, and Power Generation & Distribution exerted downward pressure on the index.

Specifically, companies that added points to the index included LUCK, UBL, HBL, MTL, and MLCF, whereas companies such as MEBL, FABL, OGDC, THALL, and BAFL dragged the index lower.

In the broader market, the All-Share index closed at 46,865.87 with a net loss of 98.78 points. The total market volume slightly increased to 655.936 million shares, while the traded value recorded a decrease of Rs6.82 billion, totaling Rs24.49 billion.

Furthermore, there were 282,235 trades reported in 368 companies, with 168 closing up, 178 closing down, and 22 remaining unchanged.

In terms of volume, the top ten companies included KEL, PIBTL, FCCL, PAEL, MLCF, WTL, AIRLINK, FFL, PIAA, and UNITY.

Notably, the KSE-100 index has shown significant gains during the fiscal year, surging by 29,907 points or 72.15%. Similarly, the ongoing calendar year has witnessed a cumulative increase of 8,908 points, equivalent to 14.26%, reflecting a robust performance in the Pakistani stock market.