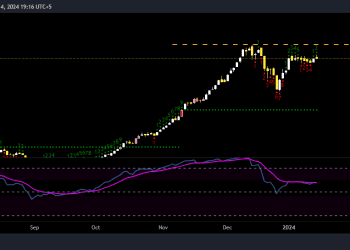

he KSE-100 index of the Pakistan Stock Exchange (PSX) experienced a significant drop on Wednesday, shedding 741.82 points, equivalent to a negative change of 0.94 percent. The index closed at 77,886.99 points, down from the previous day’s close of 78,628.81 points.

TRADING VOLUME AND MARKET PERFORMANCE

Despite the bearish trend, the trading volume increased, with a total of 382.6 million shares being traded, compared to 313.1 million shares on the previous day. However, the total value of traded shares decreased to Rs 14.638 billion, down from Rs 17.615 billion.

Out of 442 companies that participated in the trading session, 118 recorded gains, 254 sustained losses, and 70 remained unchanged.

TOP TRADING COMPANIES AND MARKET MOVERS

- Top Trading Companies:

- WorldCall Telecom: 81.2 million shares traded at Rs 1.25 per share.

- Kohinoor Spinning: 24.7 million shares traded at Rs 4.08 per share.

- TLP Properties: 19.7 million shares traded at Rs 7.94 per share.

- Top Gainers:

- Nestle Pakistan Limited: Increased by Rs 112.70 per share, closing at Rs 6,965.50.

- Mehmood Textile Mills Limited: Rose by Rs 27.18 per share, closing at Rs 665.95.

- Top Losers:

- Unilever Pakistan Foods Limited: Decreased by Rs 312.14 per share, closing at Rs 18,000.00.

- Sapphire Fibres Limited: Declined by Rs 98.99 per share, closing at Rs 1,499.92.

PAKISTAN ECONOMY

GOLD PRICE IN PAKISTAN RISES TO RS 252,800 PER TOLA AMID GLOBAL STAGFLATION FEARS

The price of 24-karat gold in Pakistan surged on Wednesday, reaching Rs 252,800 per tola, marking an increase of Rs 2,300 from the previous day. This rise in gold prices reflects ongoing global economic concerns.

GLOBAL GOLD MARKET SEES RECOVERY AMID ECONOMIC UNCERTAINTY

On the international front, Gold (XAU/USD) has shown a recovery for the second consecutive day, trading in the $2,410 range. The upward movement is driven by mounting fears of stagflation—an economic condition characterized by stagnant growth coupled with high inflation.

PAKISTANI RUPEE DEPRECIATES BY 09 PAISA AGAINST US DOLLAR, CLOSES AT RS 278.74

The Pakistani rupee (PKR) experienced a slight depreciation of 09 paisa against the US dollar during Wednesday’s interbank trading session. The currency closed at Rs 278.74 per USD, compared to the previous day’s closing of Rs 278.65.

FACTORS INFLUENCING PKR’S SLIGHT DEPRECIATION

The minor dip in PKR’s value against the dollar is reflective of ongoing market fluctuations influenced by both domestic economic conditions and global financial trends. The rupee’s performance continues to be monitored closely as Pakistan navigates through economic challenges.

IMPACT ON LOCAL MARKET AND FUTURE OUTLOOK

While the depreciation was marginal, it still signals the fragile state of the rupee amidst ongoing economic pressures. Analysts are keeping an eye on the rupee’s trajectory, particularly in relation to international currency movements and upcoming economic data releases.