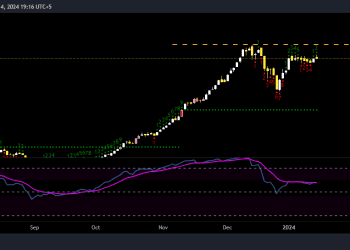

The benchmark KSE-100 Index ended Tuesday’s trading session at 78,628.80, reflecting a decrease of 198.94 points or 0.25%. The index traded within a range of 808.81 points, reaching an intraday high of 79,327.04 (+499.30) and a low of 78,518.23 (-309.51) points. The total trading volume for the KSE-100 Index was 143.37 million shares.

The State Bank of Pakistan (SBP) on Monday lowered its key policy rate by another 100 basis points to 19.5%, in line with market expectations. This reduction marks the second consecutive decrease, bringing the total reduction since June 2024 to 250 basis points.

Out of the 100 index companies, 30 closed higher, 68 closed lower, and 2 remained unchanged. The top losers of the day included FCCL (-3.95%), DGKC (-3.41%), MLCF (-2.99%), DAWH (-2.94%), and TRG (-2.85%). Conversely, the top gainers were FFC (+5.03%), PSEL (+4.94%), HABSM (+4.75%), AKBL (+4.15%), and KTML (+3.54%).

Corporate Highlights

Fauji Fertilizer Company Limited (PSX: FFC) reported a significant increase in earnings, nearly tripling during the quarter ending June 2024 to Rs15.55 billion (EPS: Rs12.22). The company also announced an interim cash dividend of Rs10 per share for its shareholders.

In terms of index-point contributions, the companies dragging the index lower were EFERT (-63.91 pts), DAWH (-47.78 pts), HBL (-46.06 pts), FCCL (-24.19 pts), and DGKC (-21.70 pts). Engro Fertilizers Limited (PSX: EFERT) was the biggest drag on the KSE-100 Index, closing down 1.96%. Investors are closely monitoring EFERT as its board meeting, which began at 10:00 am, is still in progress, focusing on approving the financial statements for the period ending June 30, 2024, and considering potential entitlements.

Companies that added points to the index included FFC (+189.83 pts), HUBC (+28.64 pts), PSEL (+25.81 pts), MTL (+19.02 pts), and ENGRO (+16.90 pts).

Sector Performance

Sector-wise, the KSE-100 Index was weighed down by Cement (-105.35 pts), Oil & Gas Exploration Companies (-51.34 pts), Investment Banks / Investment Companies / Securities Companies (-45.34 pts), Commercial Banks (-43.83 pts), and Oil & Gas Marketing Companies (-30.41 pts). Meanwhile, the sectors supporting the index were Fertilizer (+138.89 pts), Miscellaneous (+27.96 pts), Power Generation & Distribution (+22.38 pts), Automobile Assembler (+15.52 pts), and Pharmaceuticals (+6.81 pts).

Broader Market Performance

In the broader market, the All-Share Index closed at 49,892.37, down by 206.19 points or 0.41%. Total market volume was 313.09 million shares, compared to 371.09 million in the previous session, with a traded value of Rs17.62 billion, showing a decrease of Rs1.54 billion. There were 213,748 trades reported across 447 companies, with 152 closing higher, 239 closing lower, and 56 remaining unchanged.

Top Ten by Volume

1. TOMCL: Rs40.47, +3.72%, 24,830,333 shares

2. SEARL: Rs60.31, +3.22%, 24,067,099 shares

3. FCCL: Rs21.63, -3.95%, 15,819,905 shares

4. FFBL: Rs42.44, +0.14%, 15,590,659 shares

5. WAVESAPP: Rs9.36, -4.68%, 13,351,209 shares

6. WTL: Rs1.16, +0.87%, 9,356,734 shares

7. FFC: Rs178.82, +5.03%, 7,815,600 shares

8. KEL: Rs4.2, -1.64%, 7,300,395 shares

9. WAVES: Rs6.7, -0.45%, 7,288,714 shares

10. AVN: Rs66.23, +2.00%, 7,119,017 shares

Yearly Performance

- The KSE-100 Index has gained 184 points or 0.23% during the fiscal year, while the current calendar year has witnessed a cumulative increase of 16,178 points, equivalent to 25.90%.