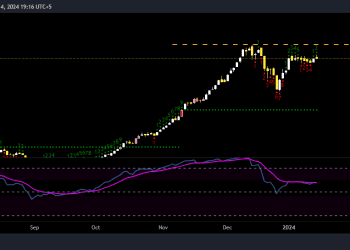

The Pakistan stock market experienced a volatile session on Friday, with the KSE-100 Index concluding the day in the red zone. The benchmark index closed at 78,029.50, reflecting a decrease of 439.83 points or 0.56%.

INTRADAY TRADING PERFORMANCE

The KSE-100 Index traded within a range of 648.41 points during the session. It reached an intraday high of 78,569.88 points, up by 100.55 points, and an intraday low of 77,921.47 points, down by 547.86 points. The total trading volume of the KSE-100 Index was 116.86 million shares.

MARKET MOVERS: TOP GAINERS AND LOSERS

Out of the 100 index companies, 24 closed higher, 71 closed lower, and 5 remained unchanged.

Top Losers:

- NPL (-5.05%)

- PSX (-4.25%)

- SNGP (-3.62%)

- NRL (-3.15%)

- INIL (-2.94%)

Top Gainers:

- YOUW (+3.09%)

- BAFL (+2.38%)

- HGFA (+2.29%)

- PGLC (+1.99%)

- THALL (+1.95%)

INDEX POINT CONTRIBUTORS

Companies Dragging the Index Lower:

- HBL (-52.38 points)

- OGDC (-46.15 points)

- MEBL (-44.09 points)

- PPL (-35.53 points)

- FFC (-33.00 points)

Companies Supporting the Index:

- BAHL (+46.30 points)

- UBL (+40.46 points)

- BAFL (+34.82 points)

- THALL (+9.87 points)

- HUBC (+8.93 points)

SECTOR-WISE PERFORMANCE

The KSE-100 Index was mainly impacted by declines in the following sectors:

- Oil & Gas Exploration Companies (-106.58 points)

- Technology & Communication (-59.62 points)

- Fertilizer (-57.70 points)

- Oil & Gas Marketing Companies (-56.91 points)

- Commercial Banks (-20.02 points)

Conversely, the sectors that provided support included:

- Automobile Parts & Accessories (+9.87 points)

- Tobacco (+6.91 points)

- Miscellaneous (+5.78 points)

- Property (+1.31 points)

- Close-End Mutual Fund (+1.26 points)

BROADER MARKET OVERVIEW

The All-Share Index closed at 49,603.98, registering a net loss of 331.05 points or 0.66%. The total market volume was 278.33 million shares, down from 327.28 million in the previous session. The traded value decreased to Rs 11.62 billion, showing a drop of Rs 3.66 billion. There were 181,576 trades reported across 429 companies, with 114 companies closing higher, 255 closing lower, and 60 remaining unchanged.

TOP TEN BY VOLUME

| Symbol | Price | Change % | Volume |

| KEL | 4.27 | -1.84% | 15,218,855 |

| SNGP | 69.98 | -3.62% | 14,833,712 |

| WTL | 1.16 | -1.69% | 14,224,557 |

| QUICE | 6.08 | -6.32% | 12,345,708 |

| AGL | 24.1 | 2.47% | 10,326,642 |

| DFML | 41.9 | -5.99% | 7,176,317 |

| HASCOL | 6.19 | -4.03% | 7,151,945 |

| SILK | 1.03 | -5.50% | 7,068,772 |

| CNERGY | 3.59 | -2.18% | 6,828,597 |

| PIAHCLA | 15.7 | -3.62% | 5,980,696 |

ANNUAL PERFORMANCE INSIGHTS

During the fiscal year, the KSE-100 Index has lost 415 points or 0.53%. However, the ongoing calendar year has seen a cumulative increase of 15,578 points, equivalent to a 24.95% rise.

GOLD PRICES SURGE IN PAKISTAN: 24 KARAT GOLD HITS RS. 251,500 PER TOLA

On Friday, the price of 24 karat gold saw a significant increase of Rs. 1,000 per tola, reaching Rs. 251,500. This marks a notable rise from its previous value of Rs. 250,500 recorded on the last trading day.

PRICE CHANGES IN GOLD AND SILVER

The cost of per 10 grams also saw an uptick:

- 24 Karat Gold: Rose by Rs. 858 to Rs. 215,621 from Rs. 214,763.

- 22 Karat Gold: Increased to Rs. 197,652 from Rs. 196,866.

According to the All Sindh Sarafa Jewellers Association, silver prices remained stable, with per tola and ten grams staying at Rs. 2,860 and Rs. 2,451.98, respectively.

INTERNATIONAL GOLD MARKET TRENDS

Globally, the price of gold increased by $3, reaching $2,473 from $2,470. This rise follows gold’s recovery from the 50-day Simple Moving Average (SMA), bouncing back from a sharp decline the previous day. On Thursday, gold prices had dropped by over 1.0% due to concerns about global economic growth, impacting the broader commodities market.

IMPACT OF THE PAKISTANI RUPEE

In the currency market, the Pakistani Rupee (PKR) appreciated by 6.79 paisa against the US Dollar during Friday’s interbank session, adding another layer of complexity to the local gold pricing dynamics