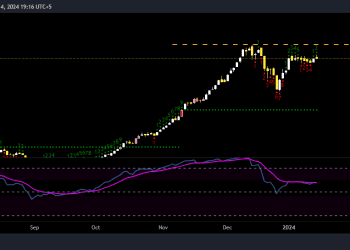

KARACHI, April 4, 2024 (MMF): The benchmark KSE-100 index closed the week at a historic high of 68,417, marking a substantial increase of 1,412 points or 2.11% week-on-week (WoW). Simultaneously, the Pakistani Rupee recorded a marginal gain of 0.01% WoW. In USD terms, the KSE-100 index also experienced a notable gain of 2.11% for the week.

Throughout the week, the KSE-100 index exhibited considerable volatility, fluctuating within a range of 1,866 points, with highs and lows recorded at 68,439 and 66,574 levels, respectively, before concluding the week at 68,417.

Despite the market’s impressive performance, the turnover witnessed a decline during the week, with an average traded volume of 129 million shares valued at Rs6.96 billion. This indicates a decrease of 22.11% WoW in the number of shares traded and 17.11% WoW in traded value.

Moreover, the overall PSX average traded volume (All-Share) stood at 307 million shares worth Rs11.77 billion, reflecting a decline of 7.15% WoW in the number of shares traded and 0.22% WoW in traded value.

On the economic front, headline inflation slowed to a 22-month low of 20.7% year-on-year (YoY) in March. However, on a monthly basis, it surged by 1.7%, raising concerns about potential price pressures in the future.

In addition, the government raised petrol prices by Rs9.66 per litre for the first half of April 2024. Furthermore, the latest trade figures indicated a substantial 24.6% month-on-month (MoM) increase in the trade deficit, reaching $2.17 billion compared to $1.74 billion in the previous month. While exports experienced a marginal drop, imports saw a significant decline.

During the week, the government conducted two auctions, raising Rs557.6 billion through Market Treasury Bills (MTBs) at unexpectedly higher yields and Rs5.4 billion through PIB-PFL auction. Surprisingly, the central bank increased the cut-off yields for the six-month T-Bills by 101 basis points, potentially impacting expectations for a rate cut in April’s meeting.

SECTOR-WISE PERFORMANCE AND TOP-PERFORMING STOCKS ON KSE-100 INDEX

Taking a sector-specific lens, the Commercial Banks sector emerged as the best performer on the KSE-100 index during the week, contributing significantly to the index’s gains by adding 367 points. This was followed by the Fertilizer sector, which contributed 278 points, and the Inv. Banks / Inv. Cos. / Securities Cos. sector, adding 201 points. Additionally, the Oil & Gas Exploration Companies and Cement sectors contributed 153 and 148 points, respectively.

In contrast, several sectors ended in the red zone, including Chemical, Paper & Board, Tobacco, Textile Composite, and Synthetic & Rayon, which collectively subtracted 25, 21, 19, 14, and 7 points from the index, respectively.

On a scrip-wise analysis, DAWH, ENGRO, EFERT, PPL, and SYS emerged as the best-performing stocks during the week, contributing significantly to the index’s gains by adding 200, 157, 101, 84, and 81 points, respectively. Conversely, PTC, PAKT, COLG, PKGS, and MARI collectively detracted 108 points from the index.

These insights shed light on the diverse performance of sectors and individual stocks within the KSE-100 index, providing valuable information for investors navigating the stock market. It’s essential for investors to consider both sectoral trends and specific stock performances to make informed investment decisions.

FOREIGN INVESTORS REMAIN NET BUYERS; FOREIGN CORPORATES LEAD IN PURCHASES

Foreign investors continued to demonstrate bullish sentiment in the Pakistani equity market during the week, ending as net buyers with purchases totaling $3.86 million worth of equities.

Flow-wise, Foreign Corporates emerged as the dominant buyers, making a significant net investment of $3.81 million. Notably, they allocated the majority of their capital, amounting to $1.69 million, to Commercial Banks.

However, the leading sellers were Insurance Companies, who divested $5.6 million worth of stocks. This divestment follows significant net buying observed in the first quarter of 2024.

Insurance Companies’ most substantial sales activity was seen in Oil and Gas Exploration Companies, with sales amounting to $3.6 million.