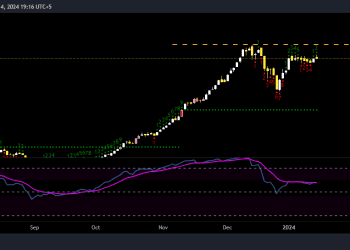

After reaching a record-breaking high in the previous session, the dazzling rise in gold prices in Pakistan paused for a short while today. The price of the precious metal, which had surged to an all-time high of Rs241,100 a tola, saw a slight decline, losing Rs900 to close at Rs240,200. The price has risen significantly despite this decline, and it has surpassed the previous high of Rs240,000 recorded on May 10, 2023.

It’s worth noting that while gold reached a new all-time high in the previous session, the intraday peak is yet to be surpassed. According to data from the Karachi Sarafa Association, the highest intraday price recorded stands at Rs242,700.

The ongoing rally in domestic gold prices has been a remarkable journey since March, with the yellow metal surging by a substantial Rs19,100, in tandem with the global upsurge in gold prices.

The association also reported that the price of 24-karat gold reached Rs205,932 per 10 grams, marking a gain of Rs772 compared to the previous session. Similarly, the price of 22-karat gold saw a decline, being quoted lower at Rs188,772 per 10 grams.

On the global stage, the international spot gold market snapped its seven-day winning streak, experiencing a 0.38% drop in the previous session. This retreat in international rates can be attributed to the anticipation of lower U.S. interest rates in the coming months, as investors await further clarity on the timing of rate cuts.

Bart Melek, head of commodity strategies at TD Securities, highlighted the impact of recent statements by Federal Reserve officials, particularly Chairman Jerome Powell’s remarks, which suggested a readiness to consider rate cuts amid expectations of inflation exceeding the 2% target.

“Typically, this is very favorable for gold, particularly since it appears the Federal Reserve is inclined to lower interest rates despite the anticipation of inflation surpassing their target,” Melek stated, as reported by Reuters.

While Fed officials, including Powell, have emphasized the need for more deliberation and data before any decision on rate cuts, financial markets anticipate such a move as early as June.