Pakistani local Gold market, the gleam of gold and silver remained unaltered on Monday, with prices holding firm despite subtle shifts on the international stage. The All Sindh Sarafa Jewellers Association disclosed that the per tola price of 24 karat gold showed no deviation from its previous stance, standing resolute at Rs. 228,200. Likewise, the price of 10 grams of 24 karat gold remained static at Rs. 195,645, reflecting a market steadfastness embraced by investors and buyers alike.

Gold prices have experienced a notable rebound, touching the $2,184.34 mark per troy ounce, as the precious metal claws back losses from preceding sessions. This surge can be primarily attributed to the weakening US Dollar (USD), which has been influenced by the dovish sentiments surrounding the Federal Reserve’s stance on interest rate trajectory.

XAUUSD posted an intraday high of $2181.34 and intraday low of $2163,71. Gold is currently trading at $2175.61 (9:51pm Monday, 25 March 2024 (GMT+5) Time in Pakistan). A day earlier Gold was trading at $2167.28 (2:55pm Friday, 22 March 2024 (GMT+5) Time in Pakistan) March 2024 (GMT+5) Time in Pakistan).

FED’S DOVISH SIGNALS FUEL BULLION APPEAL

During a recent press conference, Federal Reserve Chair Jerome Powell hinted at the possibility of interest rate cuts, particularly if there is an unexpected rise in unemployment. Powell’s remarks, coupled with reassurances regarding the Fed’s measured response to inflation, have bolstered market expectations of interest rate cuts commencing in June. This dovish stance has significantly enhanced the allure of gold as a hedge against economic uncertainty.

INTERNATIONAL MARKET FLUCTUATIONS

While local prices maintained their equilibrium, the international arena witnessed a modest uptick in gold rates. The price of gold in global markets experienced a marginal increase of $2, reaching $2,187 from its previous standing at $2,185. Such fluctuations underscore the interconnectedness of global economies and the nuanced dynamics of precious metal markets.

CONFIDENCE IN FED’S RATE CUT PROJECTIONS

Recent indications from Fed policymakers further support the notion of impending interest rate cuts. Despite recent spikes in inflation, the Fed remains steadfast in its anticipation of reducing interest rates by three-quarters of a percentage point by the close of 2024. Such confidence in future rate adjustments has contributed to the upward momentum of gold prices.

CHALLENGES FROM US TREASURY BONDS

While gold enjoys renewed investor interest, challenges persist from US Treasury bonds, particularly in light of stable yields. The 2-year and 10-year yields on US Treasury bonds remain steady at 4.60% and 4.21%, respectively, potentially diverting investor attention towards the relative safety and stability of bonds over non-yielding assets like gold.

IMPACT OF UPCOMING ECONOMIC INDICATORS

Gold traders are closely monitoring forthcoming US economic indicators, notably the Gross Domestic Product (GDP) data for the fourth quarter of 2023 and the Personal Consumption Expenditures (PCE) price index report. These releases are expected to provide crucial insights into inflationary pressures, subsequently influencing gold prices as investors recalibrate their positions based on evolving market conditions.

CONSISTENCY IN 22 KARAT GOLD RATES

In tandem, the price of 10 grams of 22 karat gold echoed a similar sentiment, remaining unswerving at Rs. 179,341. This consistency signifies a notable assurance in the market, fostering an environment conducive to stable investments.

Silver, often seen as a resilient alternative, mirrored the solidity of its golden counterpart. Both the per tola and ten-gram rates remained unchanged, standing at Rs. 2,580 and Rs. 2,211.93, respectively. Such unwavering figures reinforce silver’s status as a dependable asset within the market landscape.

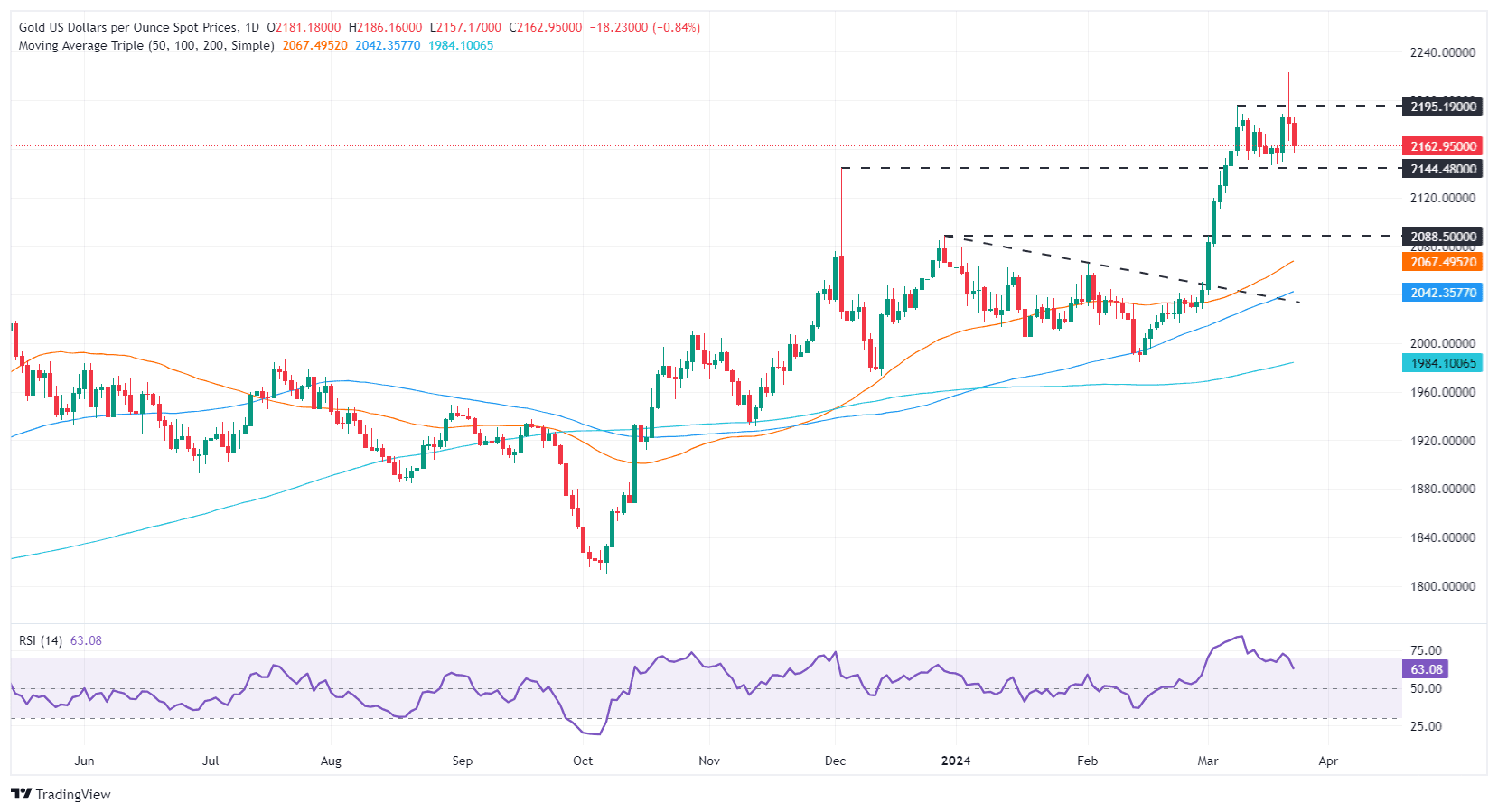

GOLD XAU/USD TECHNICAL ANALYSIS

Technically speaking, XAU/USD has been consolidating over $2,150 for the past eleven days. However, a drop towards the high-turned-supportive level of $2,088 on December 28 is likely if sellers intervened and forced Gold prices below the previously indicated barrier. Crucial support levels, such as the peak on December 4th, which turned into support at $2,146 before testing the $2,100 mark, must be broken on the way down, though.

Conversely, if buyers drive prices up towards $2,200, they will reveal the all-time high of $2,223 before moving towards $2,250.