GOLD PER TOLA RATE IN PAKISTAN TODAY: The price of per tola of 24 karat gold decreased by Rs.3,000 and was sold at Rs.251,000 on Friday against its sale at Rs.254,000 on last trading day.

The price of 10 grams of 24 karat gold also decreased by Rs.2,572 to Rs.215,192 from Rs. 217,764 whereas that of 10 gram 22 karat gold went down to Rs.197,259 from Rs. 199,617, the All Sindh Sarafa Jewellers Association reported.

The price of per tola silver decreased by Rs.50 to Rs.2,850 whereas that of ten gram silver went down by Rs.42.87 to Rs.2,443.41.

The price of gold in the international market decreased by $55 to $2,415 from $2,470, the Association reported.

Gold prices in Pakistan hit an all-time high on Thursday, with the price of 24-karat gold soaring by Rs4,600 per tola to reach Rs254,000.

This rally is attributed to signs of slowing inflation in the United States, which has led to speculation that the US central bank may soon lower interest rates. Typically, high interest rates are unfavorable for gold, as the precious metal does not bear any interest.

Additionally, it is noteworthy that the current price of gold in Pakistan is kept Rs4,000 below its actual cost due to a reduction in purchasing power.

Gold price (XAU/USD) extends its losing streak for the third trading day, declining to near $2,410 in Friday’s European session. The precious metal faces profit-booking after rallying to fresh all-time highs above $2,480 on Tuesday. The yellow metal has also been weighed down by a decent recovery in the US Dollar (USD) and bond yields amid growing speculation that the Republican Party will be victorious in the United States (US) Presidential elections later this year.

US DOLLAR INDEX REBOUNDS TO 104.30

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, bounces back to near 104.30. A higher US Dollar makes investment in Gold an expensive bet for investors. 10-year US Treasury yields jump to 4.21%. Higher yields on interest-bearing assets increase the opportunity cost of holding an investment in non-yielding assets, such as Gold.

FED RATE CUT EXPECTATIONS REMAIN STRONG

Gold price slides further to near $2,410 amid a strong recovery in the US Dollar. However, the near-term appeal of Gold remains firm as investors see expectations for the Federal Reserve (Fed) to begin reducing interest rates in September as certain. Expectations for the Fed to initiate a move toward policy normalization in September rose as policymakers gained slight confidence that inflation has returned on its path to the central bank’s target of 2%. However, officials still want to see more soft inflation data to gain greater confidence in lowering interest rates.

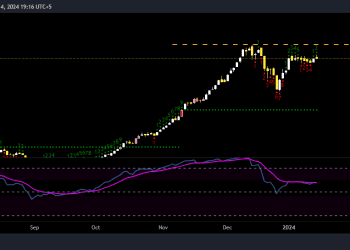

TECHNICAL ANALYSIS: GOLD PRICE FINDS SUPPORT NEAR TRENDLINE

Gold price slides further to near $2,410 in Friday’s European session. The precious metal weakens after failing to sustain above the crucial figure of $2,450. The near-term outlook of the Gold price remains firm as short-to-long-term Exponential Moving Averages (EMAs) are sloping higher. The advancing trendline plotted from the February 14 low at $1,984.30 will be a major support for Gold bulls. The 14-day Relative Strength Index (RSI) drops to 58.00, suggesting the upside momentum has stalled. However, the upside bias remains intact.