GOLD PER TOLA RATE IN PAKISTAN TODAY: Gold prices in Pakistan saw a decrease on Tuesday, with 24-karat gold being sold at Rs252,300 per tola, marking a decline of Rs400. The Karachi Sarafa Association also reported a reduction in the price of 24-karat gold per 10-gram, now at Rs216,306, down Rs344. Similarly, the price of 22-karat gold decreased to Rs198,281 per 10-gram.

In contrast, silver prices in the domestic market remained stable, with 24-karat silver being sold at Rs2,860 per tola and Rs2,452 per 10-gram.

On the international front, spot gold traded near $2,389 an ounce, up by $8.1 or 0.34% from the previous session.

India’s Rising Gold Demand

Commerzbank’s commodity analyst, Carsten Fritsch, noted a significant increase in gold demand in India. This surge is attributed to the reduction in the gold import tax, which has brought local gold prices to a four-month low. Consequently, the price premiums demanded by dealers in India over official domestic prices have risen to as much as $20 per troy ounce. According to Reuters, this is the highest premium level in ten years, contrasting with the $65 discounts offered just last week before the tax cut.

Meanwhile, gold prices in other Asian countries have remained relatively stable. In China, dealer discounts compared to global market levels are close to a two-year low, ranging from a discount of $10 to a premium of $2. In Japan, gold is sold at a $3 discount, while in Singapore and Hong Kong, it is offered at either slight premiums or discounts.

Technical Analysis

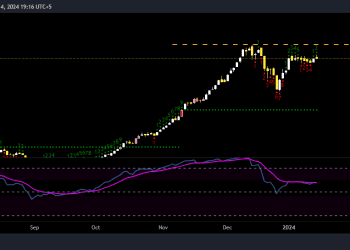

XAU/USD is experiencing a corrective decline after being capped near $2,500 in mid-July. The pair has found significant support at the 61.8% Fibonacci retracement of the June-July bullish run, around $2,360. The higher low printed last week suggests that the correction might be complete. The 4-hour Relative Strength Index (RSI) is pulling higher and is about to cross the key 50 level, indicating a potential breach of the $2,400 resistance area. However, additional bullish triggers, such as soft data or a dovish stance from the Federal Reserve, may be needed to achieve this.

Fundamental Overview

The gold price (XAU/USD) found buyers after a moderate pullback on Monday, continuing its mild recovery during Tuesday’s Asian and European sessions. Geopolitical concerns have eased with news that Israel is willing to avoid an all-out war in the Middle East, allowing the safe-haven US Dollar (USD) to trim some gains.

Investors are now focusing on the Federal Reserve’s monetary policy decision due on Wednesday. While the bank is expected to leave interest rates unchanged, the attention will be on the press release by Fed Chair Jerome Powell. With price pressures on a disinflationary trend and the labor market showing signs of exhaustion, Powell’s suggestion that the easing cycle might start before December could harm the US Dollar and support precious metals.