Tuesday saw a turnaround in Pakistan’s domestic gold market, with 24-karat gold prices rising by Rs300 per tola to Rs216,400. Ten grammes of 24-karat gold were listed for Rs185,528; this represents a Rs257 increase. Furthermore, 10 grammes of 22-karat gold were recorded at Rs170,067 in price. On the other hand, the price of silver stayed constant, with 10 grammes of 24-karat silver trading at Rs2,280.52 and 24-karat silver trading at Rs2,660 per tola.

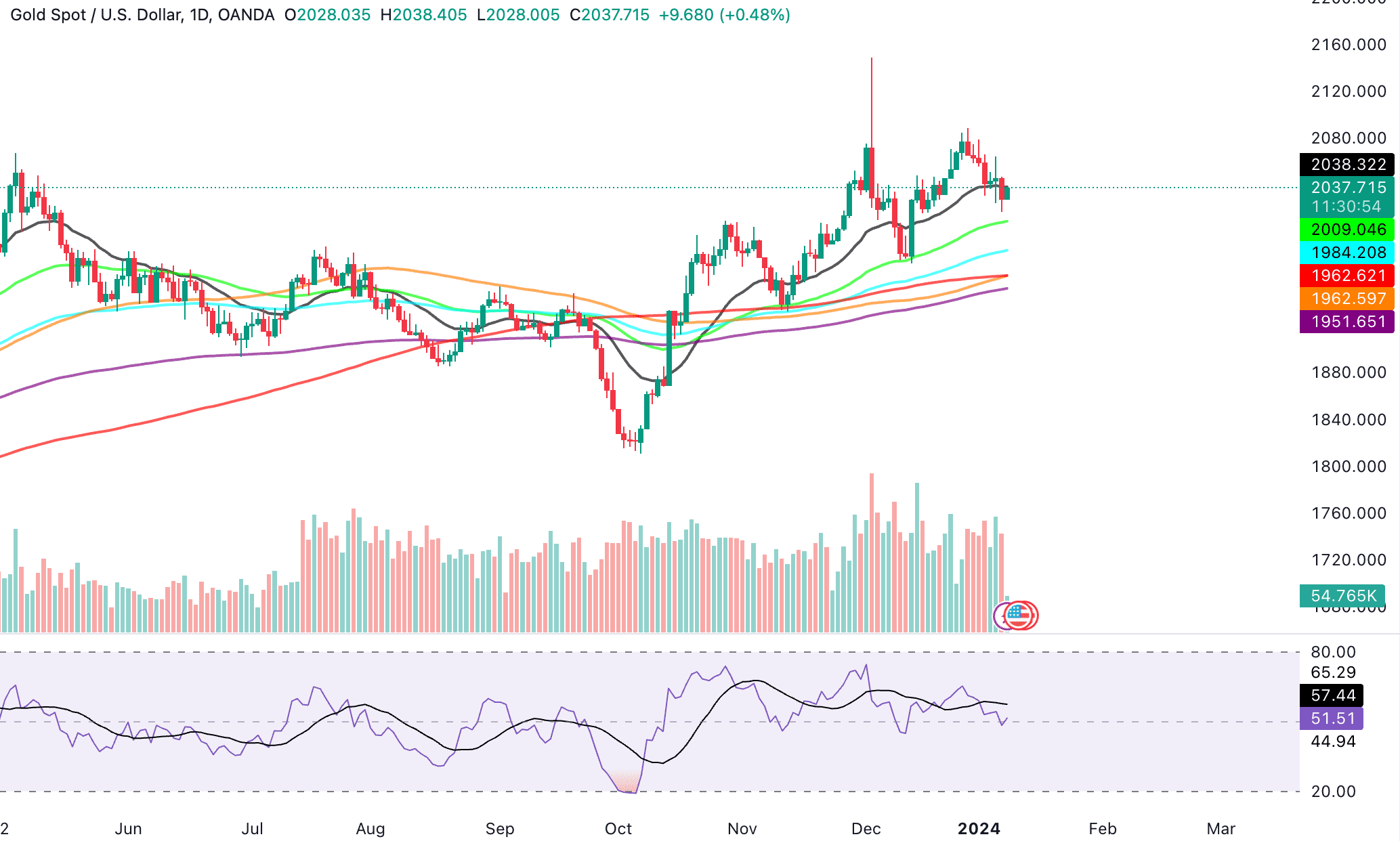

The gold price maintains a stable and positively inclined trading pattern, with stochastic indicators approaching overbought thresholds. The anticipation is for this condition to prompt a continuation of the anticipated bearish trend today.

TECHNICALLY

A breakthrough is noted at the crucial level of 2016.90 to validate a rally towards the next correctional level at 1977.46.

It is important to remember that a break above 2046.60 and then 2065.70 would reverse the expected trend lower and could even suggest that the market is trying to reverse its previous upward trajectory. Trading professionals should monitor these critical levels to gather insight into the direction that gold prices will take going forward.

XAUUSD

Banks generally predict that the price of gold will be between $1,950 and $2,200 per ounce in 2024, according to information obtained by Bloomberg from significant financial institutions.

XAUUSD posted an intraday high of $2038.40 and intraday low of $2028.00. Gold is currently trading at $2037.71 (3:30pm Tuesday, 09 January 2024 (GMT+5) Time in Pakistan).