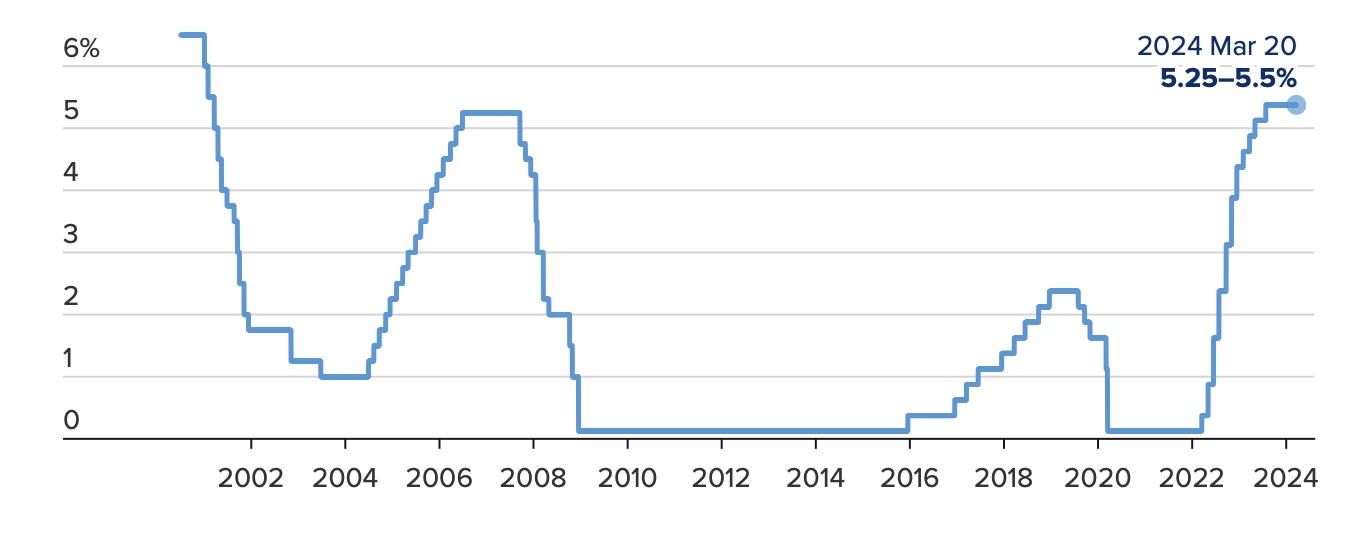

In a widely anticipated move, the Federal Reserve kept interest rates unchanged following its recent policy meeting. The decision, announced by the central bank’s rate-setting Federal Open Market Committee (FOMC), maintains the benchmark overnight borrowing rate within the 5.25%-5.5% range, a level held since July 2023.

FUTURE CUTS SIGNALLED

INSIGHTS FROM THE DOT PLOT

Accompanying the decision were insights from the Fed officials, who indicated the possibility of three quarter-percentage point cuts by the end of 2024. These would mark the first reductions since the onset of the Covid pandemic in March 2020. The current federal funds rate stands at its highest level in over 23 years, influencing various consumer debt instruments.

CHAIR POWELL’S REMARKS

Federal Reserve Chair Jerome Powell underscored the potential for rate cuts, emphasizing a data-driven approach. Powell suggested that if economic conditions evolve as expected, policy restraint could be dialed back later in the year. However, he refrained from specifying exact timing, citing the need for ongoing data evaluation.

GDP FORECAST AND MARKET REACTION

UPWARD REVISION IN GDP PROJECTIONS

Post-meeting projections saw a significant uptick in GDP growth estimates for the year, now projected at a 2.1% annualized rate, up from 1.4% in December. Additionally, forecasts for unemployment rates adjusted slightly lower, while core inflation estimates edged higher.

MARKET OPTIMISM

Market response to the FOMC decision was positive, with the Dow Jones Industrial Average surging nearly 300 points. Treasury yields, meanwhile, trended lower, with the benchmark 10-year note showing a decline to 4.28%.

JULY 2000–MARCH 2024 FEDERAL FUNDS TARGET RATE

Officials from the Federal Reserve made the decision along with the provision for three quarter-percentage point cuts by the end of 2024. These would be the first decreases since the early stages of the epidemic in March 2020.

We are seeing the greatest level of federal funds rates in over 23 years at this time. While it influences various types of consumer debt, the rate determines what banks charge one another for overnight lending.

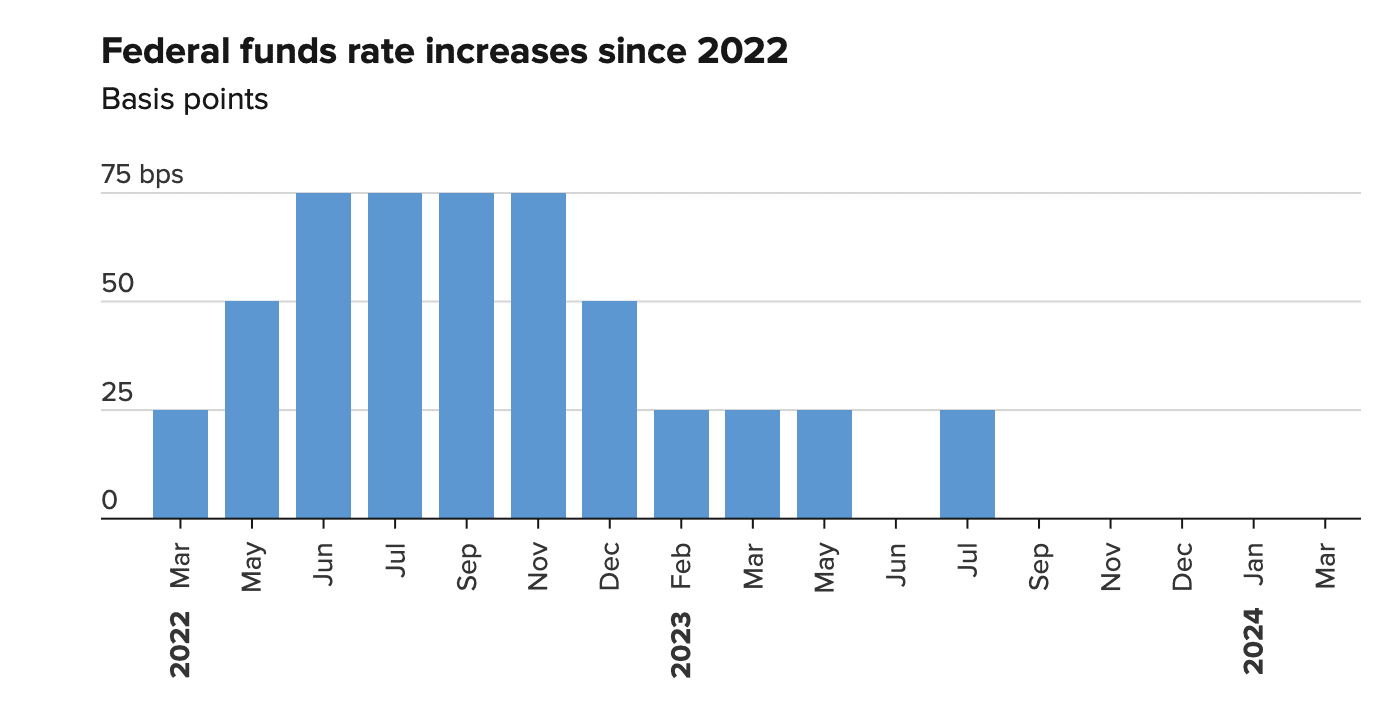

FEDERAL FUNDS RATE INCREASES SINCE 2022

READ: INTEREST RATES AND ITS IMPACT ON ECONOMY AND THE STOCK MARKET

POLICY OUTLOOK AND BALANCE SHEET REDUCTION

PATIENT APPROACH TO MONETARY POLICY

Powell reiterated a cautious stance, emphasizing patience and a measured approach to monetary policy adjustments. With the economy continuing to show strength and inflation moderating, Fed officials signaled a more deliberate path forward.

BALANCE SHEET REDUCTION CONSIDERATIONS

Discussion at the meeting also touched upon the Fed’s balance sheet reduction program. While no decisions were reached regarding the extent and timing of potential reductions, indications suggest a slowdown in the pace of balance sheet runoff in the near future.

MARKET REACTIONS

Bitcoin soars over 9% at the time of the writing. Moreover, the international markets followed the trend with SPX gaining (+0.89%), DJI (+1.03%), NDQ (+1.15%) at (1:37 am Thursday, 21 March 2024 (GMT+5) Time in Pakistan)