Energy stocks suffered a sharp decline yesterday after the government redirected RLNG to domestic consumers. Investors expressed concerns about a potential increase in circular debt, though IMF monitoring is expected to prevent significant surges. Experts suggest that any gap may be bridged through cross-subsidies or sectoral reallocations.

SBP’s Economic Insights

The Governor of the State Bank of Pakistan (SBP) projected a rise in inflation due to base effects and higher energy costs but assured it will remain within the 5%-7% target range. Interest rates have seen a remarkable reduction from 22% to 13%, with single-digit levels anticipated soon, promising substantial liquidity for the capital markets.

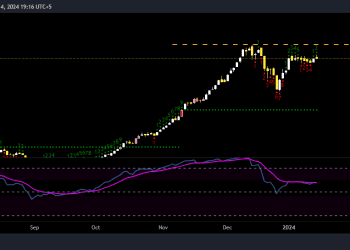

Investor Strategy

Current market consolidation presents an opportunity to accumulate fundamentally strong stocks during dips. Analysts suggest capitalizing on the liquidity influx driven by declining interest rates.

PSX Highlights: January 7, 2025

Key Headlines

- SBP buys record $9 billion to stabilize reserves.

- OCAC declines to endorse downstream oil sector deregulation plans.

- Punjab’s ‘Green Tractor Scheme’ delivers 3,973 tractors.

Top Picks

OGDC, PPL, PSO, UBL, MEBL, BAFL, FFC, FATIMA, CHCC, MLCF, DGKC, SAZEW, GHNI, ATLH, AGTL, INDU, ISL, ASL, PSX, LOADS, COLG, GCIL, PAKT, IMAGE, SPEL, HUMNL, TGL, GHGL

Important Events Today

- Board Meeting: Mughal Energy Limited (Other Matters)

- Entitlement Deadline: JS Momentum Factor – 25% Dividend