The Real Effective Exchange Rate (REER) is an index that measures the value of a country’s currency relative to the weighted average of its major trading partners’ currencies, adjusted for inflation. It’s a crucial indicator used to evaluate a currency’s competitiveness, purchasing power, and overall economic health. A REER value of 100 is typically considered its base or “fair value.” When the REER deviates from this base, it indicates changes in the country’s currency competitiveness.

This article explores the concepts of Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) and their significance in evaluating a country’s currency competitiveness, trade dynamics, and overall economic health. Exploring Understanding Exchange Rate Dynamics: NEER vs. REERthe implications of NEER and REER movements, it provides insights into their respective roles in short-term exchange rate policies and long-term economic sustainability. Additionally, it examines the differences between NEER and REER, highlighting their complementary nature in assessing currency values and trade competitiveness.

REER INCREASES ABOVE FAIR VALUE (100)

When the REER increases above the fair value of 100, it implies that the country’s currency has appreciated in real terms against the currencies of its trading partners. This can have several implications:

- Decreased Export Competitiveness: An appreciated currency makes a country’s exports more expensive and less competitive in international markets. This can lead to a decrease in export volumes.

- Cheaper Imports: With a stronger currency, imports become cheaper. While this can benefit consumers and companies that rely on imported goods, it can also negatively affect domestic industries by exposing them to tougher foreign competition.

- Inflationary Pressures: A higher REER can exert downward pressure on inflation since imports become cheaper. However, this effect can vary based on the economy’s reliance on imports and other factors.

- Impact on Economic Growth: While cheaper imports and reduced inflation might seem beneficial, the overall impact on economic growth can be negative if a decline in exports leads to a trade imbalance and affects industries and employment.

REER DECREASES BELOW FAIR VALUE (100)

When the REER decreases below the fair value of 100, it suggests that the country’s currency has depreciated in real terms against the currencies of its trading partners. This can lead to:

- Increased Export Competitiveness: A cheaper currency makes a country’s exports more competitively priced on the global market, potentially boosting export volumes.

- More Expensive Imports: The cost of imports rises, which can increase the prices of goods in the domestic market, potentially leading to inflation.

- Inflationary Pressures: A lower REER can cause import-driven inflation, impacting the cost of living and potentially leading to wage-price spirals.

- Impact on Economic Growth: An increase in exports can stimulate economic growth, especially in export-oriented economies. However, the benefits need to be balanced against the risks of inflation and the impact on import costs.

HOW IS THE REAL EFFECTIVE EXCHANGE RATE (REER) CALCULATED?

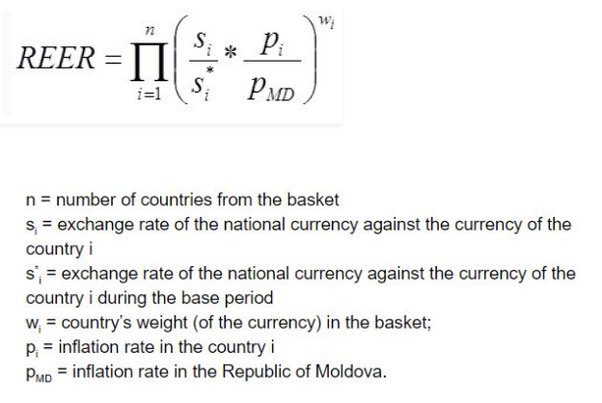

The REER can be used to determine if the value of a nation’s currency is in equilibrium, undervalued, or overpriced. When a nation’s currency is in equilibrium, all trade balances are equal—that is, the total value of imports equals the total value of exports—and the currency is stable. The formula below can be used to easily compute the REER.

REAL EFFECTIVE EXCHANGE RATE (REER):

REER adjusts the NEER for inflation differentials between the domestic country and its trading partners. The formula for REER involves multiplying NEER by the ratio of the domestic price level to the foreign price level, both adjusted for inflation.

NEER

The Nominal Effective Exchange Rate (NEER) is an index that measures the value of a country’s currency relative to a basket of currencies of its major trading partners. Unlike the Real Effective Exchange Rate (REER), which adjusts for inflation differentials between countries, the NEER is unadjusted for price levels. This makes the NEER a more straightforward indicator of the foreign exchange market movements and the nominal competitiveness of a country’s currency.

NEER is calculated by taking an average of the bilateral exchange rates between the home country and its trading partners, weighted by their respective trade balances (i.e., the share of trade each country represents for the home country). These weights ensure that the currencies of larger trading partners have a bigger impact on the NEER than those of smaller partners.

IMPLICATIONS OF NEER MOVEMENTS

- Appreciation in NEER: If the NEER increases, it means that the home country’s currency has strengthened against the currencies in the basket. An appreciated NEER can make a country’s exports more expensive and less competitive internationally, while making imports cheaper. This could potentially lead to a trade deficit if the country starts importing more due to lower prices but exports less because of reduced competitiveness.

- Depreciation in NEER: Conversely, if the NEER decreases, the home country’s currency has weakened against the currencies in the basket. This can make the country’s exports cheaper and more competitive internationally, potentially boosting export volumes. However, it can also make imports more expensive, which might lead to inflationary pressures if the country relies heavily on imported goods.

HOW IS NOMINAL EFFECTIVE EXCHANGE RATE (NEER) CALCULATED?

A weighted index based on a foreign exchange basket is called the Nominal Effective Exchange Rate (NEER). A simple way to calculate the value of a foreign currency in a basket is to take the average of the entire value of imports and exports between two countries. The domestic currency is considered to have a higher value than the foreign currency under comparison if the NEER coefficient is higher. However, the value of the home currency in the basket is lower than the foreign currency if the NEER coefficient is lower. The following formula makes it simple to calculate the NEER.

NOMINAL EFFECTIVE EXCHANGE RATE (NEER):

NEER is calculated as a weighted average of the bilateral nominal exchange rates, with each weight determined by the share of trade with the respective trading partner.

NEER vs. REER

While both indices are used to assess a currency’s external value and its impact on trade competitiveness, they serve different analytical purposes:

- NEER provides a more immediate view of currency movements and competitiveness as it reflects current exchange rates without adjusting for inflation. It’s particularly useful for monitoring short-term exchange rate policies and their immediate impact on trade.

- REER, by adjusting for price levels, offers a deeper insight into the medium to long-term competitiveness of an economy. It’s more indicative of the economy’s underlying trade dynamics and purchasing power parity over time.