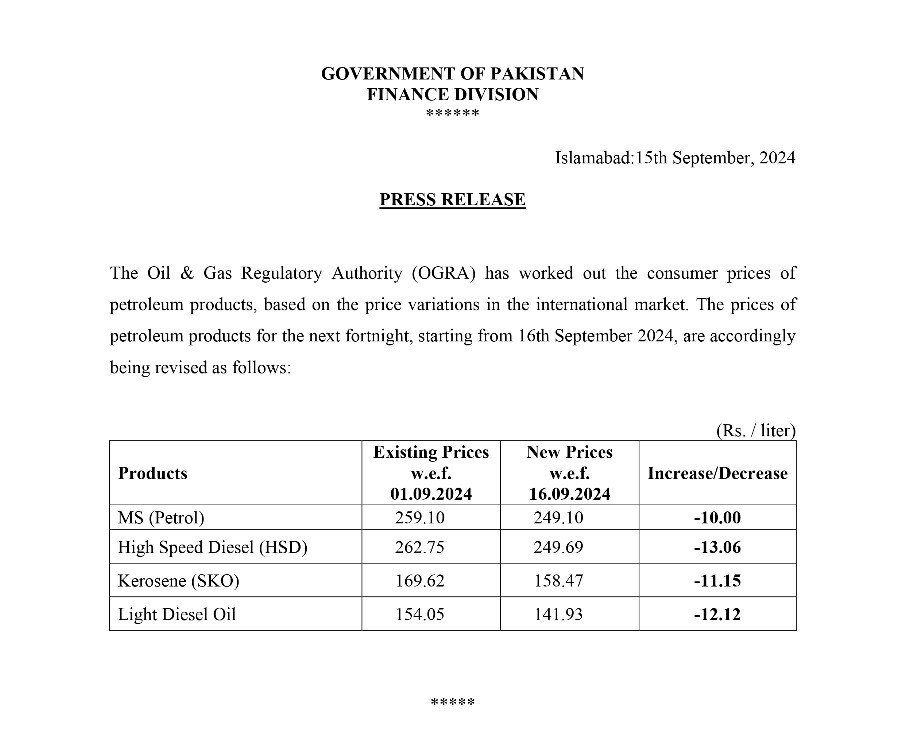

In a welcome move for Pakistani consumers, the federal government announced a reduction in fuel prices, effective from midnight Sunday. The price of petrol has been slashed by Rs10 per litre, bringing it down from Rs259.10 to Rs249.10. Additionally, high-speed diesel (HSD) saw a reduction of Rs13.06 per litre, lowering its price from Rs262.75 to Rs249.69.

ADDITIONAL REDUCTIONS IN FUEL PRICES

KEROSENE AND LIGHT DIESEL ALSO SEE PRICE CUTS

The price of kerosene oil has been reduced by Rs11.15 per litre, with its new rate set at Rs158.47 from the previous Rs169.62. Similarly, light diesel oil saw a reduction of Rs12.12 per litre, now priced at Rs141.93, down from Rs154.05.

IMPACT OF GLOBAL OIL MARKET FLUCTUATIONS

PRICING INFLUENCED BY INTERNATIONAL MARKETS

The price cuts are a direct reflection of the fluctuations in the global oil markets. Federal Minister for Petroleum, Musadik Masood Malik, stated that while Pakistani consumers are benefiting from the decline in international petroleum prices, they will also bear the burden when prices rise.

SAUDI OIL ON DEFERRED PAYMENTS

Malik highlighted that Saudi Arabia continues to provide support through oil on deferred payments, and domestic prices are determined by global trends. Since May, petrol prices in Pakistan have dropped by a total of Rs47 per litre, with further reductions expected as smuggling of Iranian petrol declines.

XTIUSD has taken a downtrend in the recent weeks falling to a low of $64.74. The global oil market continues to face significant challenges, with declining oil prices fueled by concerns over slowing economic growth in key consumer markets like the U.S. and China. Despite robust supplies, weakening demand has led Brent crude to fall by over 9% in 2024.

FUTURES MARKET SIGNALS BEARISH OUTLOOK:

Market indicators suggest that oil prices could stay under pressure for the foreseeable future. The futures curve, an important measure of market sentiment, has dipped into a bearish contango, where future oil prices are lower than current prices, signaling less supply constraint. While Brent crude saw a modest recovery on Wednesday, bolstered by the American Petroleum Institute’s report of a 2.8 million barrel reduction in U.S. stockpiles, the overall outlook remains cautious. The combination of weaker demand and ample supply sets a bearish tone for the oil market.