THE STATE OF THE PAKISTANI RUPEE AGAINST THE US DOLLAR: AN IN-DEPTH ANALYSIS

INTRODUCTION

In the ever-evolving landscape of global and regional economics, the currency exchange rate between the Pakistani Rupee (PKR) and the US Dollar (USD) holds significant importance. This article provides a detailed analysis of the current state of the PKR against the USD, focusing on both the interbank and open market rates, and the factors influencing these rates.

LATEST INTERBANK CLOSING RATES

The interbank rate, crucial for understanding a currency’s value, is the rate at which banks exchange currencies. On January 22, 2024, the interbank closing rate for USD to PKR was 279.8510 PKR per USD. This rate is essential as it is used for the revaluation of currency books by authorized dealers and impacts the overall financial market.

OPEN MARKET RATES AND COMPARISON

In contrast to the interbank rate, the open market rate is determined by currency exchange companies and individual transactions. As of the same date, the open market quoted USD at 279 PKR for buying and 281 PKR for selling. These rates slightly differ from the interbank rate due to factors like supply and demand dynamics in the open market.

FACTORS INFLUENCING THE RUPEE’S VALUE

Several economic, political, and global factors are currently impacting the PKR-USD exchange rate:

- Economic Stability: Pakistan’s recent receipt of an IMF installment and commitments to FX market reforms are positive signals.

- Political Climate: Government policies and international relations play a pivotal role.

- Global Factors: The global economic environment, including trade dynamics and USD performance against other currencies, also affects this pair.

CONCLUSION AND FUTURE OUTLOOK

The PKR’s value against the USD is shaped by a complex interplay of internal and external factors. While recent trends show a marginal appreciation of the PKR, the future outlook remains cautiously optimistic, contingent on continued economic reforms and global market stability.

TECHNICAL ANALYSIS OF USD/PKR

CURRENT STATUS

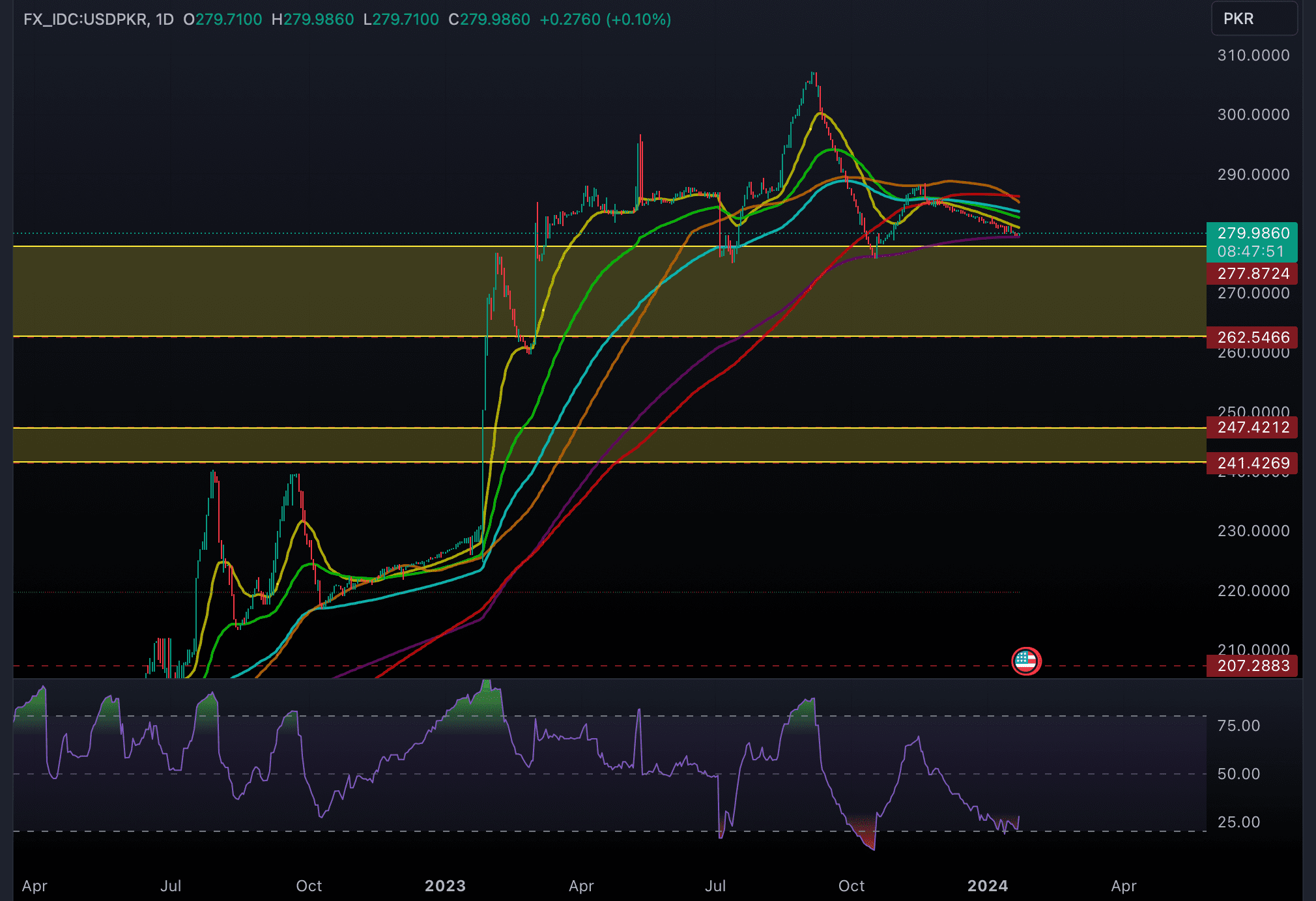

As of the latest update, the USD/PKR pair is trading at 279.9860 PKR. This represents a slight increase of 0.10%. Analyzing the performance over different time frames, the USD/PKR has seen a decrease of 0.44% over the past five days and 0.92% over the past month. However, there’s been a significant increase of 22.27% over the past year, and an even more substantial rise of 101.92% over the past five years.

TECHNICAL INDICATORS AND PREDICTIONS

- RSI Analysis: The Relative Strength Index (RSI) indicates bearish oscillation. There’s an expectation that the pair could hit a support level at around 275 PKR within the next 40 days.

- Elliott Wave Analysis: Different analysts have provided Elliott wave-based analyses, suggesting both short and long positions at various points. These analyses are based on assumptions and should be considered as educational rather than definitive trading advice.

- Trend Analysis: A recent trend analysis suggests a possible decline to the 275 PKR level on a weekly basis. If this support level is broken, a further decline to the 260-239 PKR range might be expected.

MARKET INFLUENCES

The USD/PKR pair is influenced by various factors including Pakistan’s economic stability, policies of the government, and global market trends. Recent news suggests that the Pakistani Rupee has been under pressure due to inflation and other economic challenges.

CONCLUSION

The USD/PKR exchange rate is currently experiencing slight bullish movement but is expected to face bearish pressure in the near term. The technical analysis indicates potential support at around 275 PKR. Traders should monitor this pair closely, considering the volatile economic environment and the potential for significant fluctuations.