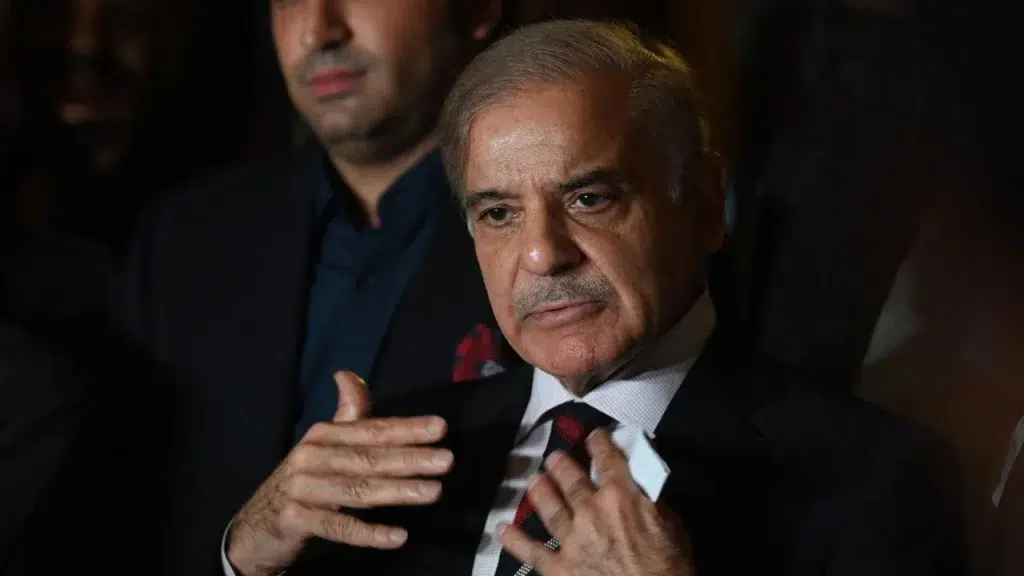

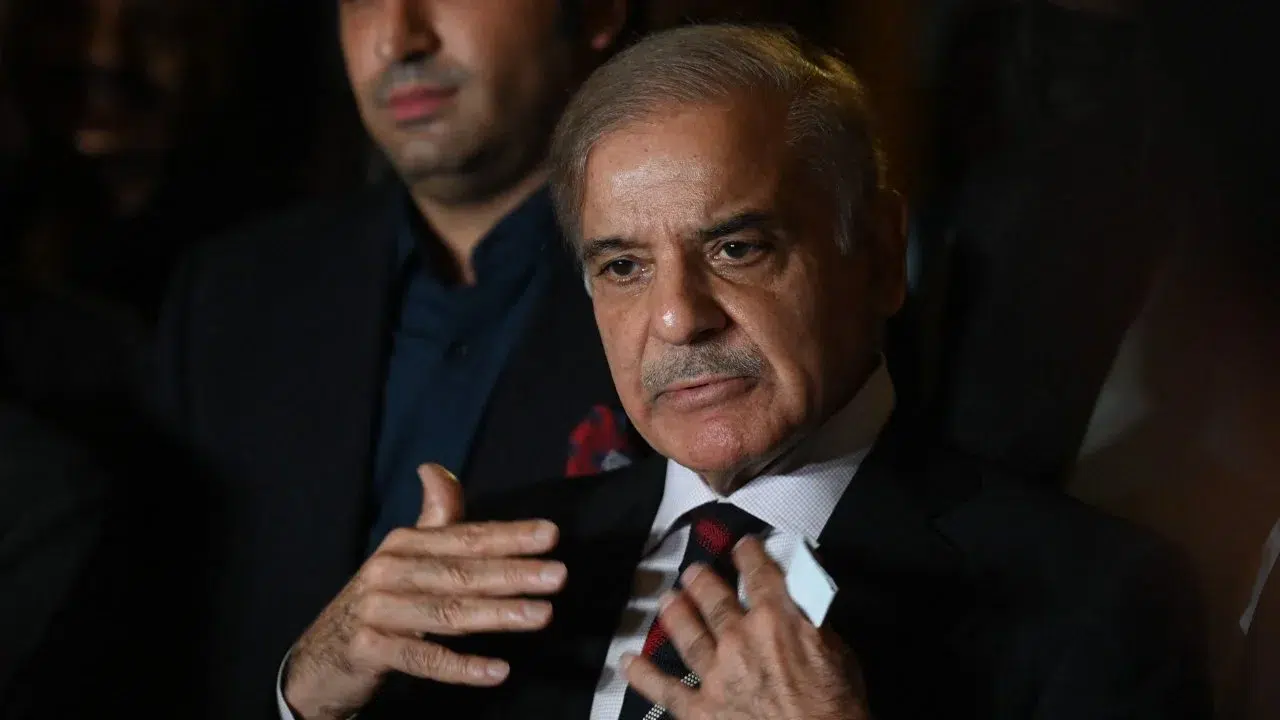

ISLAMABAD: Prime Minister Shehbaz Sharif has approved significant measures for tax enforcement and compliance, including a ban on all banking and financial transactions for non-filers of tax returns. This step aims to ensure the documentation of the economy and enhance tax revenue collection.

Prime Minister Shehbaz Sharif also gave the green light to Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial to submit summaries to the federal cabinet, aiming to accelerate the FBR Indigenous Transformation Plan. This plan was developed by over 50 tax officers and experts in just 40 days, with a focus on resolving structural issues hampering revenue growth. One key aim is to reduce the amount of cash currency in circulation, currently at 25%, far higher than Pakistan’s regional peers.

RESTRICTIONS FOR NON-FILERS

A major component of the new measures is the introduction of restrictions on non-tax filers in Pakistan, who will now be barred from purchasing immovable property, vehicles, and financial instruments, as well as from opening bank accounts, except for basic “Asaan” accounts. These changes aim to improve the documentation of income and ensure compliance with tax laws.

The FBR’s new strategy divides taxpayers into three categories based on declared income. Those declaring over Rs10 million will have access to the benefits of acquiring cars, property, and financial instruments. Those in the second tier, with a declared income under Rs10 million, will have to justify their source of funds when making purchases, although they will be allowed to open bank accounts.

NON-FILER PENALTIES AND ENFORCEMENT

Non-filers and unregistered manufacturers, wholesalers, and distributors face severe penalties, including freezing of their bank accounts and restrictions on utility services if they fail to register. These actions will target unregistered entities with annual turnovers of over Rs250 million for manufacturers and wholesalers, and Rs100 million for retailers.

FBR INTEGRITY INDEX AND PERFORMANCE INCENTIVES

To encourage integrity and performance within the FBR, tax officers will be incentivized quarterly based on 60% integrity and 40% performance. This move is expected to boost tax collections, improve service delivery, and strengthen the social sector.

The premier also emphasized the importance of third-party audits for FBR projects and measures to curb smuggling. A new appraisal and enforcement mechanism was introduced, which will see appraisers and inspectors assigned tasks without prior knowledge and monitored via cameras to prevent customs theft.

Earlier in May 2024, The Federal Board of Revenue (FBR) blocked around 11,250 SIM cards of non-filers under the Income Tax General Order (ITGO) to enhance tax compliance. This action highlights the FBR’s efforts to promote a tax-compliant culture in the country.

ENFORCING TAX COMPLIANCE

The FBR aims to encourage individuals to meet their tax obligations by blocking SIM cards, a move seen as both punitive and educational.

Earlier this year, the FBR disabled SIMs of over 500,000 individuals who failed to file tax returns for 2023. Additional efforts include public awareness campaigns and simplifying tax filing.

PUBLIC REACTION

While some support the initiative as a step toward fairness, others are concerned about disruptions for those unaware of their obligations. Despite mixed reactions, the FBR is focused on boosting Pakistan’s tax-to-GDP ratio for national development.